IT was another disappointing week for the spot auction market, with most Merino qualities easing by 80 cents.

The forward market traded in a wide range, but in line with the cash market. Growers were able to hedge prior to the auction at what looked like modest discounts for 18 micron of 1200 cents, for 19 micron at 1060 cents and for 30 micron at 380 cents, but this proved 40-60 cents over cash by the week’s end.

Post-sale activity improved Thursday. Bidding was tentative early, but under better competition saw levels rise to within 15-20 cents of cash, leading to 15 tonnes being traded in the 19 micron index at 975 cents for October and at 980 cents for November. Spring and early summer closed on a reasonably positive note bid for 19 micron at 970 cents and for 21 micron at 870 cents when considering the magnitude of the falls this week.

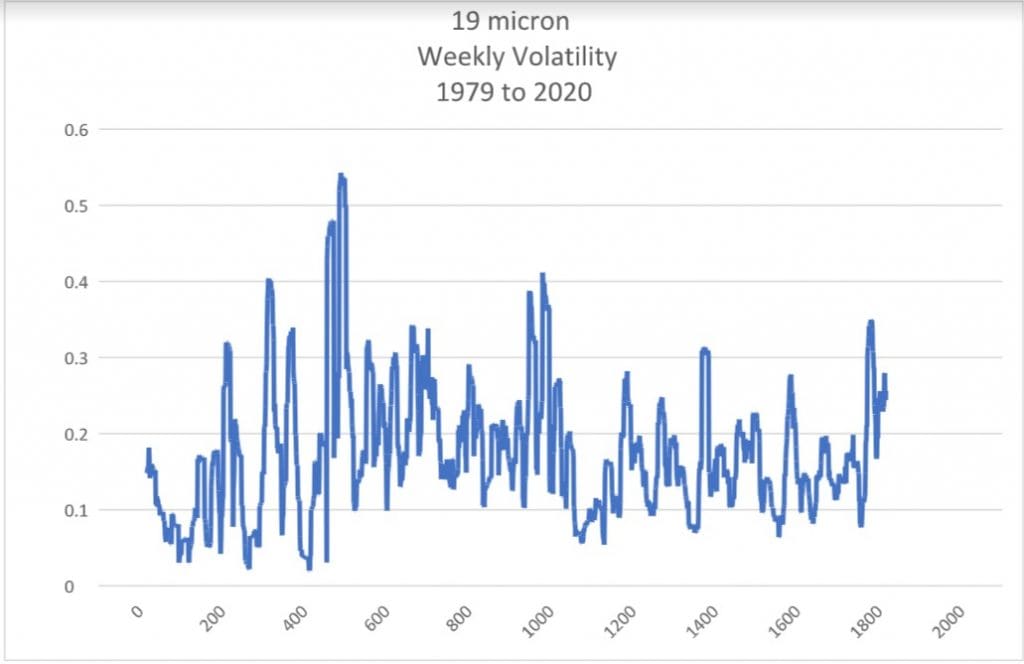

We expect this bidding activity to continue into the early part of next week. Exporters and processors seem to trying to keep a tight and balance book with volatility like to with us for some time. This will likely create opportunities for growers to hedge nearly flat to cash out to the Christmas recess.

A chart for uncharted waters. 19.0 micron volatility over the last 40 years

Trade summary

September 21 micron 875/945 cents 23 tonnes

October 19 micron 950/975 cents 15 tonnes

October 21 micron 850/925 cents 15 tonnes

November 19 micron 980 cents 5 tonnes

January 2021 19 micron 1060 cents 10 tonnes

March 2021 30 micron 380 cents 5 tonnes

April 2021 18 micron 1200 cents 5 tonnes

TOTAL 78 tonnes

Indicative trading levels next week

19 micron 21 micron

Sept/Oct 970 cents 870 cents

Nov/Dec 980 cents 870 cents

Jan/February 930 cents 850 cents

Mar/April 920 cents 820 cents

May/June 920 cents 820 cents

HAVE YOUR SAY