NCWSBA executive director Chris Wilcox

RECENT wool price levels compared to synthetic and cotton fibre values should support demand for Australian wool by garment markers, weavers and knitters, according to leading industry consultant Chris Wilcox.

In his latest newsletter as executive director of the National Council of Wool Selling Brokers of Australia, Mr Wilcox said prices for cotton and synthetic fibres have risen by more than wool prices in the past few months.

“This trend has continued in the past fortnight, with cotton and synthetic fibre prices rising again this week.

“As a result, Australian wool’s price competitiveness has improved significantly since the start of 2020,” he said.

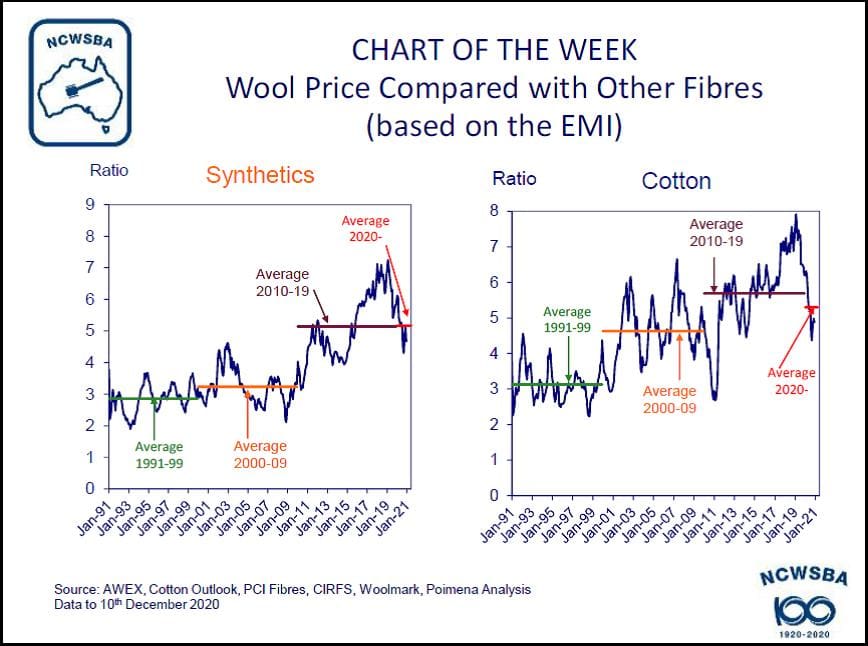

“The ratio of the (Australian wool price benchmark) Eastern Market Indicator to cotton price has fallen from an all-time peak of 7.92 in February 2019 to 6.32 in February 2020 and is currently sitting at 4.88.

“The ratio of the EMI against synthetic fibre prices has also fallen from an all-time peak of 7.25 in February 2019 to 6.08 in February 2020 and currently sits at 4.66,” Mr Wilcox said.

In his first Chart of the Week below, Mr Wilcox showed the trends in the price ratios between the EMI and synthetic fibres (left hand graph) and cotton prices (right hand graph).

“As can be seen, the current ratios of wool against both synthetics and cotton are well below the peak levels reached in late 2018.

“For cotton, both the current price ratio and the average since January 2020 are well below the levels seen through the 2010s,” he said.

“This means that wool is more competitive against both synthetics and cotton, which should support demand for wool by garment makers, weavers and knitters.”

October wool export values slump

However, Mr Wilcox said the latest Australian Bureau of Statistics data on Australian wool exports in October showed that the volume of exports to all destinations was down by 2 percent.

“Reflecting the large year-on-year drop in wool prices in September and October, the value of wool exports collapsed, down by 32pc for the month compared with November 2019.

“Exports to China were 13pc higher by volume compared with October 2019, although the value of exports to China in October was down by 20pc,” he said.

“This puts China’s share of Australia’s export volumes at 89pc for the month.”

Mr Wilcox said exports to Korea, the fourth largest destination, were 43pc higher, while exports to the UK 81pc, although the UK is only a very small export destination.

“On the other hand, Australia’s exports to Europe as a whole slumped by 54pc in volume and by 72pc in value.”

He said exports to the Czech Republic were down by 21pc in volume and shipments to Italy slumped by 75pc.

“Exports to India dropped by 39pc, although that country remained the second largest destination for Australian wool in October.

“For the four months of the 2020/21 season to October, the volume of exports was a slight 1pc higher than a year ago, with exports to China and the Czech Republic than a year earlier, up by 18pc and 15pc respectively,” Mr Wilcox said.

“The value of Australia’s wool exports was down by 30pc in the July-October 2020 period.”

HAVE YOUR SAY