Southern Aurora Markets partner Mike Avery.

IT was another arduous week on the wool auction front and forward markets were thinly traded.

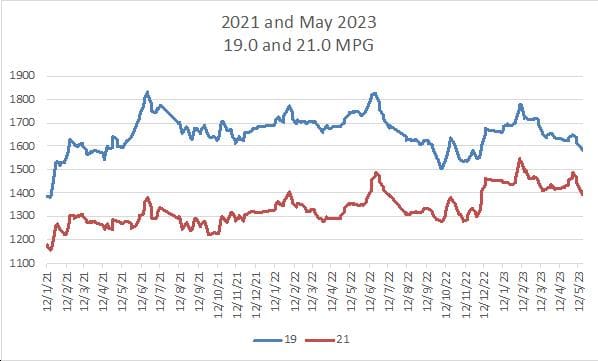

Support levels that had held since before Christmas broke with the 19-micron index dropping below 1600 cents and 21 micron below 1400 cents.

The forward markets were once again only thinly traded with all action in the nearby window. May and June all traded above the closing cash numbers. The forward board closed the week dominated by the sellers. The focus remains in the nearby with offers at cash out into June. Spring sellers remain a little more conservative with offers still 40-80 cents above cash.

Buyers are hard to find with activity clearing the few bids in nearby and exporters and processors yet to find interest in the first half of next season. Longer term bidding remains with April 2024 to June 2025 still supported at 1600 cents for limited quantities.

Next week, with 46,000 bales on offer, will be important as the market looks to find support. The general commodity landscape remains steady having absorbed the ongoing negative sentiment out of the US around debt ceiling standoff. Cotton futures trading close to five-month highs before retreating slightly.

This week’s trades

May 19 micron 1600 cents 5 tonnes

June 19 micron 1600 cents 5 tonnes

June 19.5 micron 1535 cents 5 tonnes

June 21 micron 1410 cents 5 tonnes

Total 20 tonnes

HAVE YOUR SAY