WOOL forward trading increased this week as the spot auction market finally stabilised, breaking out of its sawtooth pattern to be relatively unchanged.

WOOL forward trading increased this week as the spot auction market finally stabilised, breaking out of its sawtooth pattern to be relatively unchanged.

The 17 and 18 micron wools were in demand with medium Merinos and crossbreds steady.

Auction clearance rates improved, with 33,000 bales changing hands and the passed-in rate fell to 11.2 percent.

There was better activity on the forwards, with most months bid flat to cash out to Christmas and into the early New Year. The second quarter of 2022 and into 2023 is still commanding a slight premium for the 19 and 21 micron indices. This was reflected with the trades in 19 micron in November at 1650 cents, in April 2022 at 1660 cents and October 2022 at 1660 cents against the closing spot of 1644 cents.

The 18 micron contract traded this week in December at 2020 cents and for June 2022 at 2010 cents. The spot closed the week at 2065 cents. The 18 micron index trading at a discount and 19 micron at a premium can be rationalised by looking at the relative historical pricing.

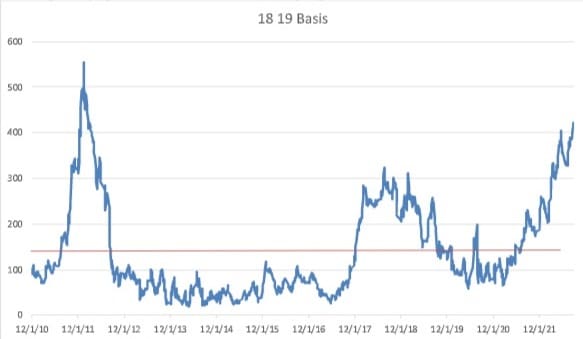

The graph below traces the price difference (basis or spread) between 18 and 19 micron since 2010. The spread between the two at auction sits just over 400 cents well above the long-term average of 142 cents. This, along with the fact that 18 micron is currently sitting at the 75th percentile, would justify growers of 18 micron wool hedging their risk with the 18 MPG.

Next week will likely see the forwards follow a similar pattern. Exporters will look to manage their risk by bidding flat to cash in the nearby months to modest premiums in the medium microns for 2022/23.

Demand is moderate and logistic issues, raising freight and handling charges are challenging finance lines with cycle times (purchase to payment) blowing out. The “just in time” nature of the market is almost clouding medium and longer term signals.

This week’s trades

November 19 micron 1650 cents 5 tonnes

December 18 micron 2020 cents 5 tonnes

April 2022 19 micron 1660 cents 2 tonnes

June 2022 18 micron 2010 cents 6 tonnes

October 2022 19 micron 1660 cents 2 tonnes

Total 20 tonnes

WOOL forward trading increased as the spot auction market finally stabilised, breaking out of its sawtooth pattern to be relatively unchanged this week.

The 17 and 18 micron wools were in demand with medium Merinos and crossbreds steady.

Clearance rates improved with 33,000 bales changing hands and the passed-in rate fell to 11.2 percent.

There was better activity on the forwards, with most months bid flat to cash out to Christmas and into the early New Year. The second quarter of 2022 and into 2023 is still commanding a slight premium for the 19 and 21 micron indices. This was reflected with the trades in 19 micron in November at 1650 cents, in April 2022 at 1660 cents and October 2022 at 1660 cents against the closing spot of 1644 cents.

The 18 micron contract traded this week in December at 2020 cents and for June 2022 at 2010 cents. The spot closed the week at 2065 cents. The 18 micron index trading at a discount and 19 micron at a premium can be rationalised by looking at the relative historical pricing.

The graph below traces the price difference (basis or spread) between 18 and 19 micron since 2010. The spread between the two at auction sits just over 400 cents well above the long-term average of 142 cents. This, along with the fact that 18 micron is currently sitting at the 75th percentile, would justify growers of 18 micron wool hedging their risk with the 18 MPG.

Next week will likely see the forwards follow a similar pattern. Exporters will look to manage their risk by bidding flat to cash in the nearby months to modest premiums in the medium microns for 2022/23.

Demand is moderate and logistic issues, raising freight and handling charges are challenging finance lines with cycle times (purchase to payment) blowing out. The “just in time” nature of the market is almost clouding medium and longer term signals.

This week’s trades

November 19 micron 1650 cents 5 tonnes

December 18 micron 2020 cents 5 tonnes

April 2022 19 micron 1660 cents 2 tonnes

June 2022 18 micron 2010 cents 6 tonnes

October 2022 19 micron 1660 cents 2 tonnes

Total 20 tonnes

Source: Southern Aurora Markets.

HAVE YOUR SAY