THIS week’s property review includes this wrap up of recently completed sales, and a separate article on interesting recent listings across the country.

Scale sells in NSW’s Southern Tablelands

Nundle’s Tarwarri makes around $8m

Scale sells in NSW’s Southern Tablelands

A Sydney investor has paid close to $20 million for two adjoining properties spanning 1337ha on the Southern Tablelands of New South Wales.

Inglis Rural Property agent Sam Triggs, who offered the holdings via an expressions of interest campaign, was unable to disclose the price or the buyer but confirmed the transaction.

Gundowringa

Gundowringa, Crookwell – Goulburn NSW from Inglis on Vimeo.

The sale of the 825ha historic holding ends 120 years of ownership by the Prell family.

Gundowringa is situated 17km from Crookwell and 32km from Goulburn, where its well-drained granite and red basalt soils grow perennial pastures that can support 9000 to 11,000DSE.

When Gundowringa was offered to the market last year, Mr Triggs said the property’s profitability was underpinned by a diversified income stream.

“With 13 wind turbines and a substation, there is a (pending) 30-year lease agreement with an income stream of $226,800 per annum indexed at Sydney CPI.”

The property is situated in a 750mm annual average rainfall region and has extensive frontage to the Wollondilly River and 24 dams.

Improvements include a six-bedroom stone home, a four-bedroom home and three cottages, a circa 1900 eight-stand (three equipped) shearing shed, numerous sheds and steel cattle yards.

Gundowringa was offered to the market with an $11m to $12m price guide.

Pejar

Pejar, Crookwell – Inglis Rural Property from Inglis on Vimeo.

The neighbouring 472ha grazing holding Pejar boasts 6km of Pejar Dam frontage and was offered for around $6.5m to $7.5m.

Pejar is located halfway between Crookwell and Goulburn. Its undulating country has fertile red basalt and well drained granite soils growing improved perennial pastures than can run around 5500DSE.

As well as Pejar Dam frontage, the property has 1.5km of double frontage to the seasonal Pejar Creek and 1km of double frontage to the seasonal Gray’s Creek. Water is also supplied by a 3ML water access licence and 23 dams.

Improvements include steel yards for cattle and sheep and three silos with 130 tonnes of grain storage.

Nundle’s Tarwarri makes around $8m

Another Sydney investor has paid around $8 million for the Nundle district holding Tarwarri.

Ray White Rural agent Riley Gibson, who handled the sale, was unable to disclose the buyer or the price paid, but the property did pass in at auction for $7.5m.

The 1013ha are located in the tightly held Garoo district, described as some of the finest cattle country in the area, 51km south-east of Tamworth.

It is close to a number of markets including the Tamworth Regional Livestock Exchange and beef and lamb processing facilities.

Tarwarri was offered to the market last year by Guyra’s Dave Carlon to consolidate his New England assets in northern New South Wales.

Around 80 percent of the gently undulating basalt soils are arable and grow fodder crops, including oats, sorghum and lab lab.

Tarwarri has a history of growing, barley, oats and sorghum and could be sown back to permanent pastures supported by seasonal fodder crops; however, Mr Riley believes the highest and best use is breeding and finishing, with the operation rated to run around 500 cows or DSE equivalents.

Tarwarri is serviced by eight bores (four of which are equipped with solar pumps), three windmills and one electric submersible. There are 18 dams, as well as double frontage to both the Sandy and Benama Creeks.

Improvements include a four-bedroom home, two cattle yards, a wool shed, a machinery shed, a meat house, a cool room and two silos.

Properties for sale

THIS week’s property review includes this wrap up of properties that have returned to the market.

Fairview, SA

One of the largest grazing properties in South Australia’s south-east has returned to the market to take advantage of improved market sentiment due to rebounding livestock prices, stabilising interest rates and favourable seasonal conditions.

