WOOL price volatility has led to buyers hedging forward positions, providing growers with selling opportunities.

It was another topsy turvy week on the spot auction market. The lack of any fundamental change in demand signals led to the market continuing to grid down Tuesday. This was against a background of stabilising global news around the outcome of the US elections and positive progress on the vaccine front.

While global stock and commodity prices rose substantially at the start of the week, the auction began with an immediate retraction of 3 to 4 percent (40 to 50 cents).

Just as we have marvelled at the market’s ability to change from one day to the next, we experienced an intra-day change in sentiment, with the Western Australian market bucking the trend by firming throughout Tuesday afternoon. This stimulus fed into the forward market and the auctions in the east and the west on Wednesday.

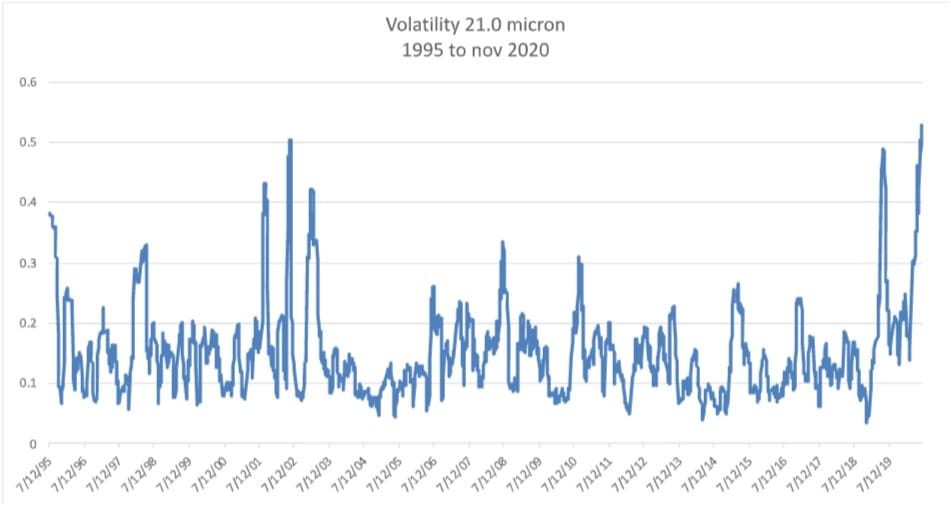

Volatility remains at unprecedented levels and this has led to buyers looking to hedge forward positions and subsequently provide growers with selling opportunities.

Forward premiums were paid on 18 micron in January of 1620 cents against the spot level of 1587 cents, 19 micron traded at 1425 cents in November and December against a spot of 1402 cents, and 21 micron traded December at 1245 cents against a spot of 1225 cents.

Probably just as interesting was seeing 19 micron trade flat to cash at 1400 cents out in May 2021. When you consider that the 19 micron index has averaged just 1194 cents for the current season, having opened at 1296 cents and had a range of 996-1453 cents, securing 1400 cents for part of your clip seven months forward appears a sound strategy.

We anticipate a similar pattern, with prices moving on sentiment and demand changes. Hedging opportunities will likely also ebb and flow making calculated target setting the optimum strategy to take advantage of further rallies.

Indicative trading levels

19 micron 21 micron

Nov/Dec 1400 cents 1225 cents

Jan/Feb 1380 cents 1180 cents

Mar/April 1380 cents 1180 cents

May/June 1380 cents 1180 cents

This week’s trades

November 19 micron 1370/1425 cents 7.5 tonnes

December 19 micron 1320/1425 cents 20 tonnes

December 21 micron 1160/1245 cents 20 tonnes

January 18 micron 1620 cents 4 tonnes

May 19 micron 1400 cents 5 tonnes

TOTAL 56.5 tonnes

HAVE YOUR SAY