Southern Aurora Markets partner Mike Avery.

FORWARD wool trading lacked diversity this week, despite another solid series of auctions across Australia.

Spurred by a strong US dollar, Merino qualities achieved rises of between 30 to 70 cents (1.5 to 5 percent).

Tight supply helped keep the Merino momentum going, with medium wools gaining the most. Crossbreds and carding wools remain becalmed.

The forward market lacked the diversity of last week, which had trades from 17 to 210 microns and a spread in maturities out for twelve months.

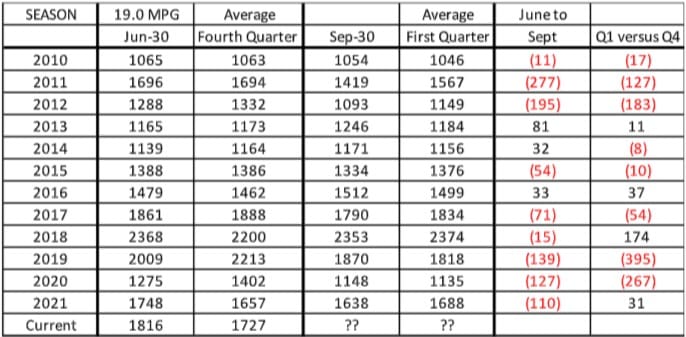

This week the focus centred on 19 microns, with Spring the popular maturity, although January 2023 traded at a new high of 1730 cents. The logic of the Spring focus is illustrated in the table below. This highlights seasonality over the last 12 years. In 9 out of the past 12 years the market experienced a lower price on the 30th September compared to the 30th June and also a

lower quarterly average for September quarter against the June quarter.

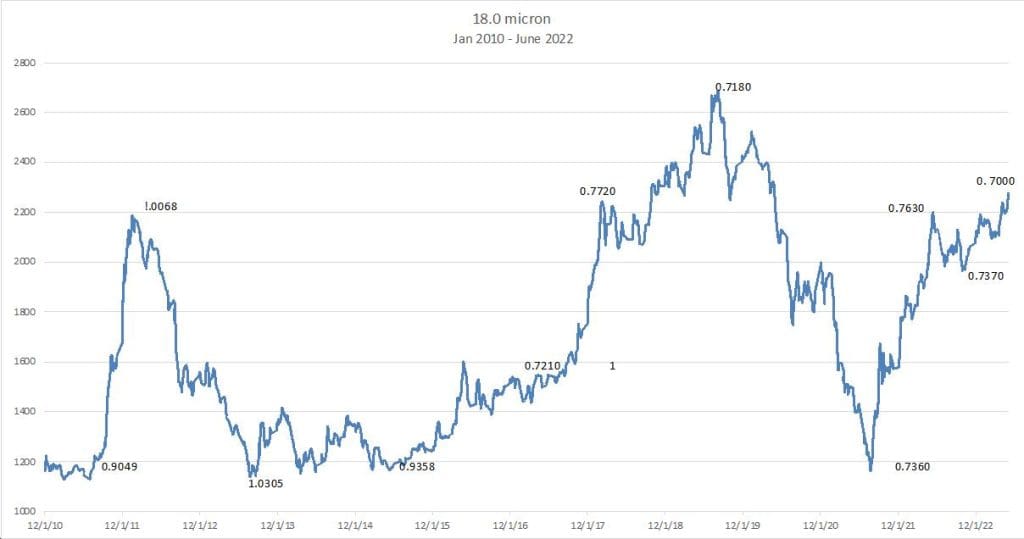

The driver is generally supply. Most analysts would agree that the effect of the US$ on the wool

market is secondary to the overall forces of supply and demand. (See attached chart).

With another tight supply week ahead spot prices are likely to hold and provide growers with

opportunities to reassess hedging levels. Volatility has returned stock and commodity markets. Hedge targets should focus on margin management valuing certainty over the fear of lost opportunity.

This week’s trades

September 19 micron 1730/45 cents 15 tonnes

October 19 micron 1750/60 cents 12.5 tonnes

January 2023 19 micron 1730 cents 12.5 tonnes

Total 40 tonnes

HAVE YOUR SAY