FOR the second consecutive week there were no trades on the forward wool market.

FOR the second consecutive week there were no trades on the forward wool market.

The spot auction was firm to a little dearer, but the grower offering into the new season was sparse at best.

Volumes through the platform have fallen away over the last four months. The causes are multi-faceted and have presented growers and exporters with a range of challenges.

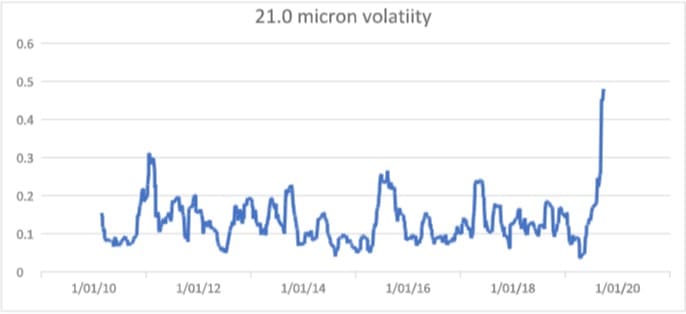

Volatility began to rise in April, but really hastened from August, peaking at almost 50 percent in October. The steadier decline in prices throughout November has seen volatility fall to under 20pc, but fatigue continues to dog the participants. Volatility at these levels have not been seen since 2002.

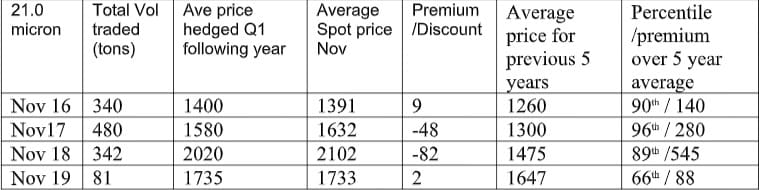

If we look at the historical trading into the first quarter of the last four years, we can possibly draw some insights into the root cause of the reduction in offering by growers. In 2016 growers were comfortable hedging at 1400 cents, as this was flat to cash — 140 cents above the average price for the previous five years and the 90th percentile of prices for the same period. As prices moved up, growers were accepting of a discount to cash as hedging levels were strong on a percentile basis and in outright price. This was consistent throughout 2017, 2018 and the first half of 2019.

The rapid fall and rollercoaster ride of spring took confidence out of the whole pipeline. Sellers were reluctant to accept the new forward levels even after the bounce off the new low of 1444 cents set in by September. Confidence seemed to be restored as price rallied to 1828 cents, but that confidence seemed to be replaced by apathy as the 21 micron index fell back under 1700 cents again.

Growers have been confronted with adverse environmental conditions and the feeling of missed hedging opportunities. Similar problems dog the pipeline, with high prices stocks, delayed take-up and contract renegotiations chocking the smooth flow of trade.

Hopefully, the steading of the auction market into the Christmas break will lead to renewed activity on the forward markets in the New Year. Growers, exporters and processors would all benefit from a more stable trading environment. This can only come about better forward market signals driven by participation along the pipeline.

Opinions on where we are in the price cycle vary dramatically. I guess that is why forward markets have a role in price risk management. The key are educating to become aware of the risks, and how to monitor and develop a strategy to mitigate.

We expect a steady close to the year but could be a little compromised by logistical issues around tight shipping window into Christmas.

Indicative trading levels for next week

19 micron 21 micron

January/February 1720 cents 1670 cents

March/April 1720 cents 1670 cents

May/June 1700 cents 1650 cents

HAVE YOUR SAY