The 4326ha Fairview near Lucindale, 42km west of Naracoorte, comprises six contiguous properties – Old Fairview, Lantara, Wombalano, Keys, Watson’s and Mickan’s – aggregated over 35 years by the overseas owners.

In August last year, Colliers agents Jesse Manuel and Tim Altschwager were appointed to sell the property via expressions of interest.

Mr Manuel blamed the failed campaign on dampened buyer confidence.

“In the second half of 2023, the market was at the juncture of several consecutive interest rises and the sharp decline in livestock values.”

“With strengthening prices and excellent rainfall, market confidence has rebounded quickly and the RBA’s recent decision to leave interest rates unchanged was also a welcome announcement,” he said.

In terms of price expectations, Mr Manuel said since the spring marketing campaign, the vendor's original expectations have now eased.

“It will be interesting to watch how the market responds to the more stable interest rate environment and improved stock prices.”

Having run conservative stocking rates over the past few years during extensive pasture improvement and soil redevelopment, farm manager Marc Dupree emphasised the significant potential to increase the property’s overall carrying capacity now that it is mostly back in production.

Featuring flat to gently undulating grazing country growing improved pastures, Fairview runs a self-replacing cattle herd of black Angus and Angus/Black Simmental cross cows and a mostly Merino ewe flock using Suffolk and Poll Dorset rams.

As well as grazing, there are areas suited to cropping with 130ha planted to barley for a fodder crop.

Situated in a 600mm average annual rainfall region, Fairview benefits from 1053ML of water entitlements for irrigation, with 25ha developed to flood irrigation.

It is also watered by solar and electric bores, with underground water pumped to header tanks and reticulated to troughs.

Improvements include four homes, three shearing sheds, extensive hay and grain storage, multiple sheep and cattle yards, a large workshop, horse stables and implement sheds.

The selling agents are reportedly in continuing discussions with a diverse pool of prospective buyers and are inviting prospective purchasers to submit offers for all or parts of Fairview, or alternatively on a walk-in walk-out basis (including land and improvements, water entitlements, livestock and plant and equipment).

Willawong, NSW

A premium well-watered, mixed farm of scale within easy reach of Canberra and Sydney has been listed for $51.9 million after failing to sell following an expressions of interest campaign.

The 3838ha Willawong, near Murringo on the New South Wales south-west slopes, was aggregated over 35 years by the late Dr Jane Wallace, a University of Sydney academic and passionate farmer from Camden.

The property offers the flexibility and scale to produce a range of commodities, from fine wool to cereals, prime lamb and beef.

The improved pastures can comfortably run 40,000DSE and is currently stocked with 1000 trade cattle, 4000 wethers and 9500 joined Merino and crossbred ewes and replacements, turning off trade and store lambs.

Around 2888ha (84 percent) has been sown to improved perennial grass and clover pastures, lucerne and winter crops (including canola, wheat and barley), some of which is used for fodder.

LAWD senior director Col Medway said it has been a wonderful summer on the south-west slopes and producers are flat out sowing early grazing crops.

“Conditions are vastly different to those that were forecast for 2024 in spring last year and livestock markets have rebounded from when we initially offered Willawong for sale.”

“The excellent season has boosted the productive improved pastures that cover 83 percent of the property and are capable of sustaining a stocking rate of 12 DSE/ha,” he said.

Mr Medway expects the more positive sentiment to be reflected in the market enquiry from those seeking highly productive farms that can be used for livestock and/or dryland cropping.

Willawong comes with a 168ML groundwater irrigation licence and is securely watered by five bores through a reticulated water system, as well as three creeks and 85 dams.

Improvements include six homes (including a circa 1850s stone homestead), sheep and cattle yards, three woolsheds, multiple machinery and hay sheds and silos.

Castle Hill, NSW

Merino stud breeders Steve and Liz Phillips have reduced the price on their blue-ribbon livestock and cropping portfolio in New South Wales’ central west.

