ANZ Head of Agribusiness Mark Bennett.

A STRONG upside case for increased sheep industry investment could be made in Australia, according to an agricultural research paper released by ANZ yesterday.

Releasing the paper ‘The Sheep’s Back’, ANZ Head of Agribusiness Mark Bennett said sheep enterprises present a far lower volatility profile compared to other broadacre farming systems.

“And as an investment case, numbers highlight a relatively low cost, high returning business.

“So why aren’t more farmers and external investors chasing this asset class? I think there is a strong upside case to be made,” he said.

Mr Bennett says sheep farming is a low cost and low volatility enterprise, which is less exposed to an international price than cropping, beef or dairy.

“While we’re unlikely to reach the flock numbers and outputs of the 1970s, sheep and wool production still accounts for approximately 11 percent of Australia’s agricultural production and 14pc of agricultural exports.

“Therefore the opportunity for expansion is there for sheep farmers with a focus on efficiencies, innovation and value-adding,” he said.

Sheep enterprise return on equity higher than beef

The paper said Australian sheep farming has been a stable and low cost and low receipts business since the early 1990s. Prices for wool and sheep meat are also less exposed to global markets than Australia’s other main agricultural exports.

“Profits from an average sheep farm have improved in recent years, but remain below the profit levels of both cropping and dairy farms over a 10 to 15 years period.

“The profitability and returns from sheep farms are more closely aligned to the beef industry, and in recent years, an average sheep farm has maintained a relatively higher profit and return on capital than the average beef farm,” the paper said.

ANZ said the top 10pc of sheep farms by size have a 20pc lower profitability than the top 10pc of beef farms. However, the equity held or invested by that top 10pc of beef farms is more than twice that of the top 10pc of sheep farmers.

“This means that sheep farmers have a return on equity of 2.5pc compared with a 1.3pc rate of return for beef farmers.”

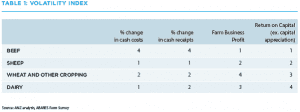

ANZ analysis of ABARES Annual Farm Survey results show not only the relative returns, but also the volatility of an average farms’ costs, receipts, profits and returns. Results indicate that sheep farming, and livestock farming in general, are lower volatility enterprises than dairy and cropping, even though historically cropping and dairy are more profitable.

ANZ analysis of ABARES Annual Farm Survey results show not only the relative returns, but also the volatility of an average farms’ costs, receipts, profits and returns. Results indicate that sheep farming, and livestock farming in general, are lower volatility enterprises than dairy and cropping, even though historically cropping and dairy are more profitable.

“Sheep farming also has a potential role to play as a stabiliser for income of mixed-operations.

“It is noticeable that the price index changes for lamb and wool run broadly counter-cyclical to wheat and beef prices, and can be a risk mitigation strategy for those commodities which are strongly based on the international price and large players in global supply,” the paper said.

Almost 30pc of farmers across the nation farm sheep, primarily as part of a mixed farming operation.

Productivity is the key to ramming home opportunity

The Sheep’s Back paper said Australia’s $6.5 billion sheep industry needs 22 million more sheep just to maintain its current share of global production. It reveals that improved productivity gains – supported by the growth of the national flock number from its near record low – are critical to realising the 21pc increase in global demand for meat and nine per cent rise for wool by 2040.

Mr Bennett said economic growth in developing nations and consumption patterns give rise to optimism for sheep farming, with forecasts showing the total value of sheep meat produced could increase by 30pc by 2040.

“But in order to be competitive and take advantage of this growth opportunity, sheep farmers will need to improve productivity through increased farm size, flock size and better on-farm processes. “Farm management efficiencies include better land use, improved lambing and weaning rates, reduced fattening times and more intensive management,” he said.

The Sheep’s Back’s key findings:

- Global demand for sheep meat could increase by 2.8 million cwt, or 21pc, by 2040.

- In comparison, global demand for beef is forecast to rise by 22 million cwt (33pc), 25.6 million cwt (23pc) for pork and 15.4 million cwt (15pc) for poultry.

- If current trends continue, the total value of sheep meat produced globally will increase by 30pc by 2040 – compared to beef 34pc, pork 27.5pc for and chicken 9.8pc.

- Demand will grow most strongly in Asia (including the Middle East) and Africa, but will be relatively subdued in developed economies in Europe and America.

- Growth in demand for wool is not likely to be as significant, but global demand is still expected to increase by 8.8pc. This is substantially less than increases in demand for cotton and synthetics. Regional demand for raw wool for processing is also likely to be concentrated in Asia and weakening in America and Europe.

- Sheep farming in Australia is a low cost, low volatility and relatively high return on capital industry.

The paper suggests that while demand for lamb and mutton is not expected to grow at the same volume and value as beef, the percentage growth in value of global demand for sheep meat is expected to outstrip both pork and poultry.

“The modelling in the report shows greater demand coming from Asia, the Middle East and Africa. Conversely, we’re expecting demand in other markets like America and Europe to cool,” Mr Bennett said.

Asia will also continue to be the number one destination for Australian wool, and with China transitioning towards a service-based economy it’s expected Vietnam and Indonesia will increase their processing capabilities.

“Overall demand for wool is only expected to increase slightly, but the value of global demand could also increase by as much as $1 billion by 2040,” Mr Bennett said.

The report concludes that the sheep industry will continue to play an important role in the mix of Australian agriculture.

“While we may not return to ‘riding on the sheep’s back’, Australia should take confidence from these future demand forecasts. The case for greater investment in the industry is strong,” Mr Bennett said.

Click here download the Sheep’s Back report.

Source: ANZ.

HAVE YOUR SAY