Southern Aurora Markets partner Mike Avery.

“In order to carry a positive action, we must develop here a positive vision” – Dalai Lama

Nothing about this week’s wool market seemed positive until it was, with the week opening with no positive signs from the forward market.

Bidding in the nearby months disappeared and even the buyers in the last quarter of 2025 and into 2026 looked a bit hesitant.

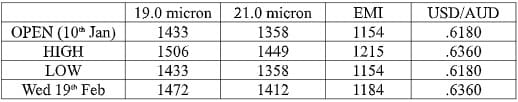

That frailty played out in the spot auction opening Tuesday. All indicators dropped between one and two percent not helped by a steadily firming AUD.

The AUD has marched from a low of US61 cents at the start of February to US64 cents today. The visionaries that saw the Aussie Dollar heading to the mid-50s are now rethinking that position. The AUD/USD has a moderating influence on the wool market, but the drivers remain supply and demand.

On Wednesday, there was a firmer tone, with modest gains across most micron groups. Clearance rates continue to be the strong with the pattern of less than 10 percent passed in continuing as it has done for the majority of the year.

Demand signals remain muted across the key consuming markets. Impacts of the looming tariff wars are on the minds of many with the landscape changing daily.

The likely outcome is that we will continue to see a maintenance of the range trading in the short to medium term. Forward books will remain conservatively controlled. Opportunities to hedge on the edges of the range should be closely analysed.

The tightening of supply appears to be the only constant in an ever-disruptive landscape. The combination of adverse climate, rising costs of production and low prices are steadily eroding supply. A positive vision needs to manifest itself in attractive forward pricing by processes and traders. That far-sightedness needs to be at a level that growers see a long-term financial future wool production.

Source – Southern Aurora Markets.

HAVE YOUR SAY