Located 8km from Baldry, 22km from Yeoval and 44km from Parkes, the 1758ha Castle Hill has been listed for $15 million, well below the $18m plus it was anticipated to achieve in July last year.

Castle Hill comprises three holdings (Castle Hill, Mountain View and Fairy Mount) aggregated over 23 years.

Described as versatile and productive, it is equally suited to any combination of mixed dryland cropping and livestock breeding and grazing.

Vendors Steven and Liz Phillips, together with Steve’s parents Don and Thea, operate the highly regarded Yarrawonga Merino Stud and a large-scale enterprise across a number of holdings in the Harden, Yass, Monaro and Gundagai districts.

LAWD senior director Col Medway said buyers looking to secure a premium livestock and cropping asset will find Castle Hill compelling value.

“That price equates to $8532 per hectare or $932 per DSE (bare), making it the best value high rainfall mixed farming land on the market.”

“Most of Castle Hill is highly arable which provides the incoming purchaser with the flexibility to choose a mix of enterprises,” Mr Medway said.

Capable of running 16,000 DSE, the property is currently stocked with 4500 Merino ewes and 250 Angus cows.

The creek flats rise to gently undulating grazing country, of which 962ha (74 percent) is considered arable for cropping purposes or suitable for the direct drilling of pastures.

Mr Phillips said Castle Hill is a standout with reliable annual rainfall and strong red soils.

“Our focus has been on growing wheat, oats and canola crops to graze through winter before locking them up for grain recovery.”

“The added potential to expand the cropping area or maintain the current focus on livestock production makes it a very attractive prospect,” Mr Phillips said.

“A moderate elevation of 440m above sea level provides an excellent climatic base for winter crop and improved pasture production.”

Water is supplied by several bores through an extensive reticulated water system supported by 36 dams and 5.3km of frontage to the seasonal Rocky Ponds Creek.

A large-scale Landcare tree planting program in the 1990s has enhanced the landscape and provides protection for livestock.

Over the past 22 years, the Phillips family has invested in extensive fencing and infrastructure.

There are two homes, 445 tonnes of grain storage, two shearing sheds and sheep yards, cattle yards and numerous sheds.

Castle Hill is being offered for sale as a whole or as separate holdings.

Braemar, NSW

Braemar Tamworth Main Video (All Agents) from WALTERS MACRI on Vimeo.

A highly productive mixed farming opportunity in the renowned New England region of New South Wales has returned to the market with a $17 million to $19 million price guide.

The 1870ha Braemar, 35km north of Tamworth, is owned by rural communications specialist Robbie Sefton and husband Alistair Yencken who are downsizing.

Inglis Rural Property and Christies International Real Estate have been appointed to sell Braemar via expressions of interest closing on April 23.

Braemar was purchased in 2007 and has been extensively developed to the point where the business is now performing in the top two percent of regional benchmarking enterprises.

The beef, wool and prime lamb operation is conservatively carrying 750 cows and 15,000 winter DSE together with 300ha to 400ha of dryland cash cropping annually.

Last year about 50 percent of the property was sown to lucerne, canola and cereals on fertile red basalt soils.

Inglis Rural Property agent Sam Triggs said Braemar is not only beautifully presented, but also a high-yielding agricultural enterprise.

“It represents genuine value for money, particularly when compared with similar sized properties in southern New South Wales and areas of Victoria.”

Braemar could also attract interest from poultry farmers because it is situated in a relatively new poultry zone where an increasing number of chicken broiler sheds are being built to support Baiada’s abattoir in Tamworth.

Braemar has been drought-proofed through a sophisticated bore water system that supplies all 42 paddocks. In addition, there are 28 dams, six bores and dual frontage to the seasonal Greenhatch and Dead Horse Gully Creeks.

The vendors have invested extensively in land development, prioritising the wellbeing of the soils and local flora and fauna through the retention of biodiversity corridors.

The principal residence is an historic renovated homestead dating from 1900.

There are a further four refurbished residences on the property, including a historic Cobb and Co coach house.

