Jimmy Jackson celebrates 50 years in the wool industry with his daughter Anastasia, left, and his wife Alina.

CREATING and marketing innovative woollen products is the way forward for Australia’s struggling wool industry, according to leading textile consultant Jimmy Jackson.

The 66 year-old this week has celebrated 50 years working in the world wool industry, most of it on behalf of Australian growers.

He started working for the International Wool Secretariat’s (now The Woolmark Company) International Development Centre in Ilkley, West Yorkshire, England on August 10 1970 as a 16-year-old.

Ilkley is just north of his hometown Bradford, a major wool-processing centre then known as Wool City, because about half of all the world’s wool passed through its mills.

“When we was walking to school there was wool everywhere.”

His first job was as a laboratory technician in a chemical processing lab, working initially on the wool machine-washable process Superwash that is now established around the world.

Extensive education and training with Woolmark led to an honours degree in textile technology form the University of Huddersfield and becoming a fellow of the International Textile Institute.

“They educated me.”

Rising through the ranks, he came to Australia 15 years ago to become general manager of product development and innovation at Australian Wool Innovation before his position was cut in a restructure in 2016. He has worked in about 100 countries and played a key role in established processing in several countries including China and Vietnam.

In Australia about 40 years ago, he oversaw Superwash research to make wool machine-washable, and was involved in establishing early stage processing for Michells in Sydney, setting up a shrink-proofing plant in Patons’ hand-knit spinning factory in Launceston and helping Chargeurs establish a wool Merino combing factory in Wagga Wagga.

All of these processing operations have now closed, except the Michells plant which was moved to Adelaide. Mr Jackson now travels the world with his International Wool Consulting Group, working for major textile companies and brands on processing and product development. His Chinese clients consumer about 40 million kilograms of greasy wool annually.

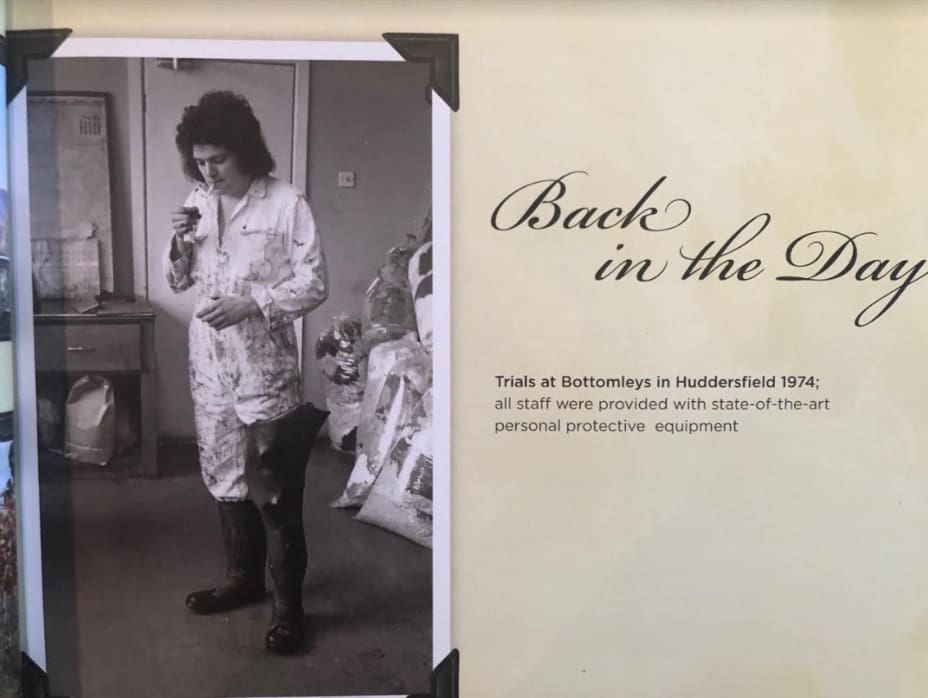

A 20 year-old Jimmy Jackson takes a break in 1974 after carrying out Superwash trials while wearing personal protective equipment.

Costs and knowhow will limit an Australian textile revival

However, despite modern wool processing now involving more automation with less staff and consolidation of processing stages, Mr Jackson believes there are two main reasons why Australia’s once booming wool textile industry is unlikely to be revived.

“I’d like to see it, but there are two big challenges.

“One is the actual cost, although labour is getting more expensive in China, Australian salaries still are still a lot higher.”

