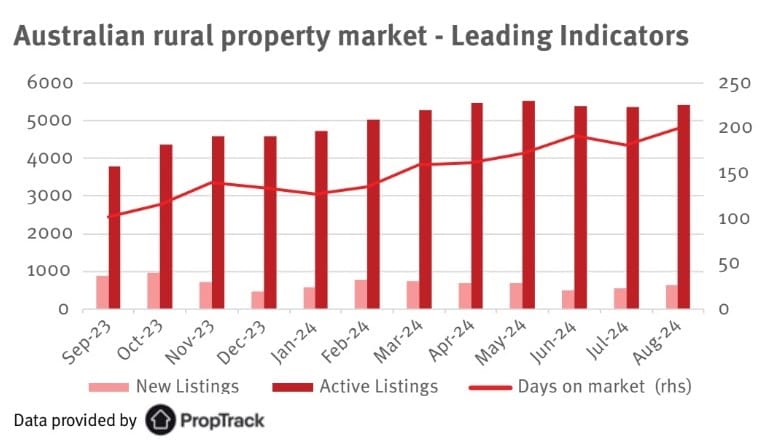

IT’S taking much longer to sell the average rural property anywhere in Australia than it did a year ago, a new set of statistics show – a sure sign that the demand boom cycle in rural land is in decline.

Australia-wide, days on market for a typical rural property has gone from about 120 days to around 200 days, over the 12 months from September last year – a rise of 67 percent.

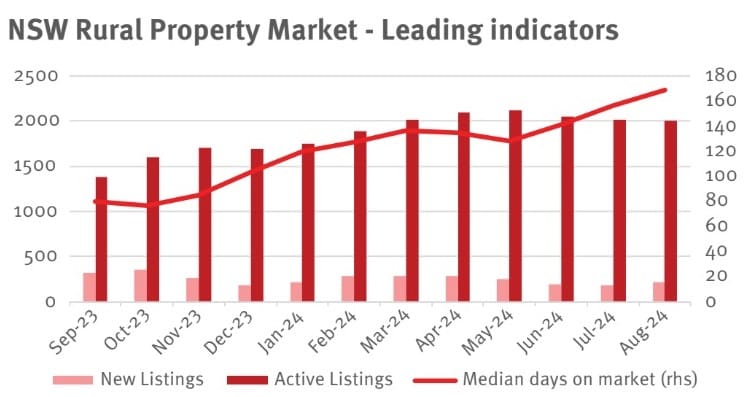

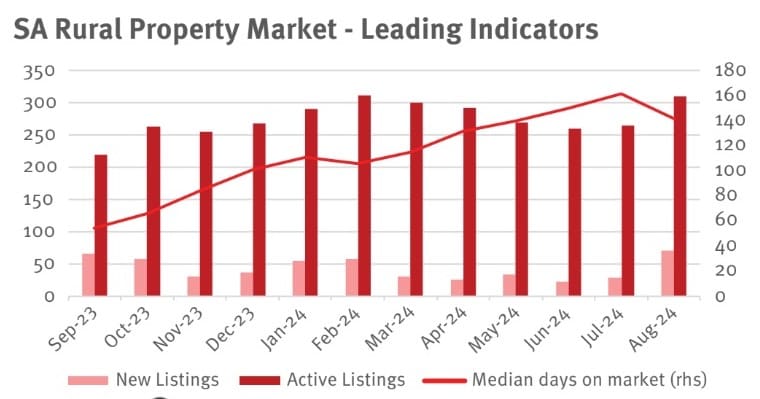

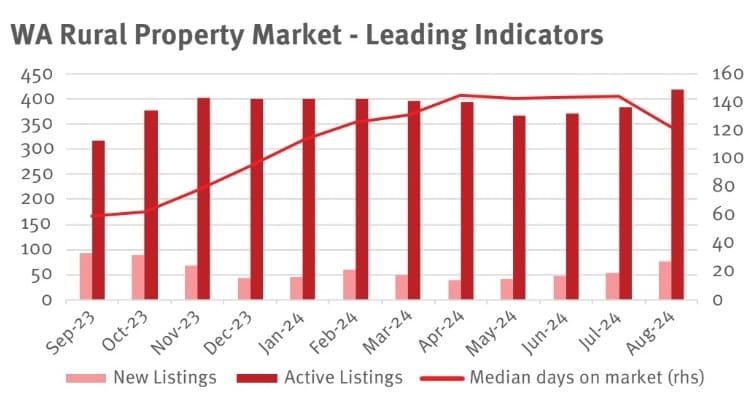

The cycle is at somewhat different stages in different states and territories, but the trend is similar, the new set of data commissioned by Elders and generated by data analytics company Proptrack shows.

The national data graphed above, and for each state published below, measures properties of 40ha or larger, across all agricultural land use types. It captures listed properties only – not those that have already been sold.

The national statistics show that while new monthly listings have been reasonably steady over the past 12 months (currently around 500/month – pink bar on graphs), the ‘active’ listings (red bar) have risen from about 3800 to 5500 since September 2023. That’s a rise of 45pc.

Time on market a new metric

The new time-on-market metric promises to be useful for followers of the rural property market. Over time, variations of the data (for example, larger properties only, above say, 250ha or 500ha which would eliminate more intensive horticultural holdings) will be generated as part of the series.

Richard Koch, Elders

“We have been working with Proptrak to develop the new set of real-time indicators of the rural property market based on real estate website sale listings,” Elders business analyst Richard Koch said.

“As can be seen from the chart, the indicators are consistent with a cooling market – days on market have almost doubled in the past year, while active listings have stagnated and new listings have fallen,” he said.

The listing statistics for Queensland/NT set out below suggest that region’s property market is at a different stage to southern markets, and it was likely that the northern property market will lead the recovery in Australian rural property values in 2025 or if not 2026, as cattle prices continue to improve, Mr Koch said.

