THIS week’s property review includes a wrap-up of interesting recent listings across New South Wales, Victoria and Tasmania, a separate story on recent listings in Queensland and the Northern Territory, and an article of recently completed sales of note.

- Stellar interest in Tasmania’s historic Rheban

- Beef powerhouse in southern NSW

- $15m for Victorian grazing enterprise

- Revised price for Dunedoo’s Lockerbie

- Baldry’s Castle Hill lists for $14m

- Cropping, wool & prime lamb enterprise split in two

Stellar interest in Tasmania’s historic Rheban

The Gray family is selling its historic grazing property on Tasmania’s lower East Coast after 87 years of ownership.

The 3250ha Rheban is located 12km south of Orford and 88km from Hobart.

Elders agent Scott Newton said Rheban is considered one of Tasmania’s premier coastal rural holdings and as a result, is receiving incredible inquiry.

“It has been the strongest response to anything we have marketed for some time. The property is in 24 titles and boasts 10km of unspoiled coastline.”

Rheban has extensive frontage to the Mercury Passage and unrestricted views of Maria Island and the Freycinet Peninsula to the north.

The property supports 5500 sheep (2000 ewes, 2000 wethers and 1500 lambs) and 100 Angus cattle plus replacements.

The Gray family purchased Rheban in 1937 and after World War 2 carried out extensive land clearing and pasture improvement.

Soil types vary from light sandy loams to alluvials and small areas of black, cracking clay.

Mr Newton said Rheban offers significant future water infrastructure and agricultural development opportunities.

“While Rheban is a dryland, livestock enterprise, there is the opportunity to develop irrigation for viticulture or horticulture. There are several potential dam sites which could harvest water from the extensive area of crown land adjacent to Rheban.”

Water is sourced from Griffiths Creek and the Sandspit River, with a licence for irrigation.

Infrastructure includes a five-bedroom home, three cottages, a three-stand shearing shed, a shearers quarters, sheep and cattle yards, numerous sheds, and some historic stone buildings.

Rheban is being offered for sale by expressions of interest closing on October 17.

Beef powerhouse in southern NSW

A beef production powerhouse on the south-west slopes of southern New South Wales has been listed for sale by Andrew and Eve MacDougall.

The 1197ha Green Hills Station is located near Sharps Creek, 10km from Adelong and 28km from Tumut.

Nutrien Harcourts agents Andrew Bell and Brian Liston said Green Hills Station is a proven top-performing grazing enterprise in a highly reliable rainfall zone.

“With 1214ha of highly improved country and an average annual rainfall of 890mm, Green Hills Station ensures consistent production year after year.”

“The granite and basalt soils are rigorously limed by the vendor to improve nutrient availability and pasture production,” the agents said.

Green Hills Station is watered by three permanent creeks (Nacki, Sharps and Dog Trap) which run through the property, as well as 27 dams.

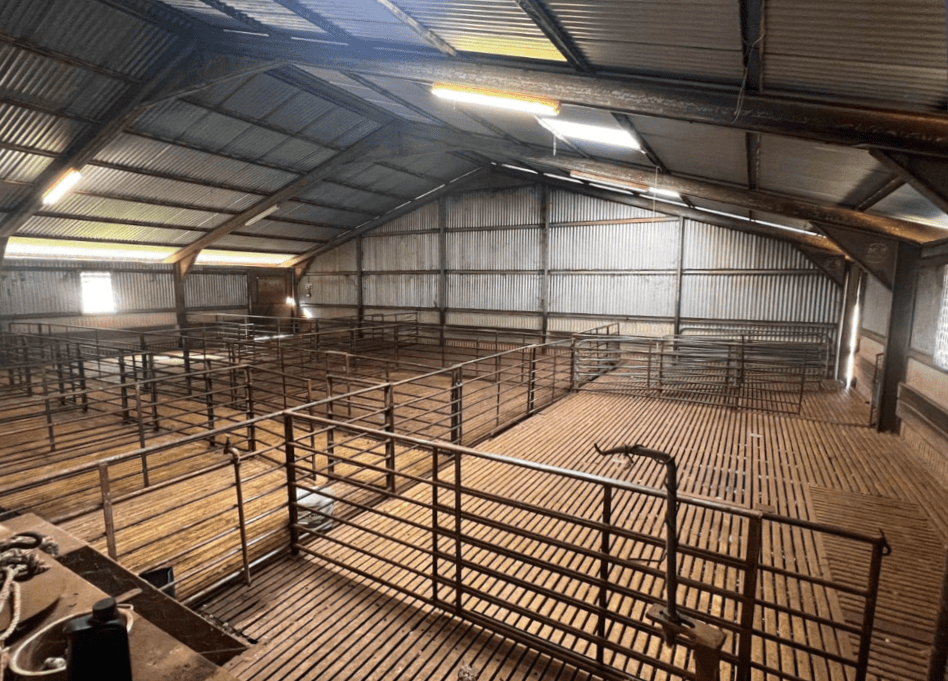

Infrastructure includes a four-bedroom circa 1840s triple brick home, a five-bedroom home, cattle yards, a four-stand shearing shed, steel sheep yards, and a number of sheds.