He said land, buildings and utilities are also very cheap in China, where most of the world’s wool is still processed.

“The other problem is knowhow, essentially all the wool processing knowhow today resides in China, they bought it in.

“They’ve been employing more for the last 14 years and when I go up to China, I’m tripping over old Italians, old British people, people the same age as me, experts.”

Many of the managers and general managers of major Chinese processors are his students from 20 years ago. Australia would have to import textile processing knowhow from China if it was to re-establish its textile industry, he said.

“With what’s going on today, I don’t know if that would be possible in the foreseeable future.”

He said early stage processing equipment is also very wool-specific, large and expensive, whereas spinning machines can often be adapted to handle many types of fibres. The knowhow in processing equipment is also primarily in China today, with New Zealand having the one exception, Mr Jackson said. Some Australian plants with European ownership also failed due to union and staff troubles.

Where to with wool marketing….

As for marketing wool in the current market, Mr Jackson said it is difficult because conditions are changing daily due to the COVID-19 pandemics impact on global economies.

Mr Jackson said most apparel retail clients had record online sales in May and June, but then volumes “dropped off a cliff” in July, perhaps because of shops re-opening, less discretionary income among people who have lost jobs or are concerned about their financial situation and are focusing spending on essentials.

“You can live without a new wool sweater or a new wool suit.

“Wool also is very seasonal, it is an Autumn-Winter fibres and most of the woollen products are sold in the Northern Hemisphere,” he said.

“In the Northern Hemisphere, the main markets for our Chinese clients, the United States and Europe, have almost stopped.”

He believes there is little value in marketing wool until the COVID-19 situation improves globally.

The four Chinese companies he works for sell yarn and fabric to most major retailers in Australia and New Zealand – for suits, sweaters, sports and outdoor wear. In early July, he was fielding strong enquiries from Melbourne for yarn and fabric catalogues, European colour and fashion trend information, but then it died due to the COVID-19 pandemic. He said online sales have not offset the losses from the lack of retail foot traffic business.

Australia’s first opportunity is China’s recovery

Jimmy Jackson presents at the 2015 ABARES conference.

Mr Jackson said the first opportunity for Australian wool post-COVID will come from China’s economic recovery and there are some early signs its economy is bouncing back.

Key areas of growth are likely to come through the increased interest in sports wear in China with the country building several ski resorts, including the world’s biggest indoor complex and the young people are now more interested in outdoor activities.

“They’ve got 350 million people who can afford to buy wool products.”

He said there has been a resurgence of good quality domestic brands in China.

“They are much more keen now to buy much more quality stuff, the same with the beef.

“The biggest protection we’ve got is that Australia produces about 80pc of the world’s apparel wool – wool going into clothing – so we (my Chinese clients) can’t go anywhere else,” he said.

Not enough non-mulesed wool being produced

However, Mr Jackson said his Chinese clients have been buying more wool from Argentina and South Africa in the past year, but simply because of orders for non-mulesed wool accredited under the Responsible Wool Standard.

“We have to buy more wool for these other countries, but there still isn’t enough.”

The finest wool his clients buy comes from New Zealand, but in small quantities, because 95pc of the country’s wool is coarse crossbred, mainly suitable for carpets.

“If there was some other country producing fine apparel wools in the quantity of Australia then we would have a real problem.”

Mr Jackson said another big opportunity for Australia lay in maximising its non-mulesed wool production.

“Absolutely, because even last year we got to a point where the manufacturers I work for couldn’t even find enough RWS wool, even though that wool at yarn stage worked out 12pc more expensive.

“I think there are only 11 (RWS) growers in Australia, whereas there are 39 in Argentina.

“But Argentina has fewer wool growers, but they tend to be really big properties, whereas Australia has more growers, but most properties are quite small.”

Mr Jackson said he has been doing more direct sourcing of wool from farms through other non-mulesed assurance systems.

“The big trend until the COVID-19 pandemic was traceability, every company in the America and Europe wanted to do a traceable story – farm to fashion or sheep to shop.”

He said it was virtually impossible to satisfy the traceability and wool volume needs by working with individual farms in Australia, so the provenance story is based around “lead” farms and quantities are made up by blending wool from other properties to meet specifications.

“But how can you do a beautiful supply chain story when you’ve got a skeleton in the cupboard?

“It’s like saying you go to church every day, but you murder somebody once a week.”

The “skeleton in the cupboard” is that Australia is now regarded as a mulesed wool country, Mr Jackson said.

