Southern Aurora Markets partner Mike Avery.

IT was another challenging week for the wool spot market at auctions across Australia.

However, with passed-in rates under ten percent all week, growers, in general, are committed sellers.

Overall, the losses occurred mainly on the first day. Fine wools were the most adversely affected. Crossbreds bucked the trend finishing two percent up for the week.

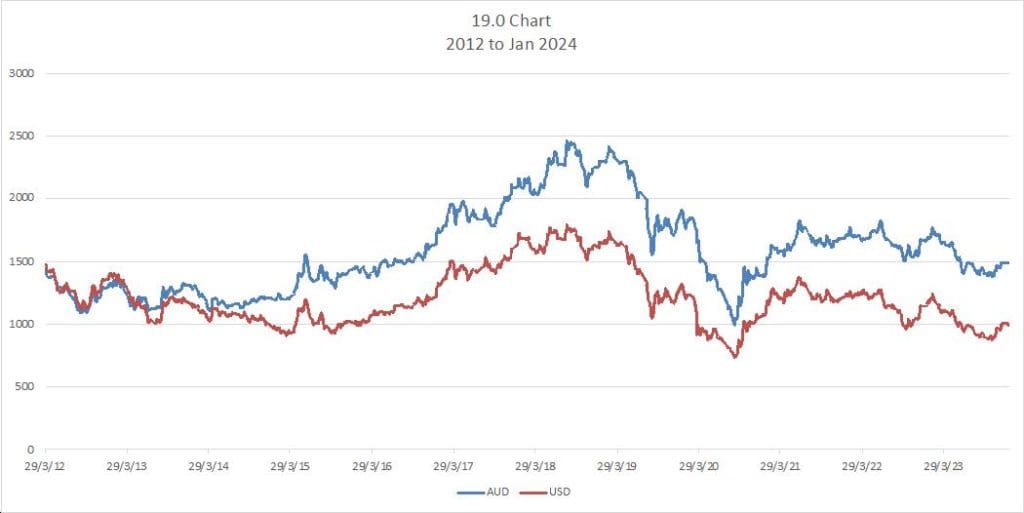

The forward market followed another path, with demand signals muted and global risk still high, buyers had reduced forward levels last week. That sentiment bought out some selling prior to auction, with 19 micron trading at 1455 cents and 19.5 micron at 1392 cents. The spot market fell on the first day towards those levels, but after a short pause bidding returned. Quantities remain limited expressing the uncertainty in the market.

Buyers are looking to get some cover and share the risk, but not yet committed to building a long position. The widespread opinion is this will continue in the short term. Any break in this pattern will require a shift in demand and an improvement in the total risk landscape.

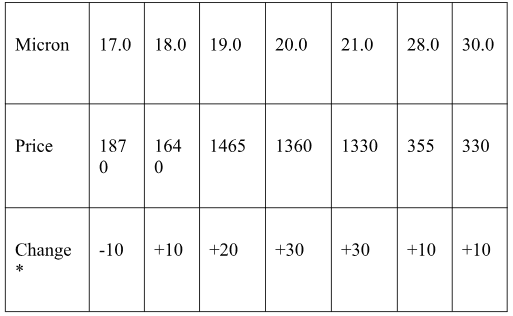

Forward sellers remain very thin on the ground, making it challenging for exporters. Current bid levels out to June 2024 (*change from last week) have lifted from last week to be flat to cash.

This week’s trades

February 19 micron 1455 cents 10 tonnes

February 19.5 micron 1392 cents 10 tonnes

Total 20 tonnes

HAVE YOUR SAY