These 1.5 year-old first cross ewes at Trundle, NSW, were scanned in lamb to Poll Dorset rams and sold for $270 on AuctionsPlus earlier this month.

ONLINE sheep buyers paid an average $25 premium for scanned in-lamb Merino ewes above prices for unscanned station mated or joined ewes over the past four years, an AuctionsPlus analysis has found.

But this price difference could potentially increase this year depending on rainfall across sheep areas this autumn, with an increased focus on rebuilding flock numbers ravaged by drought and bushfires.

AuctionsPlus operations manager Tom Rookyard said the AuctionsPlus Market Insights team analysed Merino ewes which have been offered on AuctionsPlus, as either 100 percent scanned in-lamb, or as station mated, since 2015.

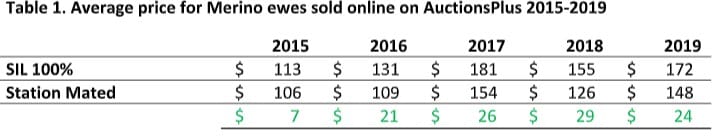

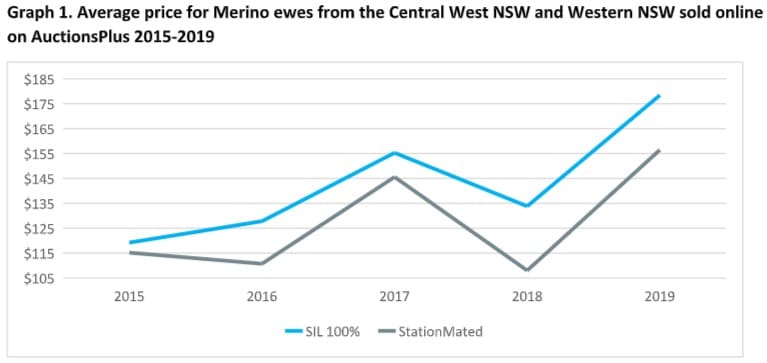

The analysis found that in 2015, online Merino ewe buyers paid only a $7 premium for scanned ewes, but this jumped to $21 in 2016, to $26 in 2017, peaking at $29 in 2018 and dropping slightly to $24 last year.

Mr Rookyard said with sustained and severe drought conditions through Queensland and New South Wales, many sheep producers are constantly looking at ways to reduce operating costs, without impacting productivity.

Mr Rookyard said Merino ewe sales on AuctionsPlus in early 2020 have opened at very similar levels to where they closed off 2019. Recent sales include four year-old scanned in-lamb Merino ewes at Cudal, New South Wales, selling for $225 on 14 January and five year-old station mated Merino ewes at Trangie, NSW, making $205 on 7 January.

At the Deniliquin January store sheep sale last Friday, scanned in-lamb Merino ewes mostly made $200-$280, while those carded as “depastured or joined” (not scanned) sold from $168-$232. Elders Deniliquin agent Jason Andrews said this indicated a price premium for scanned ewes over station mated lines of $25-$30, although scanned lines did not sell at a premium to unjoined ewes preferred by producers wanting to join rams of their choice.

Benefits outweigh scanning costs

Ewe scanning costs can vary depending on travel costs, numbers and whether the service is providing a wet/dry or singles/multiples service, but the overall cost plus mustering and station labour is generally estimated to total about $1/sheep. Scanning rate alone can vary around 60 cents for a wet/dry scan or up to 90 cents for a singles versus multiples service.

Stock agent Greg Seiler of Landmark Walsh Hughes, Bourke, NSW, knows the importance of scanning in a dry year and believes more producers are becoming aware of the benefits.

“While there are costs associated, we feel that the data growers gain on their flock far outweighs the costs…whether they are selling or not, it is important for vendors to be able to measure their ewes in the paddock to ensure they are staying profitable.”

Mr Seiler attributed the lift in the scanned to joined ewe price premium from $7 in 2015 to the $25 average over subsequent years to the lift in ewe values over time and an increasing focus on production.

“People are prepared a premium if they can lock in production, they are paying that extra money for stock that they know they are going to produce a quantified number of lambs.”

He said he preferred to buy ewes scanned or empty “because we know what we are buying.”

Sheep consultant Jason Trompf expected the price premium for scanned over unscanned joined ewes to increase and possibly double due to demand if there was good autumn rainfall. He was not surprised by the average $25 price premium for scanned ewes over the past four years.

“The (price) gap will be double that this autumn if there is any breaking rains, particularly earlier in the year if the break has come and there is a shortage of sheep.

“With the ewe shortage and prices likely to increase significantly on breaking rain, I think you will find that farmers will be more willing to go that extra yard with that investment,” he said.

“There will be a reasonable number of sheep bought under finance and if I was going to get finance, buying scanned ewes mean you are a bit more assured of your returns.”

“Buying ewes with that (pregnancy) information tells you effectively what crop potential you are buying, particularly if they are scanned for multiples,” Mr Trompf said.

He said knowing which ewes were dry, or carrying single or multiple lambs enabled buyers to be more prudent, eliminating variables and enabling differential management to maximise survival of ewes and lambs.

“With station mated ewes, you don’t really know what you are getting, do you?

“And a critical question that buyers need to keep asking is whether the dry ewes have been left in the sale line?”

Coincide scanning with management to minimise costs

Livestock scanner Baradine in NSW, Nathan Harris, said the management costs of mustering must also be taken into consideration along with his cost for scanning.

“If I can fit my scanning at the same time as the sheep are being assessed for AuctionsPlus or within the grower’s management practice, that always helps manage their costs”.

While there has been no improvement in seasonal conditions in early 2020, Nathan continues to see a bright future in sheep.

“We have seen vendors looking to get back into sheep enterprises off the back of current sheep and lamb prices.

“I have had interest from certainly Queensland and New South Wales producers, who see value in looking to start running sheep again.”

He said his clients are increasingly asking him to differentiate and brand dry ewes, from single and multiple lamb-bearing ewes.

Mr Rookyard said the sustained drought conditions led to the central west and western regions of NSW offloading large numbers of breeder ewes in 2019. He said scanned in-lamb and station mated Merino ewe numbers from the area have increased 87 percent from 2018 to 2019, with 62,750 head offered online.

“However, despite the drought, buyers have looked far and wide to source the right article.

“Victoria and South Australia purchased 12,000 and 6000 head respectively, with northern and north-west Victoria, along with the central and hills regions of South Australia being the largest interstate customers.”

HAVE YOUR SAY