- The NAB Rural Commodities Index remained unchanged in August, stable in Australian dollars but down 0.3pc in US dollars month-on-month.

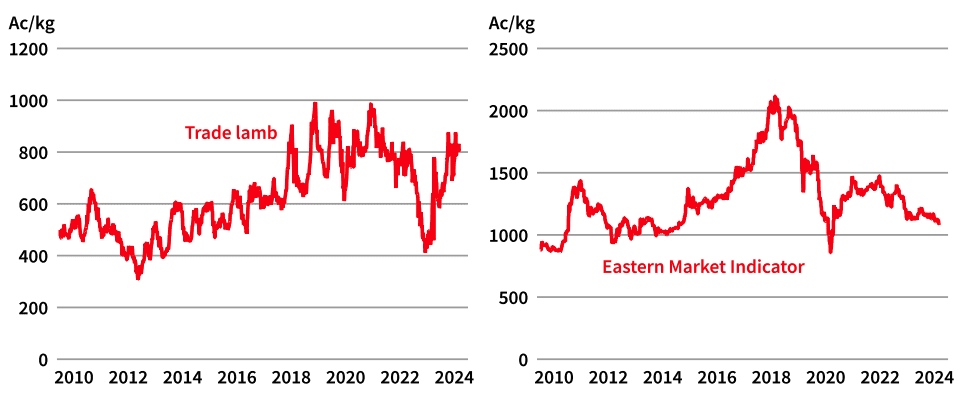

- Trade lamb prices have tracked broadly sideways around the 800c/kg mark

- The Bureau of Meteorology forecasts above-average rainfall for eastern Australia from October to December, with warmer temperatures likely.

NAB’s Rural Commodities Index has remained unchanged overall despite significant variability among individual agricultural commodities.

Having trended higher between late 2023 and April 2024, trade lamb prices have subsequently tracked broadly sideways (albeit with some volatility) around the 800c/kg mark.

In monthly average terms, prices were down 0.7% in August. MLA data shows lamb slaughter rates have grown strongly in recent months, before easing in early September.

Wool prices have continued the downward trend evident since mid-2022, with prices down 0.2% month-on-month in August, following a 3.2% fall in July. Global demand for wool remains relatively subdued, given the fibre’s consumption in more discretionary, often higher end, products.

NAB’s August Rural Commodities Wrap, released today, notes that while the overall index held steady, global dairy prices also partially recovered after sharp declines in July, contributing to the positive momentum in cattle prices.

NAB Senior Economist Gerard Burg said cattle prices have rebounded, supported by improving market conditions.

“The rise in cattle prices is indicative of producer confidence amid fluctuating seasonal trends, with a 6.3 percent month-on-month surge. The pullback in US beef supply means that global supply conditions are becoming tighter, and this presents greater export opportunities for Australian producers, ” Mr. Burg said.

While cattle prices lifted, other key commodities, such as wheat, experienced downward pressure due to global supply trends.

“Conversely, wheat prices drifted lower across much of August, briefly dipping below $300/t for the first time since mid-2021 before edging a little higher. The outlook for global supply has strengthened, adding downward pressure on prices, with a decline of 7.5% month-on-month.

“Vegetable and canola prices also showed weakness during the month, contributing to the overall mixed performance of agricultural commodities.”

August brought mixed rainfall across Australia, with southern regions experiencing below-average falls while coastal Queensland and northern NSW enjoyed above-average rainfall. Looking ahead, the Bureau of Meteorology forecasts continued higher rainfall in the eastern regions, potentially benefiting farmers.

“Seasonal forecasts indicate that farmers in the eastern regions can expect beneficial rainfall in the coming months, which could support pasture growth and crop production,” Mr Burg said.

“Current climatic conditions remain neutral, with the BoM projecting this trend to persist until February. However, several international models indicate a potential shift towards a La Niña event later in the year, often associated with increased rainfall, particularly in eastern Australia.”

On the economic front, the US Federal Reserve began its rate-cutting cycle this month, following suit with other advanced economies. Meanwhile, NAB forecasts the Reserve Bank of Australia to maintain the current cash rate until at least May 2025, with recent data suggesting a possible shift to February.

“In light of these developments, Australian agricultural producers should stay informed of both domestic and international economic factors that may influence market conditions in the coming months,” Mr Burg said.

Source: NAB

Look closely at the graph.

After Gillard and Ludwig had their say in 2011 the graph goes down. Since Albo and Watt took the reins a big drop.

Labor hates farmers.