Green Hills Station is being offered for sale by expressions of interest closing on October 31.

$15m for Victorian grazing enterprise

After 10 years of ownership, the Melbourne-based Falls Pastoral Company (owned by the Ball family) is selling its breeding and grazing enterprise in north-east Victoria with hopes of raising around $15 million.

The 1550ha Balmullin Aggregation is nestled in the Molka district, at the foothills of the Strathbogie Ranges, 15km north-west of Euroa and 40km south of Shepparton.

It is available for purchase as a whole or in three lots – 869ha Balmullin, 351ha Berridale and 331ha Boxwood Park.

CBRE Agribusiness agent Shane McIntyre said widespread interest is coming from Victorian producers seeking expansion and from Riverina producers looking to add dimension and diversity to their existing holdings.

“The Balmullin Aggregation joins 6500 cross-bred and composite ewes annually, with a history of 125 percent lambing.”

With a carrying capacity of 15,000DSE, the aggregation is a renowned producer of tender prime lamb trading as Molka Lamb.

According to its website, Balmullin runs a traditional first cross ewe flock with ewes selected on fertility, size and body shape as well as traits of rapid growth and early maturity.

Balmullin’s first cross ewes are joined to White Suffolks and Poll Dorset rams. Young ewes are joined to the lower birth weight White Suffolks and the older mature ewes are joined to Poll Dorset rams to produce a fast growing tender sucker lamb.

Lambs are finished on fodder crops and irrigated lucerne for even growth and consistent type.

Water on the Balmullin Aggregation is supplied by two dams (205ML total capacity) for irrigation and a bore.

Infrastructure includes a renovated four-bedroom home, a modern shearing complex and numerous sheds.

The Balmullin Aggregation is being offered for sale by expressions of interest closing on October 9.

Revised price for Dunedoo’s Lockerbie

Renowned Dunedoo livestock breeding and fattening property Lockerbie in central western New South Wales is being reoffered for sale with revised price expectations to reflect the current market.

After failing to sell at auction in December last year, the 3389ha were listed for $15 million and are now being sold via expressions of interest closing on October 23.

Meares & Associates principal Chris Meares said in recognition of demand for properties with scale or as additional holdings, the vendor will sell Lockerbie as a whole or three separate parcels.

They are the 1502ha Lockerbie (6100DSE), 1302ha Wheogo (4700DSE) and 534ha Bullinda (2700DSE) which sits between Lockerbie and Wheogo.

Lockerbie and Wheogo are being offered with a $5.25m to $5.5m price guide, while Bullinda is expected to achieve between $2m to $2.5m.

Mr Meares said the opportunity to purchase one or a combination of the three holdings provides a prospective buyer with optionality to meet their specific needs and budget.

“Lockerbie is a prime standalone grazing block, Wheogo boasts quality improvements, cropping and grazing capabilities and Bullinda has additional native and improved basalt grazing and cropping to supplement carrying capacity as required.”

Mr Meares said Lockerbie is currently benefiting from favourable seasonal conditions.

“The property has an abundance of feed available and more than 200ha planted to cereal crops which will be included in the sale.”

Mr Meares reports most of the inquiry is coming from locals, and New South Wales and southern Queensland producers with nearby country.

Described as one of the longest held and largest holdings in the district, the property is being sold by the Gaden family after 98 years ownership.

Rated to carry 13,000DSE to 14,000DSE, Lockerbie is described as excellent wool growing and cattle breeding and finishing country.

Today, much of the livestock operation is managed by cell grazing techniques.

The rich basalt and loam soils are complemented by 550ha of highly productive arable country, mainly along the Merrygoen Creek flats which produce cash or fodder cropping and high-performance pastures.

Lockerbie is watered by a 9.5km mostly double frontage to the permanent Merrygoen Creek, complimented by six equipped bores, 19 dams and numerous permanent and semi-permanent creeks.

Infrastructure includes two renovated homes, a fully automated modern sheep feedlot, a shearing shed, sheep yards and a horse complex.

Lockerbie also has potential to generate biodiversity offsets.

