IT was a slow week for wool forward market trading volumes, although there were a couple of highlights in this time when commodity markets generally struggle to find good news.

The spot auction bounced off its new five-year lows, created last week, and just held into the Wednesday close.

On the forwards, buying interest remains range-bound as the processors and their clients try to find a balance between risk and reward. Risk remains high in this unprecedented demand strangle. The timing of a recovery will be dictated just as much by science as by economics.

One highlight of the week was the 21 micron forward contract in May trading at 1305 cents, 35 cents above cash, ahead of the anticipated bounce. The trade finished slightly in favour of the seller, but indicated the potential volatility in the short-term and the value each party was willing to put on certainty.

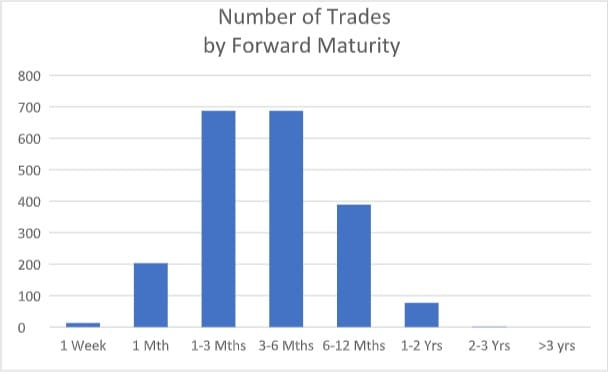

The other more significant trade was out in November 2021. The 19 micron contract traded at 1290 cents, setting a starting point for the 2021/22 season in this volatile time. In the same week, we had the shortest maturity window of two days and one of the longest at 545 days (see below graph of maturity data). Our longest date trade maturity was 764 days.

We anticipate buying interest to remain sporadic as global trade tensions ebb and flow. The balance of tight supply and uncertain demand will keep the spot auction volatile. Spring forward opportunities will most likely oscillate as the longer-term recovery picture plays out.

Growers wanting to get cover into the spring will likely see resistance from buyers above 1335 cents for 19 micron. Trades in the last three weeks for August to December have ranged between 1310 cents and 1350 cents, averaging 1325 cents. For 21 micron, we expect resistance at 1270 cents having traded 1250-1270 cents at an average of 1266 cents. Further out, the curve will likely flatten with support around 1300 cents and 1250 cents.

Anticipated trading levels

19 micron 21 micron

May/June 1345 cents 1285 cents

July/Aug/Sept 1335 cents 1275 cents

Oct/Nov/Dec 1325 cents 1260 cents

Jan/Feb/Mar 1310 cents 1250 cents

Trade summary

May 21 micron 1305 cents 5 tonnes

October 19 micron 1325 cents 10 tonnes

November 19 micron 1335 cents 2 tonnes

November 21 micron 1260 cents 5 tonnes

January 21 micron 1250 cents 5 tonnes

November 2021 19 micron 1290 cents 2 tonnes

Total 29 tonnes

HAVE YOUR SAY