THE percentage of Australian lambs processed through Meats Standard Australia-licenced pathways is expected to increase with the commercialisation of a new cuts-based model.

MSA’s strategic goal is to have the cuts-based sheep meat model commercialised in the 2022–23 financial year, but this will depend on processors.

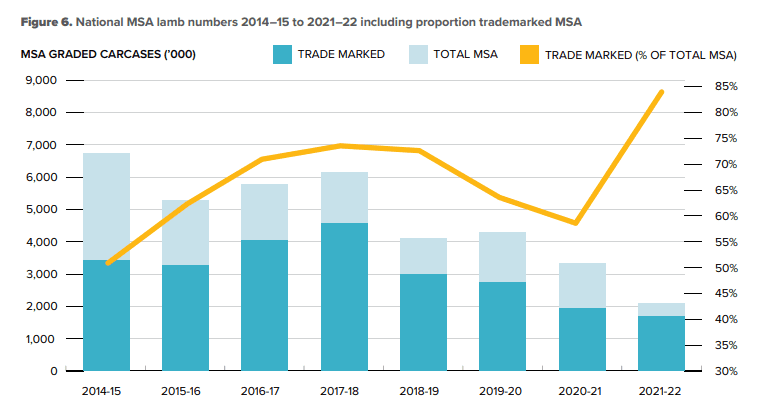

According to the 2021-22 MSA Annual Outcomes Report, more than 2.1 million sheep followed MSA pathways through 15 MSA-licenced processing facilities. This represented just 10 percent of the total lambs processed in Australia, but of these, 84pc were trademarked MSA.

Of the total lambs processed in Australia in 2021-22, 58pc were processed through MSA-licenced processing plants that follow processes to improve eating quality.

MSA program manager David Packer.

MSA program manager Dave Packer said these lambs might not have been MSA graded carcases per se, but the processors are using eating quality technology.

In addition, 802 sheep producers became MSA registered in 2021-22, taking the total number of MSA registered sheep producers to 25,458. MSA registered sheep producers represent 33pc of LPA accredited sheep properties.

In the lead up to commercialisation, Dr Packer said MLA was looking for opportunities to train producers to get “ahead of the curve” with the right genetics and management.

“So that once a plant commercialises it and offers premiums through grid, producers are ahead of the curve and have made the changes.”

Focus will be on increasing MSA lamb numbers

By volume, Victoria processed the greatest number of lambs through MSA pathways at 1.34 million head in 2021-22. A total of 97.4pc of all lambs presented for MSA met the program’s minimum requirements – a decrease of 1.6 percentage points on the previous year.

Although the number of lambs in the MSA pathways program decreased in 2021-22, Dr Packer said MSA was not too concerned.

“We know that those sheep meat processors are using the science to ensure consistent meat eating quality.

“Once we commercialise this new model there will be a really strong focus on increasing the number of MSA cuts-based grade lambs,” he said.

“It’s in everyone’s interests; the processors, the brand owners and the producers as well.”

Dr Packer said his team was working with all the medium to large sheep meat supply chains toward commercialisation of the cuts-based model.

Commercialisation of the MSA cuts-based model has been enabled by the advent of IMF and lean meat yield measurement and carcase hook tracking and the primary focus in the last 12 months has been on predicting the performance of lamb cuts for two different cooking styles, he said.

Dr Packer said the actual date for commercialisation of the MSA model is up to individual processors and a number were making steps toward this, but there was still a need for some to invest in infrastructure that enabled individual carcase feedback.

“There will be a few early players, hopefully there may be one this financial year, if not in the next financial year and I think we will have a few others pretty close behind.”

MSA will benefit lamb values as it has with beef

Dr Packer said at the moment most lamb being processed is going into the same box because there is no system to identify and differentiate lamb on eating quality, enabling it to be marketed at different price points.

“If we take the beef industry as an example, in the 1990s prior to the MSA program there was significant variation in eating quality and consumer satisfaction was dwindling. Through the industry-wide adoption of the MSA beef program, consistency in eating quality improved markedly, enabling MSA to capture greater value through underpinning consistency for nearly 200 beef brands.”