Baldry’s Castle Hill lists for $14m

Well-known New South Wales stud merino breeders, the Phillips family, have reduced the price of their premium livestock and cropping portfolio to $14 million.

Steve, Liz, Sam and Georgia Phillips operate a large-scale grazing enterprise across a number of holdings in the Harden, Yass, Monaro and Gundagai districts, including the highly regarded Yarrawonga Merino Stud.

The 1758ha Castle Hill Aggregation is located 8km from Baldry, 22km from Yeoval and 44km from Parkes in the state’s Central West.

Comprising three holdings, Castle Hill, Mountain View and Fairy Mount, the aggregation was offered for sale in July 2023 for $18m.

At the new price of $14m, LAWD senior director Col Medway described Castle Hill as the cheapest, best value, grazing and farming property in New South Wales.

Equally suited to any combination of dryland cropping and livestock breeding and grazing, Castle Hill currently produces feeder steers, prime lambs, mutton, wool, cereals and oilseeds.

Fodder and grain recovery crops, such oats, canola and wheat, are an important part of the enterprise mix.

Rising from creek flats to gently undulating grazing land, around 1424ha (80 percent) is considered arable for cropping or direct drilling of pastures.

Currently, 725ha have been sown to improved perennial pastures and 200ha developed to grazing crops, including oats, canola and lucerne.

The balance comprises productive native perennial grass and clover pastures capable of running 16,000DSE.

Significant areas are also suitable for development to cropping and/or improved pastures.

Vendor Steve Phillips said Castle Hill is a standout operation.

“It boasts a reliable 650mm annual rainfall throughout the year and has strong red soils with around 80 to 90 percent arable. So, you can do pretty much anything with it.”

Mr Phillips said there is also potential to further increase productivity with greater fertiliser use or the development of grazing land to farming.

“A moderate elevation of 440m above sea level provides an excellent climatic base for winter crop and improved pasture production.”

During the past 22 years, the family has installed extensive fencing, renewed sheep yards and cropped wheat, oats and canola.

Water is supplied from two bores, supported by 42 dams and almost 6km of Rocky Ponds Creek frontage.

An extensive Landcare tree planting program in the 1990s has enhanced the landscape and provides protection for livestock.

There are multiple accommodation options, including a seven-bedroom home and a five-bedroom home, 300-tonnes of grain storage, two shearing sheds, sheep and cattle yards, numerous sheds and eight silos.

Cropping, wool & prime lamb enterprise split in two

A highly productive mixed cropping, wool and prime lamb enterprise in the renowned New England region of New South Wales has returned to the market for above $17 million.

The 1549ha Braemar, 10km from Manilla and 33km north of Tamworth, is owned by rural communications specialist Robbie Sefton and husband Alistair Yencken who are downsizing.

Offered via an expressions of interest campaign earlier this year, 320ha have been carved off the original 1870ha holding and are being offered for separate sale as Shenfield. The farming block is likely to achieve around $4m, while the remaining 1549ha Braemar is being offered for around $13.5m.

Braemar was purchased in 2007 and has been extensively developed to the point where the business is now performing in the top two percent of regional benchmarking enterprises.

A significant portion of Braemar has been sown to high performance pastures such as lucerne, targeted at increasing carrying capacity.

As whole, Braemar is equally suited to beef cattle production and is estimated to carry 650 breeding cows or 15,000 winter dry sheep equivalents on 738ha of native pastures.

This year’s crop rotation comprises 602ha of lucerne, 110ha of barley and 99ha of wheat.

Inglis Rural Property agents Sam Triggs and Jamie Inglis said Braemar is not only beautifully presented, but also a high-yielding agricultural enterprise.

“It represents genuine value for money, particularly when compared with similar sized properties in southern New South Wales and areas of Victoria.”

Braemar could also attract interest from poultry farmers because it is situated in a relatively new poultry zone where an increasing number of chicken broiler sheds are being built to support Baiada’s abattoir in Tamworth.

Braemar has been drought-proofed through a sophisticated bore water system that supplies all 42 paddocks. In addition, there are 28 dams, six bores and dual frontage to the seasonal Greenhatch and Dead Horse Gully Creeks.

The vendors have invested extensively in land development, prioritising the wellbeing of the soils and local flora and fauna through the retention of biodiversity corridors.

The principal residence is an historic renovated homestead dating from 1900. There are a further four refurbished residences on the property, including a historic Cobb and Co coach house.

The fit-for-purpose infrastructure includes a five-stand shearing shed, undercover sheep yards, cattle yards, shedding, a 750-tonne grain storage and a 250-tonne cement grain bunker.

HAVE YOUR SAY