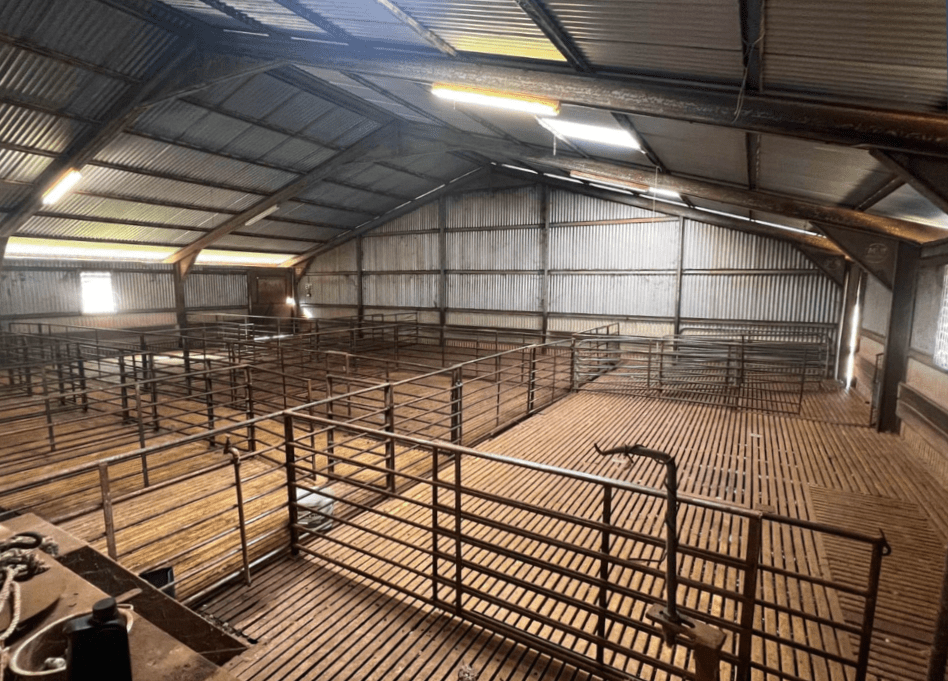

The fit-for-purpose infrastructure includes a five-stand shearing shed, undercover sheep yards, cattle yards, shedding, a 750-tonne grain storage and a 250-tonne cement grain bunker.

Brooklyn Aggregation, QLD

The well-located Brooklyn Aggregation on Queensland’s Southern Downs has returned to the market after failing to sell during the COVID-19 lockdown.

The 6092ha, 50 minutes west of Warwick, are suitable for cattle, sheep and goats.

The picturesque breeder country comprises three properties – 1178ha Brooklyn, 2849ha Cooinoo and 2071ha Oakey Creek – amalgamated by the Frith family over 10 years of ownership.

Open range areas of soft trap rock grazing country with scattered timber and timber belts run down to creek flats capable of carrying 700 breeders or 11,000DSE.

Ray White Rural agent Jez McNamara said the Brooklyn Aggregation has experienced a good season and is conservatively running 550 cows and calves.

There are 81ha of ex-cultivation which have potential for agricultural development and expansion.

In recent years, 90 percent of the internal fences, including exclusion fencing, has been renewed.

The 620mm annual average rainfall is supported by 45 dams, two bores and permanent and semi-permanent waterholes in the Macintyre Brook, the Oakey and Branch Creeks, as well as several small creeks.

Additional income will be sourced from four wind turbines which are being constructed this year. Their projected income is around $100,000 per annum.

Infrastructure includes a number of homes and cottages, three shearing sheds, three sheep yards and two cattle yards.

The Brooklyn Aggregation is expected to appeal to producers and investors from Toowoomba.

Mr McNamara is handling the expressions of interest campaign for Brooklyn (as a whole, three separate holdings or on a walk-in walk out basis) closing on March 27.

HAVE YOUR SAY