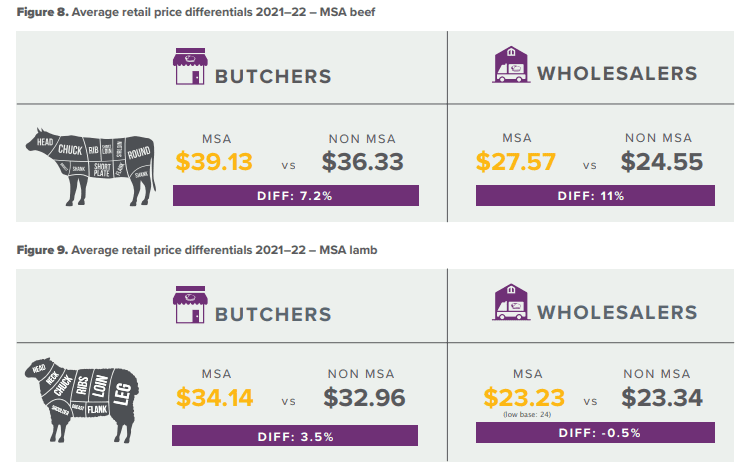

In 2021-22, the retail price margin for MSA lamb at butchers was just 3.5pc above non-MSA lamb prices and less at the wholesale level, but Dr Packer expected this to change with cuts-based commercialisation, as branded product will be underpinned by the MSA eating quality system.

“We’ve definitely seen this in the beef world, but it will come down to: Are consumers willing to pay “more for better quality product?

Dr Packer said a pathways MSA system for lamb had been in place for about a decade, which focussed on critical control points, such as ensuring lambs were finished to target specifications (fat score over 2 and GR fat greater than 6mm) and on using interventions such as electrical stimulation.

“However, under the pathways system lambs were graded as either MSA or not,” he said. “Now we are at the point where we have enough data based on more than 120,000 consumer sensory scores to establish a full cuts-based grading model.”

ALMTech has been a key contributor

ALMTech has played a key role in MSA cuts-based model development.

A key contributor to enabling the MSA sheep meat cuts-based model has been new objective carcase measurement technologies developed through the ALMTech program, supported by funding from the Australian Government Department of Agriculture, Fisheries & Forestry as part of its Rural R&D for Profit Programme, in partnership with Meat and Livestock Australia, Australian Meat Processor Corporation, Australian Pork Limited, commercial companies, State Departments and universities.

By 2040, it is estimated that ALMTech will have generated as much as $510 million extra for the beef, lamb and pork industries in Australia.

Dr Packer said the prototype of the lamb grading model was developed around 12 months ago, and since then MLA and other partners had been working closely with the majority of medium to large sheep meat supply chains towards commercialisation.

“This has been achieved through benchmarking activities on commercial flocks, allowing supply chains to understand the variation in eating quality and volumes across seasons,” Dr Packer said.

As a result of ALMTech’s research investments, new technologies have been developed and commercialised to accurately capture critical measures of eating quality and carcase value, including intramuscular fat (IMF), lean meat yield (LMY) and hot standard carcase weight (HSCW).

“Having devices which can measure IMF as one of the traits of the MSA cuts-based model, has really progressed things,” Dr Packer said.

“This has allowed us to demonstrate eating quality variation and the value proposition for the MSA cuts-based model for industry.

“We have been using the handheld SOMA NIR device which you apply to the face of a loin to generate an IMF output, which has been really useful for plants who don’t have IMF technologies,” he said.

“There is also the MEQ probe which is commercialised and installed in a number of processing facilities and doesn’t require a cut-surface, allowing a hot measure of IMF at chain speed.”

The hope is that now processing plants are utilising IMF and LMY technologies, integrated with carcase tracking MSA cuts-based grading won’t be far away.

“This would mean processers could provide consistency within their brand structures to consumers so they could really start saying ‘what type of lamb do you want? We have an option at every price point’.

“That’s when we see value and trust shared across the supply chain, starting with consumers willing to pay more for consistency,” Dr Packer said.

“This allows brand owners to differentiate their product on customised eating quality specifications and other value drivers, with MSA doing the work in the background, rather than as a marketing tool per se.”

ALMTech chief investigator Prof. Graham Gardner said it was an exciting time for the teams behind the scenes to get these technologies ready for industry.

“To see SOMA NIR and the MEQ probe out making a difference in the lamb industry is really exciting,” Prof. Gardner said.

“ALMTech’s end goal is to assist industry in utilising technology that will bring value back to them and, as the lamb MSA program nears a cuts-based grading model, I believe we are on the verge of a proliferation of lamb brands that will differentiate themselves thanks to these new technologies.

“Seeing how industry has picked up the ball and run with it is a testament to how innovative this industry is.”

Dr Packer agreed the enthusiasm of lamb processors had pushed the project forward.

“It is fantastic to have the support of so many the key supply chains in the lamb processing industry.

“Many processors are in the process of upgrading plant infrastructure and technologies in preparation for what is to come, and this will increase ever more so over the next 12 to 18 months.”

HAVE YOUR SAY