IT was another crazy week on Australia’s spot auction wool market to open the year.

IT was another crazy week on Australia’s spot auction wool market to open the year.

Exporters, battle-weary from the previous 12 months that saw historically high volatility, witnessed a 100-cent rise in most Merino types on Tuesday.

It was great news for the few lucky growers, but destabilizing for the supply chain. Prices wavered Wednesday and gave up all the gains Thursday to close at mostly at pre-Christmas levels, with the exception of fine wools that held some of the gained ground.

The forward markets again traded on light volume with sellers tending to withdraw looking for higher prices on the back of Tuesday’s rise. Light volume traded in the nearby months with 21 micron contracted at 1820 cents in January and February out to June at 1800 cents, with a few growers taking advantage of the market reaction.

It is difficult to gauge what is in store for next week, with the indent buyers holding sway in the spot market and grower levels sparse in the forward months. Buyers remain cautious due to lack of follow through from offshore. We expect forward levels to return to their new year open as if this topsy-turvy week never really happened.

Indicative trading levels

19 micron 21 micron

January/February 1780 cents 1760 cents

March/April 1760 cents 1730 cents

May/June 1740 cents 1715 cents

Volatility making value calculations difficult

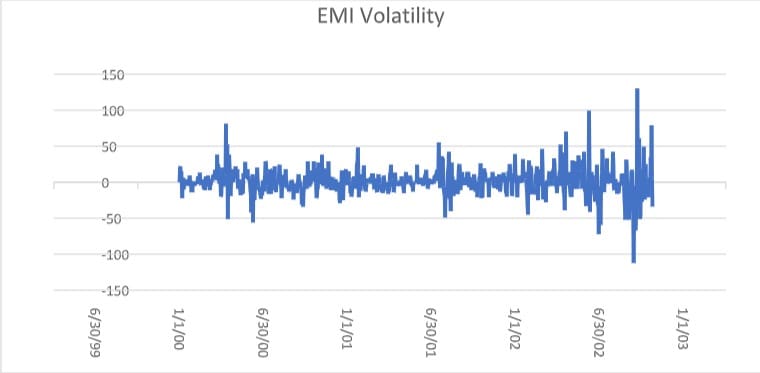

Volatility is making ascertaining fair value difficult for everyone in the supply chain. It is both the cause and effect. The lack of forward market participation and more reliance on ident/spot buying leads to more volatility, poor market signals and lower liquidity in the index products.

This is borne out by the EMI data for the last decade. In the first eight years (2010 to 2017) the EMI moved greater than 50 cents on only six occasions. Since 2018, it has suffered that degree of movement 13 times.

Trade summary

February 19 micron 1795 cents 5 tonnes

February 21 micron 1760/1820 cents 14 tonnes

March 19 micron 1810 cents 2.5 tonnes

March 21 micron 1790/1805 cents 7.5 tonnes

April 19 micron 1800 cents 2 tonnes

June 21 micron 1800 cents 5 tonnes

Total 36 tonnes

HAVE YOUR SAY