State breakdown

In Queensland and the Northern Territory, time-on-market has gone from about 90 days in September last year, peaking at just over 160 days for active listings between March and June this year, before declining a little in July and August.

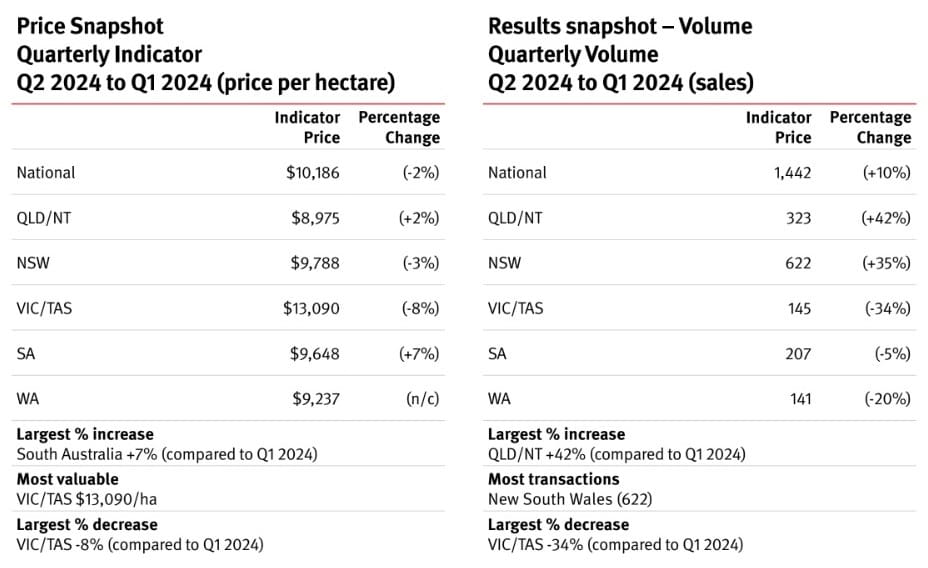

The QLD/NT market held relatively firm on a solid lift in sales and value traded with activity lifting across all regions, Elders latest quarterly Rural Property Updats says. The region had rebounded well after stuttering during the big pull-back in cattle values in 2023. The region’s indicator price for sales in the second quarter was $8975/ha, up 2pc on the previous quarter, and 44pc higher than the June quarter last year.

Time properties spent on market in New South Wales is continuing to grow, starting from about 90 days a year ago to 170 days by August this year. That has corresponded with a slight decline in the number of active listings since May.

Activity in the rural property market has been gradually slowing since peaking in 2021. Elders NSW Rural Property Price Indicator declined by 3pc on the quarter to $9788/ha, but remains 10pc above the levels of early 2023. Price trends across different regions of NSW have been quite mixed, the report said.

In Victoria/Tasmania, there has been a fairly consistent 12-month rise in time-on-market, from 110 days in September last year to 210 days by August this year. Active listings have eased slightly since May.

Property prices across the southern-most states of Victoria/Tasmania have fallen sharply since late 2023, the Update said. No doubt a contributing factor has been the very poor seasonal conditions that presented last Spring and have persisted through the Autumn/Winter and into early Spring 2024. A contributing factor has been the very poor seasonal conditions that presented last Spring and have persisted through the Autumn/Winter and into early spring 2024.

Elders VIC/TAS Rural Property Price Indicator fell another 8pc in the second quarter to $13,090/ha, putting it 15pc behind the level of the same time last year.

South Australian rural property time-on-market has recently declined a little, but the trend has been strongly higher over the past year, from around 105 days to 165 days by July 2024. Active listings dipped for a period in early/mid-winter, but are again on the rise.

The performance of the rural property market across South Australia was surprisingly strong when compared to other southern markets which endured similarly adverse seasonal conditions. After falling the previous quarter, Elders’ SA Rural Property Price Indicator recovered during the second quarter to $9648/ha, posting a gain of 7pc on the March quarter and climbing 10pc above the same time last year.

In Western Australia, active listings have been reasonably consistent, with median time-on-market peaking in April at a little over 140 days, but recently showing a small decline. The WA property market held firm on a decline in sales volume last quarter and value of properties transacted. The WA Rural Property Price Indicator was unchanged at $9237/ha, but still 3pc above year ago levels.

“The WA Rural Property Market seems to be in a very different phase than other markets around Australia,” Elders’ report said. “Like other regions, WA has been in consolidation mode through much of the year, however there looks to be a shift in market sentiment emerging through Q3 with the number of new and active listings rebounding and days on market falling,” it said.

Overall property market cooling

Overall, the national rural property market continued to cool in the June quarter of 2024, dragged lower by prices in VIC/TAS. Listing stats show that time on market has blown out and that active listings have stagnated, and new listings have contracted – consistent with a slowing property market.

Key drivers have been weak commodity values, poor seasonal conditions, low farmer confidence, falling farm incomes and rising cost of finance.

The national $/ha property indicator figure for the second quarter of $10,186 was down 2pc on the previous quarter, but was up 5pc year-on-year.

The catalyst for the falls in the National Indicator was a decline in prices across VIC/TAS where the State Indicator fell another 8pc on top of a 15pc fall in Q1. In contrast, prices in most other states were firm to moderately higher led by the South Australian and Queensland/Northern Territory markets.

Prices in SA recovered after falling in successive quarters since peaking in Q3 2023.

There was a sharp contraction in activity across southern markets in VIC/TAS where only 145 properties transacted but this was more than offset by increased sales activity across northern markets. Sales activity increased by both 10pc on the previous quarter and 10pc on the same quarter last year.

HAVE YOUR SAY