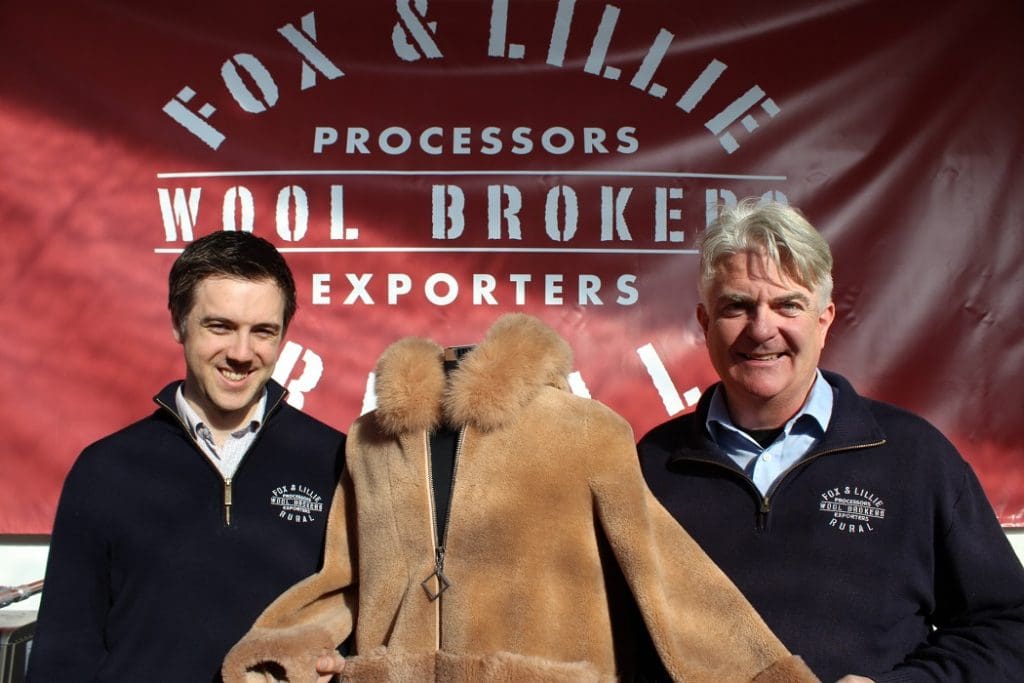

Fox & Lillie managing directors James and Jonathan Lillie.

MAJOR wool exporter Fox & Lillie is negotiating a forward pricing scheme with one of the world’s largest processors as industry concerns about supply and price volatility increase.

At a breakfast seminar at Hamilton’s Sheepvention rural expo on Monday, Fox & Lillie brokerage manager Eamon Timms said with US president Donald Trump announcing further tariffs on Chinese products, there was a real risk of greater volatility in the world as China-US trade tensions prevailed.

“So Fox and Lillie see that this issue is one that we need to tackle a bit more, so we are in negotiations with one of the largest wool processors at the moment for forward pricing scheme for wool.

“So to give a bit of certainty for people if they want to avail themselves of it, we will be announcing more details of that in the coming month or two.”

Mr Timms said longer term supply contracts – possibly for two to three years – would give growers certainty on pricing and users certainty on supply.

“It has certainly come about because of concerns about supply which is a big issue with users and they want to try to address the issue.”

Fox & Lillie managing director Jamie Lillie would not name the processor, but said a forward pricing scheme would advantage growers and the overseas client.

“The overseas client really wants to know the price of his wool coming to him in a year or maybe two years out and for the grower, they can also budget with their fixed pricing.

“If we can get it to work — and there is a bit of work to do around it – but if we can get it to work it’s meant to be of benefit to both parties – they are locking in certainty.”

Fox & Lillie trader Aaron Shaw said the company believed the forward trading of wool would become a bigger part of its business.

“Our biggest client that we’ve sold to, who is in India, a vertical mill, they buy wool on forwards and we believe there is going to be more of this around.

“Our clients are genuinely concerned about supply and at the moment these prices are affordable to the downstream market,” he said.

“Our clients are looking at, we want more certainty, because they have seen the volatility, they’ve seen the 16.5 (micron) hit $32, they’ve seen 28 micron hit $13 – they want a bit more stability.

“So we believe forwards are going to be a bigger part of the market.”

Fake fur feature of Chinese domestic demand

Fox & Lillie’s Aaron Shaw, left, and Eamon Timms with a fake fur jacket.

Mr Shaw said the China-US trade war is a worry for the industry.

“Globally conditions are in a big negative – that’s the outlook and the China-US trade war can worsen without warning.”

But he said China consumers more than half its wool imports domestically.

“So the Chinese domestic use for their uniform orders, their woollen sweater garments, which is going quite well, the fake fur, the double-face fabric – they are massive consumers of wool and we can’t lose sight of that.”

Mr Shaw said Fox & Lillie was Australia’s second largest wool exporter and demand for wool for fake fur had caused crossbred prices to surge in the past 12 months, making up a significant part of the company’s turnover. Wool had replace higher-priced alpaca for fake fur, and although demand was seasonal, starting in November, the product has had a serious impact on Australia’s wool market.

Bigger premiums expected for better spec wools

For growers, Mr Shaw said forward market signals point toward bigger premiums for Merino high spec wools versus lower spec types.

“Our expectations are that the clip will be slightly broader to last year and that gap between the fine wools and the broad Merinos will increase.

“Skirtings will stay closely priced to fleece in Merino as the knitwear continues to be in fashion.

“Oddments for us, they are the clear value and we expect more upside potential.”

Mr Shaw said there are signs are that the fake fur market will continue for crossbred wool growers, but more would be known in November. Last year the 28 micron indicator traded from 750-1320 cents, but the price range this year depend on Indian and fake fur market demand.

Mr Shaw said 34 micron and broader fleece wools still did not have a “short term upside” as carpet demand is quite low and there were plentiful supplies of this wool around the world.

“As meat prices are really good there is a lot of coarse wool around.”

Wool’s sustainability and welfare are key issues

Mr Shaw said natural fibres were gaining more attention from brands and in the media as the ‘war on waste’ continues to be a conversation driver.

“Wool is in a perfect place for that now.”

Mr Shaw said there was increasingly more competition on wools declared under the National Wool Declaration’s pain relief, ceased mulesed and non-mulesed categories “regardless of spec.”

He said programs such as Authentico, SustainaWOOL and Responsible Wool Standard were being noticed.

“And the premium at auction for non-mulesed wool is become a bit more consistent – there is definitely a really big push from our end-users – a mixture of European and Chinese.

“One of our biggest RWS buyers is a Chinese company and we are also seeing new enquiry coming through for even short wool on non-mulesed,” he said.

“So everyone is trying to enter into this ethical sustainable world with their own niche little market.”

Mr Shaw said a lot of the woollen garments being consumed domestically in China are not using non-mulesed wool.

“But what we see travelling to China a lot is a big change – there are a lot more people in Shanghai with pets and that kind of mentality – it may take another 5-15 years — is there that they are starting to care for an animal.”

He said the Australian industry’s best ‘platform’ is to be prepared for market changes and growers could not expect that wool from mulesed sheep produced without pain relief would always be acceptable.

HAVE YOUR SAY