“We should have started explaining more clearly back in 2004-2005, but you can’t even mention it now.”

Mr Jackson said it his experience that there is “no chance” of the Australian wool industry resurrecting its reputation by mandating pain relief for mulesing.

“Remember most of our customers decision-makers are based in cities like New York and London and have probably not seen a sheep in their life.

“Point number one is non-mulesed…,” he said.

The rise of the sustainability manager

Wool traceability is now not just about knowing where wool comes from and sustainability includes sheep welfare, he said.

“Just about every retailer now has set up a sustainability department with a sustainability manager.

“These people didn’t used to be so important, they were linked to HR and looked after health and safety, and nobody went to visit them.

“Now the sustainability manager has become much more important, they have to present to the board and is answerable direct to the CEO.”

However, Mr Jackson said sourcing RWS-certified non-mulesed had challenges, including the lack of supply and the cost. RWS is the most comprehensive farm-to-retailer scheme, but wool was also sourced from other non-mulesed supply chains, he said.

“The processors I work with can only find and buy small (RWS) lots, so we don’t get the economies of scale in processing – we want to do 50 tonne lots, not five tonnes.”

Wool’s post-pandemic future – innovation and non-mulesed

A proud Jimmy Jackson when his client Xinao won the gold award for the most innovative new yarn at the world’s largest sports outdoor fair ISPO Munich.

Mr Jackson said when he started in the wool industry, the fibre had a textile market share of 14pc. This has shrunk to about one percent and he believes it will be a long struggle out of the COVID-19 pandemic which has hit global economies and the apparel trade hard.

He points to Australia’s “reserve price fiasco” from which the processing sector took 10 years to recover from.

“So many manufacturers disappeared because of that reserve price scheme; basically it wiped out most of the European manufacturers within a year.

“Some manufacturers will disappear, even Chinese ones.”

Mr Jackson said the industry needed global marketing of innovative products, rather than promotions at fashion shows.

“We need more innovation, otherwise it is just generic marketing.

“I don’t see any new products coming from us (Australia),” he said.

“The two biggest innovative wool products over the last 10 years came from New Zealand.

“Icebreaker started with the base layers and now we’ve got Allbirds with the shoes.”

Mr Jackson said Australian wool growers should work together and lift non-mulesed production to improve their returns and the reputation of their wool internationally.

“They seem to be always arguing with each other.

“The wool we buy on behalf of Chinese customers we buy from 13.5 micron to 28 micron and everybody wants non-mulesed.”

Mr Jackson said the lack of non-mulesed wool supply has also been a factor in the increasing switch to other fibres or to blending over recent years, rather than use wool from flocks that have ceased mulesing or have used pain relief.

“And the blended yarn also has to have a good story, so we’ve got yarns now with recycled PVC, recycled water bottles and biodegradable nylon.

“It’s a lost supply opportunity (for wool) because it is cheaper as well.”

Mr Jackson said the companies he works for a taking time during the pandemic slowdown to create innovative yarns and fabrics and Australia should do the same.

“I worked with some great people in the past and they said use this time for innovation.

“You start thinking out of the box when you’ve got more time.”

Australian processors always did a better quality job than overseas plants. Mr Jackson is wrong to blame closing of some Australian processing plants on union and staff troubles; that is misleading. The Australian staff would not work for Asian wages. Would Mr Jackson?

I hung on every word in this article.

It is so very true Australian farmers cannot and do not work together for the collective good of an industry.

What opportunities would there be in a continent with such a varying degree in climate that just to change one thing such as this point would mistakenly become a game changer?

We Australians love to travel, but don’t embrace the change we see or even take note when going home.

I am watching the same again in the grains industry in southern Queensland with regards to the feedlots industry wanting less screenings.

Sit with your customers and take an interest, but more importantly stop resisting change.

Colin Lye – another clear thinker, what a beautiful last sentence. I love how they are coming out of the abyss. Come on Levy payers, think about what Jimmy Jackson is saying. He is directly in touch with a big proportion of the early processors, retailers and brands. They are all on their knees at the moment, but this COVID-19 will finish.

His main interest apart from his family is his love for this industry. He is trying to pass on his vast knowledge to rebuild it. No self-interest, no politics, just trying to get the truth out there. We won’t have him forever. Listen.

