Southern Aurora Markets partner Mike Avery.

“It’s not the strongest that survive, nor the most intelligent, but the most responsive to change.” Charles Darwin.

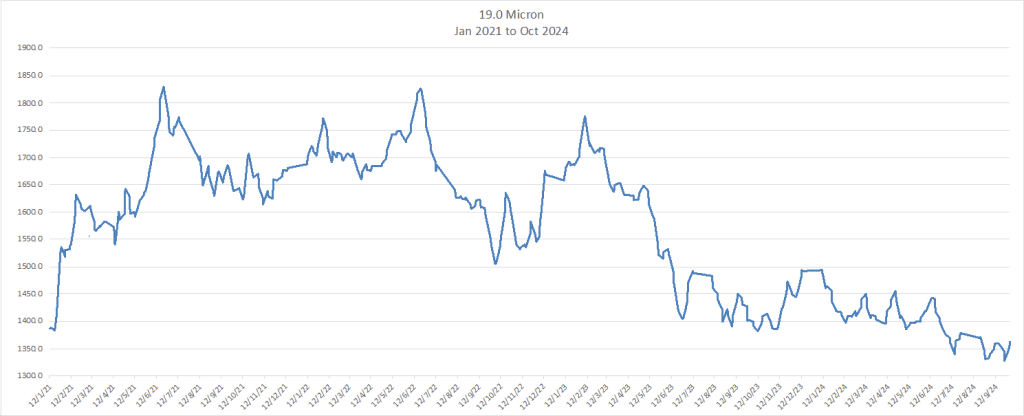

THE strong Australian dollar and sluggish sentiment from the Tongxiang Wool Conference were cast aside as many wool types rose 1.5-3 percent this week, reacted to the Chinese Government stimulus package.

On the surface, the stimuli seem similar to previous invention strategies; cut interbank and mortgage rates, reduce deposit requirements and stimulate the stock market.

How this will play out for the wool market is what is important. Any improvement in confidence and the potential for further sector specific stimulus can only be a good thing.

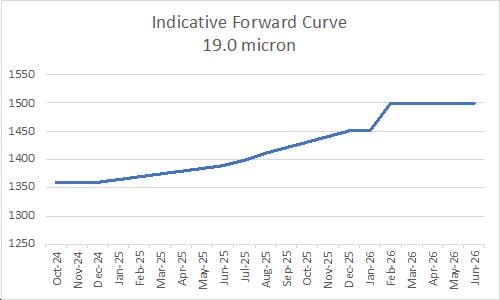

The rise in the spot auction wool prices is yet to be franked by offshore activity. It did bring out a little more activity in the forwards. While trading was light there appeared to be more interest in trying to ascertain fair value and defray risk.

Late October traded at flat to Wednesday’s auction close with 19.5 micron executed at 1325 cents. This was a rise of 40 cents over last week.

Opportunities for growers to hedge in reasonable volumes will likely hinge on a continuation of the current rally. Fair value is expected to focus around cash for the final quarter of 2024.

The first half of 2025 is holding little interest for the moment with buyers and sellers looking to spring and beyond. December 2025 and January 2026 still has modest volumes available at a 90-cent premium (7pc) to cash for 19 micron. February and March are bid a further 50 cents premium at 1500 cents.

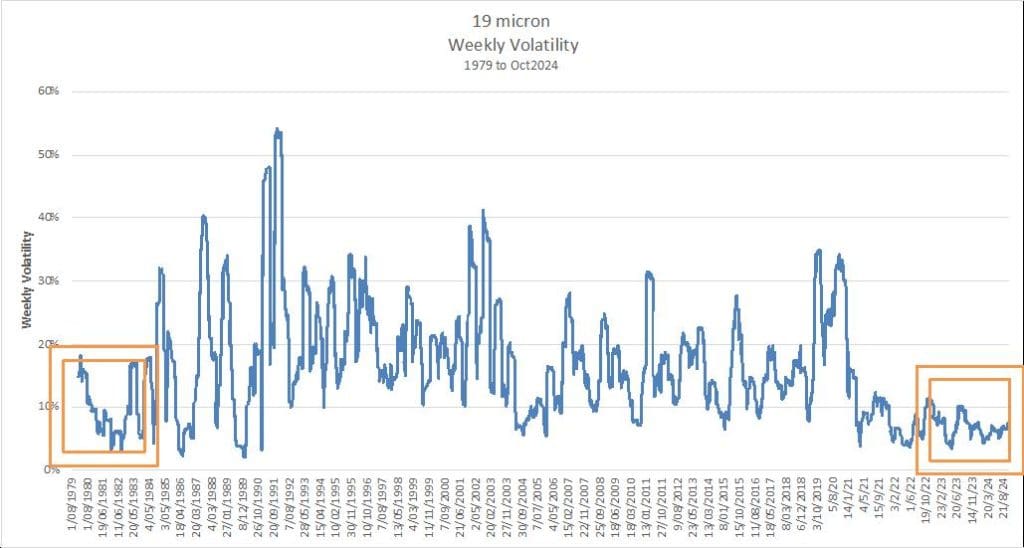

Price volatility is rising off historically low levels. Wool was once the second most volatile agricultural commodity. That title was previously held by potatoes. The current landscape is prone to see this risk in volatility continue.

The bullish triggers of invention and stimulation in China are balanced by continued listless conditions in Europe. Throw in the fickle consumer confidence, an erratic USD, global tensions, and tight supply and forecasting forward levels becomes difficult. Valuing certainty over the fear of potential lost opportunity becomes more important.

Next week auctions are spread over three days with a little over 34,000 bales on offer. The AUD has come slightly off its highs and hopefully will not hinder prices next week.

This week’s trades

December 19 micron 1335 cents 2 tonnes

October 19.5 micron 1325 cents 5 tonnes

Total 7 tonnes

Source – Southern Aurora Markets.

HAVE YOUR SAY