Southern Aurora Markets partner Mike Avery.

“Inside of a ring or out, ain’t nothing wrong with going down. It’s staying down that’s wrong.” –

Muhammad Ali

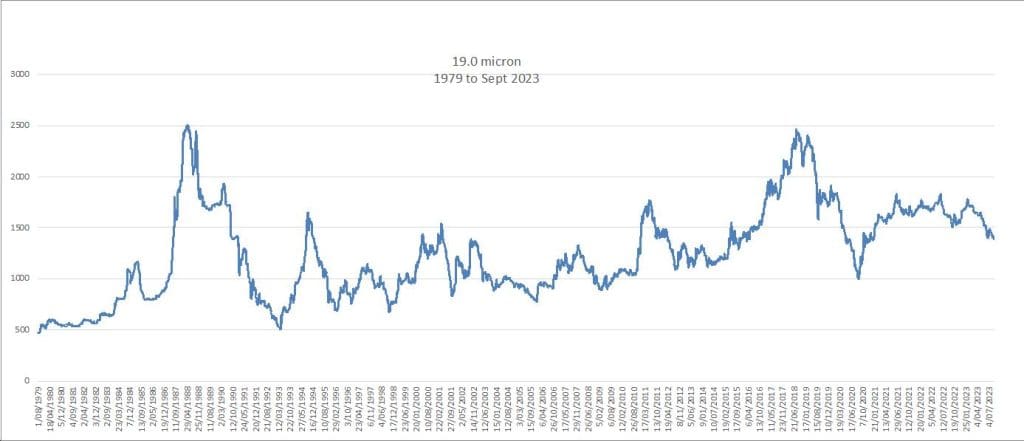

AUSTRALIA’S wool auction spot market continued to be under pressure this week, falling to its lowest point in almost three years, but there was some forward trading.

The AWEX Eastern Market Indicator fell to 1118ac on Tuesday. Still well above (260 cents) the COVID-induced low of September 2020 of 858c/kg clean.

On Wednesday, the market dragged itself off the canvas and posted gains across all microns. The EMI closed at 1127 cents, exactly where we were two weeks ago, having gone up 9 cents down 18 cents then up 9 cents.

The roller coaster bought a little more action to the forward market. October traded at a premium to spot with all activity in the key 19 micron and 21 micron categories. The 19 micron contract traded 9 cents over spot to close at 1420 cents and 21 microns traded 17 cents over spot to close at 1290 cents.

Where to from here? The forward market is giving mixed signals. The global economic indicators remain bearish with China still struggling with their recovery. The most likely outcome will be a continuation of the weakening trend with the occasional uplift stimulated by pockets of prompt demand.

How long this trend will last is conjecture. Many forecasters are predicting the second half of 2024. This is supported by recent trades at 80 to 100 cents over spot in that period and continued strong bidding on the forwards (60-80 cents-plus over cash) for January to July 2025.

How long this trend will last is conjecture. Many forecasters are predicting the second half of 2024. This is supported by recent trades at 80 to 100 cents over spot in that period and continued strong bidding on the forwards (60-80 cents-plus over cash) for January to July 2025.

A word of caution: as the old saying goes “Forecasters make sheep look like independent thinkers.”

There are two distinct strategies that can play out in this environment. First, is the general hedge strategy for buyers and sellers to limit their exposure and lock a margin in an erratic market. Second, is predominantly for growers. If growers are resolute in holding their long position in wool (storing not selling) they could improve their cash flow by selling a percentage of their wool now and buy the corresponding value in an appropriate micron.

Bidding in the nearby months is at a modest discount (10 cents) on the finer microns (17 to18) and flat to cash for the medium Merinos and crossbreds. This would indicate an anticipated firm to dearer market next week. Hopefully that will delivery some more activity and hedge opportunities.

This week’s trades

October 2023 19 micron 1420 cents 12 tonnes

October 2023 21 micron 1285/90 cents 15 tonnes

Total 27 tonnes

Source – Southern Aurora Markets.

HAVE YOUR SAY