Jimmy Jackson is spot-on about non-mulesed wool. It is much more economical to produce such wool. Less chemical, lower maintenance, truer average micron, plus higher yields. This wool is produced ethically and processes extremely well. We find shearers wanting to come back for next shearing. Obviously shearers have a higher tally on these type of sheep. The fertility in these animals is very high, making them a great proposition; remembering an extra lamb is worth more than an extra kg of wool. The whole sheep is very saleable, ie more money per acre.

More economical? All those Clik junkies doing extra crutchings and as well I would say their costs are higher. The act of not mulesing doesn’t true your micron or increase your yield just because the sheep is unmulesed. I know shearers who won’t shear on unmulesed farms. I know plenty of people who won’t buy unmulesed surplus ewes. Selection pressure is what changes things and all those things change regardless if you do or don’t mules. Maybe just speak the truth without gushing like a fan boy.

Glenn, maybe time to read again…

“Mr Jackson said Australian wool growers should work together and lift non-mulesed production to improve their returns and the reputation of their wool internationally.

They seem to be always arguing with each other.“

When in Seattle in 2012, retailers were telling me that their products were made from New Zealand wool. They could then give me brochures with details of products, sources of wool and details of farm production systems.

Then in Vancouver in 2017, I was hearing the same story. The Icebreaker company were doing an outstanding job of promoting the wearing of wool, again coming from

New Zealand.

I came home and said we are paying a 2 percent wool tax, of which 60pc goes to promotion of the product. Well for what, I asked? If a sheep and wool producer can go and find these things out then what facts are being gained by those employed in this field?

Surely, it is now time for AWI to answer these questions and other questions, look at what is happening, start doing its job or close the organisation down.

Marketing 101, give the consumer what they want and give it better than your opposition. Funny how NZ have been using this concept for years.

AWI, the floor is yours, please step forward and provide your views on this.

Doug I had a similar experience in early January 2019 on a trip to Canada & USA, before going to an AWI “consultation” meeting in Sydney later that month. You can see my observations from shops on Twitter;

No Woolmark

No ‘Australian’ branded product

Limited ‘Tasmanian’ branded product

Plenty of ‘NZ’ branded product

Some ‘USA’ branded product

Plenty of branded ‘Merino’

Plenty of ‘NM’ & ‘sustainably’ branded product claims

Sales staff said consumers loved ‘Merino’ and it was “walking off the shelves”, but did not know what Woolmark was.

I raised these issues at the AWI meeting, but they were not accepted by AWI senior staff & directors present.

Little wonder that the AWI CEO said at the AWI AGM in Nov 2019 that the USA was “a bit of a pothole” for wool marketing.

Future success includes supply chains that focus on branded Merino that is produced in a sustainable way with high standards for animal & human welfare. As Jimmy Jackson says, these supply chains already exist.

Unfortunately, they are not assisted by AWI & can be seen by AWI as competition. This must stop.

If we can find this sort of information, why can’t those that are using our wool tax find this out, or failing that, listen to those that have?

The big question is, how do we make AWI get out, find the real story and do the job that the levy payers expect?

Jimmy Jackson has set out a simple set of facts and information as a blueprint to follow.

Once again, marketing 101, give the consumer what they want and ģive it better than your opposition. AWI, it is simple as that.

Doug, the difference, as I understand it, behind the Australian and NZ systems, is structural.

Australian Wool Innovation is essentially an organisation that takes a tax on its members to promote wool. Although it isn’t government-controlled, it has similar public sector-type motivations and issues.

I think New Zealand did away with its levy system a while back. ZQ (https://www.discoverzq.com) was set up as a private wool-broking type house to differentiate NZ wool. It is ZQ that sits behind Icebreaker, All Birds, Smartwool etc as the conduit to the market. My understanding is that ZQ is doing both the job of the wool broker and the marketer for much of New Zealand’s wool, so it sits closer to the market and is more agile and motivated by market forces.

I have been to ZQs offices in Christchurch. It is more like a place Elon Musk would run; more SpaceX than a wool-broking house. It has a very innovative vibe.

Innovation doesn’t happen in big organisations, universities or quangos. It comes from small companies and teams of smart individuals who marry technology, a brand and good marketing together to create a strong value proposition. This is what NZ has done well.

I have no doubt Australia has many young innovative thinkers. What it needs is a framework program to pull together designers, technologists, entrepreneurs together to re-imagine the future of Australian wool, go out and start new native companies and brands to make this happen. If you stimulate activity that creates 30-40 ‘wool startups’ one or two of them will become a ‘unicorn’ like Icebreaker (sold for US$1billion) or All Birds worth $1.4billion https://www.wbur.org/hereandnow/2019/09/10/allbirds-tim-brown-wool-sneakers

Well, it may be in the Australian sheep industry’s best interest to adopt the New Zealand model. Dissolve AWI and get on with it.

