Merino wool prices are expected to soften, but not fall sharply. Image – AWEX.

NCWSBA executive director Chris Wilcox.

RAW Merino wool prices are expected to be softer this year as the manufacturing and retail sectors struggles to pass on recent price rises.

But wool industry analyst and executive director of the National Council of Wool Selling Brokers of Australia Chris Wilcox said there was “no sense” from feedback from processors that prices would drop sharply because of supply.

Mr Wilcox said the feedback from delegates at the recent International Wool Textile Organisation Congress in Venice Italy was that Chinese and Italian processors were finding it tough to pass on the extent of the raw wool prices rises in the last 6-9 months.

“They’ve been able to lift the price a little bit but there has been a lot price resistance from the retailers and garment makers, which is causing them some stress.

“The knitting sector is doing better than the worsted weaving sector and the common theme is that there are stocks of mens suits at retailers and garment makers which would mean there is a bit of pull-back in the orders coming through for the autumn winter season.”

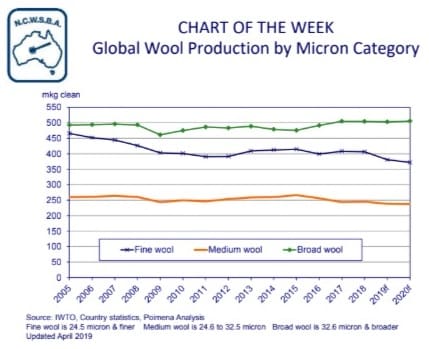

Mr Wilcox said demand is balanced by the low raw wool production world-wide.

“World wool production will be down about 2.7 percent for this year, which is a pretty big drop on a global scale.”

Mr Wilcox said fine Merino wool and medium 26-32 micron wool production will be the hardest hit, but broader wool production is expected to be up.

China continuing to drive the market

Endeavour Wool trading manager Josh Lamb.

Endeavour Wool’s trading manager Josh Lamb said China is driving the market at the early stage processing and retail levels.

He said there is not a great selection of wool suitable for European buyers in the current Australian offering.

“At the moment the Europeans are sitting out a bit because they have seen a slowdown in demand for fabric, but they are not pessimistic to the point where they can see huge corrections going forward.

“It is more a case that they’ve had four really good years back to back now, with growth at their end, and they expect at some point that will slow down, like it does no matter what the commodity you are talking about; nothing is going to grow indefinitely.

“So they’re that a little bit at the moment — they are down around 20 percent in fabric sales for this season, but they are talking that over the last four years they are still up.”

Fabric sales are still good in Asia, they have softened a little in America, but were down in Europe, he said.

“Looking forward to the new season, they are not that pessimistic, they don’t think the price of wool is a huge issue for them at the premium end of the market where they are.

“It’s just these next five or six months will be a bit thin for them, so they will probably be a bit conservative about purchasing, but going into the new season they are quite positive.

The flip side of that is that the Chinese are driving the market and it is very much supply-driven, which is a bit of a concern for your bread-and-butter wools.

“You would have to think, looking forward into the new selling season (from July onwards) into the spring that prices will continue to soften between now and then.”

Mr Lamb said passing on raw prices in the last 5-6 months, whether into China or Europe, has been difficult.

“You would expect prices to soften coming into the new season, but again, it is very much supply-related and the way things are looking at the moment, the drought is nowhere near broken in the majority of the eastern states, so supply could be a massive issue again.”

Mr Lamb said the lack of good speci wool – with good tensile strength, yield and staple length consistency – has had more of an effect in Europe.

“The supply of good quality wool at this time of the year, even in a normal year, drops off, but this year in particular it has been exacerbated.

“Prices haven’t softened a lot for the better spec end of the market, but when you start to talk China, they are pretty ingenuous about how they adapt to the supply at the time.

“They would like to be buying better quality wools, but it’s not here, so they are adjusting to what is available at our end.”

Mr Lamb said the main issue at the moment was yields, which were dropping rapidly and had an effect on scouring and processing efficiencies. He said it was great for producers with drought feed bills that wool was cleared at current price levels.

“As exporters we would love to see the proceeds from that wool going into the expansion of operations, rather than keeping sheep alive, but that is the situation at the moment.”

Hmmmm…🧐