Southern Aurora Markets partner Mike Avery.

A WEEK appears to be a long time in the commodity markets these days, as forward wool trading bids and offerings remain muted.

Last week confidence was at a high and we saw the Eastern Marker Indicator post its highest one day gain (44 cents) for eighteen months on Tuesday.

This translated into substantial gains in the key 19 micron and 21 micron indices of 62 cents and 71 cents respectively.

These gains stimulated the forward markets with trading last week and early this week through the resistance levels on both 19 micron and 21 micron. Growers obtained hedge levels on 21 microns – of March at 1475 cents and July at 1430 cents — not seen since early 2020. This highlighted the value of growers setting target forward levels to take advantage of rallies in the spot auction.

A week down the track confidence disappeared along with buying interest in physical offer boards and forwards. Sellers snapped up the remaining solid bids on the forward markets.

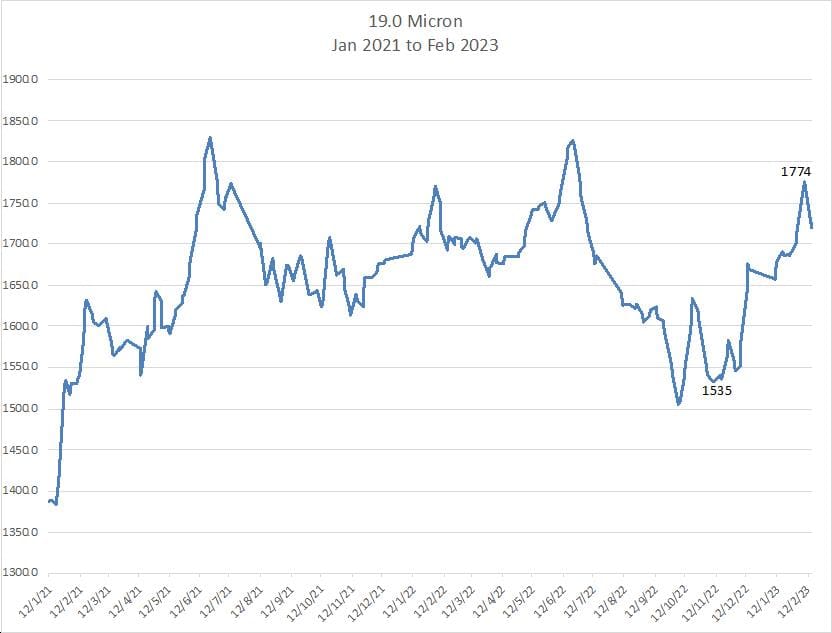

On Tuesday, the EMI was off 23 cents; 19 micron down 49 cents and 21 micron down 34 cents. Technical analysts are now looking at whether we are seeing at a retraction in the rally that has held since November last year (as indicated in the chart below) or merely a short-term inability of the market to withstand the increase flow onto the physical market.

The test will come again next week, with 57,000 bales again rostered for sale. Current bidding on the forwards is muted and not help by the current lack of grower offering. On a brighter note, bidding for 19 micron remains solid throughout 2024 and 2025; slightly above the average for the last two years at 1670 cents.

Traded this week

February 21 micron 1465 cents 5 tonnes

March 21 micron 1475 cents 6 tonnes

January 2024 19 micron 1670 cents 10 tonnes

Total 21 tonnes

HAVE YOUR SAY