Jimmy Jackson is a person who contributes all his spirit to wool industry. Thanks for all his help to us.

“I don’t see any new products coming from us (Australia),” he said.

“The two biggest innovative wool products over the last 10 years came from New Zealand.

As a now London-based Australian for the last nine years whose family are wool producers, this is not surprising. There seems to be way more Kiwi-founded/owned/run businesses in London than Aussie ones. You can also see a completely different attitude in the Aussies/Kiwis in London Facebook groups. A.I.L – We’re good because we’re Aussie, we’re the best blah blah whinge whinge. K.I.L – they just get on and actually do it, it’s not just words.

I got a similar impression of Oz v’s NZ when touring the wool mills in Italy with my parents a number of years ago. The NZ industry is doing a much better job of the “story”.

Phil Rowbottom. You have hit on the core problem. It is easy when you focus on the market as New Zealand as. Then everyone is thinking about new products the market can use, from the wool producer right through. Icebreaker has set the agenda.

Australia is still focusing on retaining mulesing and AWI is backing that, with most of their energy going into their own survival. When Australia stops fighting each other and gets a peak body that goes to the trade and asks them what they want, then backs that message one hundred percent back to the growers, we will start getting the NZ model in place.

We have to use the trade like NZ uses Icebreaker, to set the agenda.

The New Zealander seems to be able to get on with the job without the self-interest and politics. Take Rugby, the prize in NZ is for the person who throws the last pass. They make the ball do the work. They play for each other.

Rugby Australia, $20 million on administration $3 million on the players. All the energy was going into protecting the administration. Sounds familiar.

Jimmy Jackson – this man has my complete respect. Respect is the second most important word in the English language. You can’t buy it or steal it. The only way to get respect is people give it to you. For people to give you respect, all you have to do is tell the truth and do what you say you are going to do. This is Jimmy’s trademark.

Jimmy Jackson has forgotten more than most people will ever know, on the journey of wool after it is sold by the grower. He is a living legend and is so willing to pass on his vast knowledge.

As a knitwear manufacturer based in Hong Kong, I deeply appreciate all his teachings. The HK knitwear industry benefit greatly from him and his colleagues at Woolmark when they were the consulants to a HK Government/HK Knitwear Exporters and Manufacturer Association project on knitwear finishing knowhow. the knitwear industry had been known to spent heavily on Capex on knitting machines from Germany and Japan, but spent relatively little on automating the wet finish skills. Thanks to Jimmy and his colleagues to explain and open our eyes to the world of technology and new knowledge.

Congratulations Jimmy Jackson on your 50 year anniversary working in wool. I’m a wool producer and everything in this article makes sense. AWI and the global wool industry needs more people like you in a position that makes a difference. How can we make this happen?

I agree 100 percent. Innovation both in the branding and uses for wool has to be the future. Wool needs to move up the value chain to remain relevant and profitable for growers.

Coming from Scotland we have a great export trade in whiskey. The reality is any country can put yellow-coloured firewater in a bottle and sell it cheap. Scotland’s trick is it does an excellent job in selling the provenance of whiskey. The value-add comes from the authentic story behind the people, the culture, the water and countryside that make it special.

Australia needs to do this with wool. There are thousands of amazing graziers, shearers, drovers and others out there doing an incredible job. Yet Australia is only really known for supplying the raw ingredient into the final product (i.e at the bottom of the chain). To me, it appears China does most of the processing and Italy is well known for adding much of the design and marketing value into woollen garments. So the ‘Australian made’ component of the story is often lost, along with many of the (high value) jobs that go along with the other aspects of woollen top making.

Why can’t Australia have an Icebreaker or Mons Royal that is known internationally as being Aussie? When you drive around New Zealand, the farms that supply Icebreaker proudly have billboards in their fields showing us they are an Icebreaker supplier. These Kiwi growers are connecting to their consumers.

Should AWI fund an initiative to get young entrepreneurs to start developing ‘trendy’ Australian wool clothing brands where the core story is kept Aussie rather than being diluted down?

Imagine if Bonds underwear’s key selling point was that it was made of 100pc Aussie wool?

Which makes me think of Billy Connolly talking about his experience with his woollen swimming trucks? https://7plus.com.au/billy-connolly-made-in-scotland