TRADE policy work was needed to develop early-stage wool processing options in Australia, Vietnam, India and Bangladesh that were identified in a federally-funded grower-initiated project.

A business case for expanded early-stage wool processing in Australia and roadmaps for similar developments in Vietnam, India and Bangladesh have been completed as part of the Federal Government-funded project outlined in a webinar this week.

Phase 1 of WoolProducers Australia’s ‘Ensuring a sustainable future for Australia’s wool supply chain’ project found that diversification of up to 50 percent of Australia’s wool production could deliver up to $1.1 billion/year in trade risk mitigation, plus new jobs, freight efficiencies, a potential $1.8 billion GDP increase and alignment with numerous government policy objectives such as biosecurity, economic contribution and supply chain prominence.

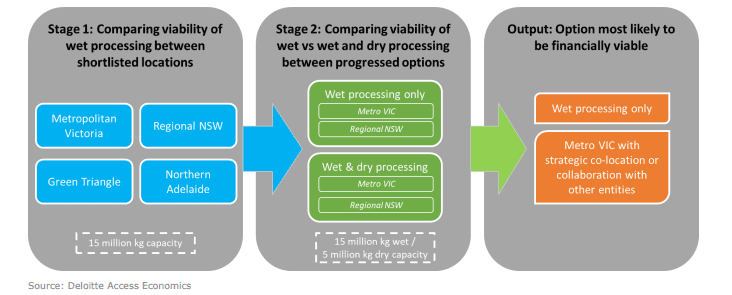

The financial appraisal results found that a wet processing only plant in metropolitan Victoria was a preferred option for addressing the identified problems and opportunities.

WoolProducers Australia general manager Adam Dawes.

WoolProducers Australia general manager Adam Dawes said diversification included supplying greasy wool to markets not sensitive to emergency animal diseases, undertaking pre-export processing of wool to removed EAD risk through scouring here or trading wool into diversified or expanded markets to reduce market concentration.

Under the Phase 1 work, the most feasible domestic processing option identified for Australia was scouring, to feed into a more contemporary supply chain, he said.

“Phase 1 really quantified that yes, domestic and diversified processing is feasible on commercial terms and also identified that there is tangible and real trade risk delivered through that diversified trade pathway.”

However, Mr Dawes said increased pre-export scouring in Australia would require supply chain adjustment with potential exports to diversified countries that have new top-making operations coupled with existing, planned or future spinning operations.

“Then that spinning and top making integrated supply chain can then start to emerge and grow in expanding export markets, and the most prominent export market that were identified through the phase 1 work were Vietnam, India and Bangladesh.”

Mr Dawes said the Phase 2 work focussed on developing roadmaps to increase top making in the priority markets of Vietnam, India and Bangladesh to integrate with their existing and growing spinning capacity.

Mr Dawes said given that the countries have well-established textile industries, individual roadmaps for each country were developed with findings catered to their specific textile industry needs and experience in relation to the use of Australian wool.

“These roadmaps have evidenced that there are clear opportunities to instigate, collaborate and cultivate early-stage wool processing in Vietnam, India and Bangladesh respectively” Mr Dawes said.

Consultations throughout the project found that downstream supply chain partners including spinners, knitters, weavers and garment manufacturers also have a desire to expand their supply chains to mitigate their procurement risks, he said

“Supply chain diversification and expansion is in everyone’s interest, but it’s no-one’s responsibility.

“With Australia production of 80pc of the worlds apparel wool we need to continue investment in this space”, Mr Dawes said.

Wool trade policy program proposed

WoolProducers Australia CEO Jo Hall.

To deliver the full potential of the work, WoolProducers is requesting the Federal Government to establish a three-year wool trade policy program to support the Australian wool industry’s endeavours to expand its wool trade and mitigate trade risk. WoolProducers said such a program would seek to commence implementation of the findings of the business case and roadmaps to deliver improvement in supply chain trade risk exposure.

“To futureproof the Australian wool industry and the prosperity of the rural and regional communities that it supports, this work must be supported and sustained by trade policy activities in the near-term years to ensure that the opportunities identified materialise into tangible actions that deliver the identified de-risking outcomes,” Mr Dawes said.

WoolProducers chief executive officer Jo Hall said importance of trade policy became more evident as the project progressed. Discussions have been initiated discussions with the Federal Government but nothing concrete had been decided.

“We don’t see that there will be a phase 3 of this process, we see that this is now finalised, but again if you want, the phase 3 could be that ongoing trade policy role that WoolProducers may or may not be part of.

“Certainly we are not driving it, we would like to be heavily influencing it.”

Vietnam early-stage processing would be cost-competitive

In a webinar earlier this week, a Deloitte consultant said early-stage wool processing in Vietnam could be cost-competitive with China.

“Australia obviously does have a higher labour cost base than some of these other countries that we’ve looked at, but remarkably a lot of the costs are fairly similar between Australia and these other countries.

“I don’t think we would want to present that if early-stage processing grew in Vietnam it would necessarily come at the cost of being able to do something in Australia as well and I think in particular, there is a potential benefit for all four of these countries working together,” he said.

With different areas of focus in each country there is a potential for a supply chain to develop, rather than just a direct export relationship with one of these countries, the consultant said.

The domestic business case report is available on the WoolProducers website and the roadmaps are accessible via this hyperlink.

The research was funded through the Agricultural Trade and Market Access Cooperation program and undertaken by Deloitte Access Economics, guided by an industry steering committee. Membership comprised of representatives from WoolProducers, Australian Wool innovation, Australian Council of Wool Exporters and Processors and the National Council of Wool Selling Brokers of Australia.

WoolProducers president, Steve Harrison said the substantial contribution from many supply chain stakeholders throughout the project has clearly demonstrated what can be achieved when we all work together towards a common goal.

I continue to be gob-smacked that no-one seems concerned about the steady drain of processing and manufacturing skills and expertise from Australia, as we export raw materials and import finished goods because it’s “good business”. I get that it’s cheaper to ship greasy wool in empty container ships to offshore processors, than from Perth to Melbourne, but there is something rotten in the state of Denmark.

Too old and too alienated to read this report in full. Unconvinced. Previous attempts by Australia to influence downstream wool processing in Australia and overseas have been costly, and occasionally damaging to existing customers, with no net benefit. Wool is a product where it makes sense to process close to the point of consumption rather than production, for numerous reasons, especially the intricacies of financing. Ironic that zombie ideas about wool processing have resurfaced at the same time as politicians, officials and woolgrower organisations are jostling over trade in live sheep where many of the economic factors influencing the location of production work the other way round. Perhaps consultants can help on that one too.

One positive thing about reports such as this one on early stage processing in Australia is that it provokes the otherwise silent Sheep Cental readership into gear. Well done editor and shame on WoolProducers for putting your name to such a futile excercise. Wool growers could be forgiven for forgetting our history, but if our wool grower organisations and their leaders have such feeble memories then heaven help us.

Thirty years ago there were numerous wool scouring, top making and other wool processing plants all over Australia. Heavy investments were still being made 20 years ago. I don’t see any explanation here of how the problems that drove all these operators out of business have been eliminated.