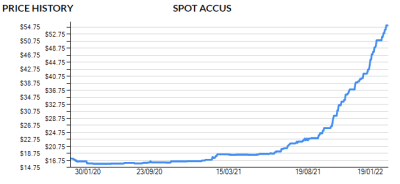

Click to enlarge. The price of Australian Carbon Credit Units has tripled in the past year. Source: Jarden

AFTER years of hovering around the same price, the value of Australia’s carbon credits has skyrocketed – tripling in the past year.

The spot price for Australian Carbon Credit Units (ACCU) reached $55.25/tonne this week, an increase of more than $30 from $18.75 in the middle of last year. The current price is another record for this evolving market, which has been reaching new territory over the past six months.

ACCUs are generated through a series of methods registered with the Federal Government’s Emissions Reduction Fund, a carbon credit system known as one of the most rigorous in the world.

Charlie Hawkins from Carbon Link, who assists producers develop and operate soil carbon projects, said the private sector was one of the main drivers behind the recent demand for ACCUs – with the Federal Government being one of the only buyers until 2018. He compared it to the carrot and stick model.

“The carrot was the Federal Government’s Emission Reduction Fund kickstarting the carbon market and incentivising farmers to create carbon credits so they could then buy ACCUs as part of the plan to reach their Paris targets,” Mr Hawkins said.

“The stick is the regulatory framework called the ‘Safeguard Mechanism’ which started in 2016 which penalises companies who exceed a baseline of emissions. Any tonne emitted over the baseline, they have to buy carbon credits to offset it.”

Charlie Hawkins says a small percentage of Australia’s land is being used to generate carbon credits.

There’s no doubt the recent COP26 summit in Glasgow last year piqued the world’s interest in the carbon market, with an agreement to set up a regulatory body for carbon trading across the globe. Some have credited policies and targets made in Glasgow for the recent rise in demand for ACCUs.

Carbon market lacking supply

Adding to the price pressure of ACCUs has been a lack of supply, with a small percentage of Australia’s land used to generate credits.

Mr Hawkins said there remains considerable scope to generate credits in Australia, in particular via soil carbon.

“Approximately one percent of Australia’s farming enterprises involved in the Emissions Reduction Fund,” he said.

“Outside of western Queensland and New South Wales where there is a lot of re-vegetation projects which have generated the most ACCU’s, there’s been a limited uptake of carbon projects on agricultural land. It’s still a really young market.”

Mr Hawkins said the current price of ACCUs has made trading them a viable option and many were investing.

“Once the private sector became involved, the true value of the ACCU was realised and it’s a booming market with a positive outlook,” he said.

“I know with several aggregators, they’re keen to retain their credits and generate more credits because they have a view that the ACCU price can strengthen further. Some producers are opting to hold their ACCUs to offset their emissions towards carbon neutral beef. This is a more recent and trending pattern.”

Supply could be increasing

While Mr Hawkins expected demand to exceed supply for some time, he said more more ACCUs were becoming available. He said Carbon Link was experiencing strong demand for its soil carbon project services.

“We have noticed a lot of people who may have been thinking about carbon projects are at the tipping point now, where they’ve decided to do it,” he said.

The rising interest in soil carbon projects has been noticed across the sector, with Armidale-based soil carbon company Precision Pastures recently completing a $500,000 capital raising.

Hamish Webb

Executive director and Interim CEO Hamish Webb said the business already had more than 150 ‘first-mover’ clients who were undertaking or exploring a soil carbon project on their farm – with the company targeting 1,000 additional properties.

“Our clients average more than 1,000 hectares per farm or carbon project. Over the course of the project, if each farm or carbon project strives for an average increase in soil carbon of one per cent per hectare, this will deliver approximately 165 tonnes of CO2-equivalent sequestered,” Mr Webb said.

Mr Webb said the company advised landholders to focus on the production benefits of soil carbon projects.

“We know this is new and there is uncertainty about the Clean Energy Regulator’s approach to sequestration modelling and soil carbon methodologies,” he said.

“However, Precision Pastures has always focused on the established production benefits from increasing soil carbon, such as improved pasture growth, soil biology and moisture retention. If we can get that right first, then the carbon credits will look after themselves.”

While some are confident the carbon market will keep increasing, carbon market advisors the Market Advisory Group said in a November report the future ACCU spot price was hard to predict.

“We expect to see new, much needed supply from landfill gas projects in 2022, which may soften the rapid price rise,” the report said.

“But even with this new supply, we think growing demand could result in further upside in the spot price.”

Thanks for all this information. Great!