Southern Aurora Markets partner Mike Avery.

FORWARD wool markets opened briskly in another steady week of auctions, with all qualities holding firm against a marginally weaker US dollar.

Merino cardings rose 3 percent to their highest level on the AWEX index in more than 12 months.

The forward markets opened briskly on Monday, with interest across all finer wool offers out to April 2023. The mood was buoyant, with buyers and sellers anticipating a strong spot market opening.

The relatively flat market led to a bit of a stand-off. Growers understandably are focused on getting some Spring cover. With risk still in the minds of buyers, a strong nearby rally is required before we see the resistance levels of 1700 cents for 19 micron and 1300 cents for 21 micron significantly breached.

The week finished with the prompt bid and offers tight with the mid-points around 20 cents under cash reflecting the ongoing risk concerns.

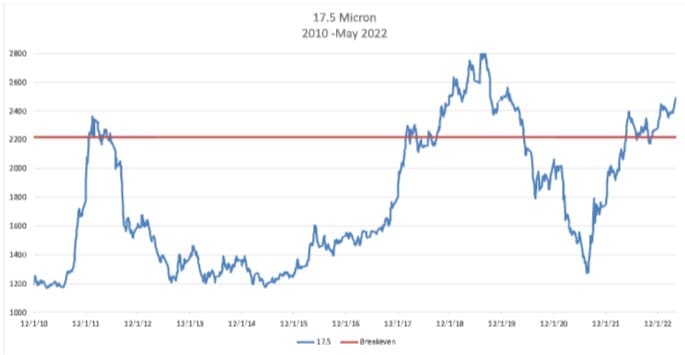

The most interesting trade for the week was a 17.5 micron put option for December 2022 maturity. Strike price was 2300 cents and the premium 85 cents. Although the strike is well under the current spot level, the graph below illustrates the thought behind the strategy. The spot price for 17.5 micron is at the 90th percentile for the last 12 years and the break-even near the 75th percentile. Looks like fair value insurance.

Anticipated levels next week remain stable with the result of this weekend election predicted to have little impact.

19 MPG 21 MPG

May to July 2022 1720/1730 cents 1320/1340 cents

Aug to Dec 2022 1690/1705 cents 1310/1320 cents

Jan to July 2023 1690/1700 cents 1270/1300 cents

Aug to Dec 2023 1680/1700 cents 1280/1310 cents

This week’s trades

July 19 micron 1705 cents 15 tonnes

Aug 19 micron 1705 cents 15 tonnes

Sept 18 micron 2105 cents 12 tonnes

Oct 19.5 micron 1540 cents 10 tonnes

Dec 17.5 micron Put option 2300 cents strike 85 cents Dec 2022 maturity 8 tonnes

April 2023 17 micron 2455 cents 10 tonnes

Total 70 tonnes

Source: Southern Aurora Markets.

HAVE YOUR SAY