Southern Aurora Markets partner Mike Avery.

THE wool spot auction and forward markets repeated themselves last week.

For the spot auction, after opening for the year after the Christmas recess flat in the first week, each subsequent week has started cheaper on the first day and then stabilised.

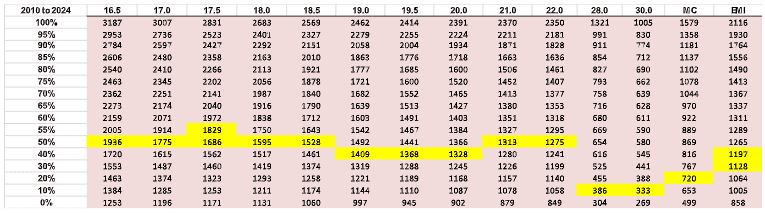

This has resulted in a decline in prices since the New Year of between 2.5 and 7.5 percent in the Merino qualities. The superfine wool has been most affected with 16.5 and 17 microns down more than 7 percent. The balance of the Merinos were down around 5pc. The 21 micron category has been less impacted and was down 2.5pc.

Crossbred wools have bucked the trend, improving 2-3pc over the month.

The forward markets tended to be bid at their highest point at the start of the week, although in limited quantity, in line with the tepid demand. It does indicate a willingness of the buyers to mitigate some of their risk, even in a falling market. The 19 micron indicator traded at 1440 cents for July, 22 cents over the closing spot of 1418 cents. It remains bid March and June at 1430 cents. This trend has been evident throughout the month. Buyers bidding flat to a premium did not attract any meaningful volume.

With the Chinese New Year around the corner, we are unlikely to see and meaningful change to the trend.

Buyers are hopeful of some activity prior to the start of the holiday that might see the continuation of the forward bidding in the nearby window at flat to spot or a slight premium. Sellers’ reluctance to engage is likely due more to the prices of almost all micron groups sitting on or below the average of the last 14 years.

This week’s trades

July 10 19 micron 1440 cents 5 tonnes

July 17 19 micron 1440 cents 2.5 tonnes

HAVE YOUR SAY