Slow-moving supplies in Australia’s major sheepmeat markets could cap mutton and lamb prices this year, Meat and Livestock Australia said today.

Slow-moving supplies in Australia’s major sheepmeat markets could cap mutton and lamb prices this year, Meat and Livestock Australia said today.

However, the MLA’s sheep industry projections April update said US cold storage lamb stocks are likely to have been drawn down over Easter.

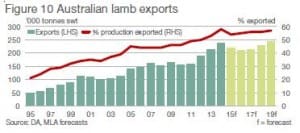

In the April update, MLA said contrasting with the high first quarter Australian lamb exports, global demand for lamb is reportedly subdued and likely to remain so over coming quarters.

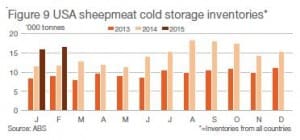

Lag in US cold storage measure

The first demand concern is in the US, where the slow moving product from cold stores has put lamb stocks from all countries up 40pc year-on-year.

“However, there is a lag on this measure and stocks are likely to have been drawn down over Easter – a peak demand period,” MLA said.

“However, there is a lag on this measure and stocks are likely to have been drawn down over Easter – a peak demand period,” MLA said.

But MLA’s manager of market information Ben Thomas said only US cold storage figures for February were available from the United States Department of Agriculture. There were similar lag periods for Australian Bureau of Statistics data, he said.

“We need to wait another two months before the March-April (US) figures come out; that will give us a much clearer indication.

“There is usually a six-week lag with any of this sort of data; it will be another couple of weeks before we get March figures.”

Imported Australian and New Zealand product in China is comparatively more expensive than domestic product, slowing trade.

Strong price fundamentals in coming years

But the update said that strong market fundamentals for sheep and lamb prices should remain in place over the coming years due to tighter New Zealand production, continued global demand and a lower $A-US exchange rate.

The current downward export lamb price pressure from weaker demand is also likely to be alleviated as the year progresses, as global stocks clear, the update said.

“The forecast slowdown in Australian sheep and lamb supply will also tend to hold export prices steady, dependent on the extent of the slowdown in lamb slaughter, and when it eventuates.

“The A$ is predicted to remain below 80US¢, which will also be of assistance.”

Price potential could be capped

Mr Thomas said the price potential for Australian sheep and lambs could be capped this year, due to unrelenting slaughter and higher, but slow-moving supplies in Australia’s largest three markets – China, the US and domestically.

“Offsetting the potential downward pressure on prices will be a slowdown in slaughter, which will happen if the three month rainfall outlook comes to fruition,” he said.

Year-to-date lamb prices have been positive, with light lambs (12-18 kg cwt) having performed the best relative to the other categories, averaging 19pc higher year-on-year, at 518¢/kg cwt. In comparison, and while fetching higher prices, the year-on-year increase for heavier slaughter lambs was less significant, with trade lambs (18-22 kg cwt) averaging 534c/kg cwt, up 8pc, and heavy lambs (22+ kg cwt) up 5pc, at 541c/kg.

The April update said of potential benefit at the lighter end of the spectrum over the coming months will be restocking interest if the current three month rainfall outlook comes to fruition.

“This will also alleviate some of the potential price pressure from the slower trade.”

Reduced lamb supplies likely as year progresses

Mr Thomas said while lamb slaughter for the first quarter has remained steady with last year, the final slaughter figure is predicted to be 850,000 head lower, at 21.4 million head, with reduced supplies becoming more prevalent as the year progresses.

“On the other hand, mutton supplies are already tightening, following two very high slaughter years.

“Mutton slaughter for the first quarter of this year is already back 20 percent year-on-year, despite the dry conditions.”

The Australian sheep flock has been revised down to just below 70 million head, as a result of prolonged mutton slaughter.

Mr Thomas said nevertheless, Australian sheepmeat exports for the first quarter were up 6pc year-on-year, with the US (12,302 tonnes), China (8,714 tonnes) and the Middle East (16,037 tonnes) the largest markets, making up 63pc of exports while shipments to the EU were down 14pc (3,031 tonnes).

Mr Thomas said nevertheless, Australian sheepmeat exports for the first quarter were up 6pc year-on-year, with the US (12,302 tonnes), China (8,714 tonnes) and the Middle East (16,037 tonnes) the largest markets, making up 63pc of exports while shipments to the EU were down 14pc (3,031 tonnes).

Mutton outlook is positive

Mutton exports for the first quarter were lower year-on-year, underpinned by reduced slaughter, with shipments to the Middle East (15,069 tonnes swt) and China (9,957 tonnes swt) accounting for the largest volumes.

While a slowdown is expected for the coming months, the five-year outlook remains positive, with demand growth from developing Asia, and continued high meat prices in the US.

Mutton prices averaged 342¢/kg cwt for the March quarter, up 42pc (or 102 cents) from the same time last year. Despite the recent easing, both lamb and mutton prices are still expected to average much higher than in 2014, providing autumn rains arrive, as forecast.

Read the 2015 sheep industry projections April update here

Source: Meat and Livestock Australia

HAVE YOUR SAY