A REBOUND in grain production is expected to take over from livestock to continue modest growth in Australian farm production value in 2020-21, according to ABARES’ June Agriculture Commodities report released today.

However, although ABARES analysts expect grain production to increase in 2020-21, wheat, barley and canola prices are expected to fall, while sheep meat and beef prices are forecast to rise.

ABARES expects the wool industry price benchmark, the AWEX Eastern Market Indicator to fall 17 percent in 2020-21 as global markets recover from the COVID-19 pandemic.

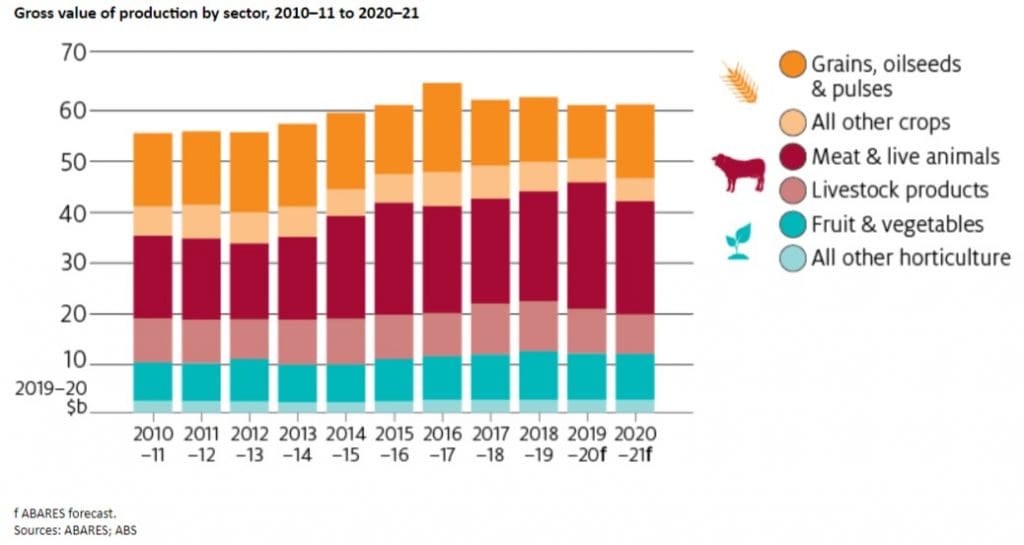

The gross value of farm production in 2019-20 is estimated to be about $60 billion, driven by a $1.5 billion increase in the contribution of livestock production as restockers drove stock prices higher in early 2020. This coincided with strong animal protein export demand driven by the African Swine Fever outbreak across Asia and particularly in China.

In 2020-21, ABARES’ acting executive director Peter Gooday said better seasonal conditions are expected to see the value of farm production increase modestly to $61 billion, the third straight year over $60 billion, driven by a strong forecast rebound in grain production, up 15 percent to $30.8 billion.

“The value of livestock production is forecast to fall 10 per cent to just above $30 billion, ending a run of very strong growth.

“After three years of widespread drought, conditions have begun to improve, and restocking is likely to commence,” he said.

“A global economic slowdown combined with higher agricultural production is going to weigh on prices – price falls are forecast for most major commodities.”

ABARES said demand for Australian exports of food staples has remained steady. This demand for food staples is likely to be less affected by COVID-19 related falls in incomes (see the Economic overview).

Red meat prices to hold up

Mr Gooday said a bright spot globally is that red meat prices are expected to hold up, with the impact of African swine fever still driving protein demand in Asia.

“As we recover from drought, the value of farm exports is forecast to fall by around $2.7 billion to $44.4 billion in 2020-21, driven by falling meat exports and the rebuilding of domestic grain stocks.

“With graziers looking to rebuild herds and flocks, slaughter numbers – and therefore exports – are forecast to fall,” he said.

“Meat and live animal exports are forecast to fall by $3.5 billion and while exports of grain are expected to increase by almost $2.3 billion, over 4 million tonnes of the 2020-21 grain harvest is expected to be retained to rebuild domestic stocks.

“Replenishing our herds, flocks and grain stocks sets us up well for the long-term.”

Mr Gooday said while Australia’s domestic grains stocks are sufficient to see it through to the winter harvest, the investment in grain stocks will be important in improving resilience in our supply.

He said Australian agriculture’s resilience and ability to adapt swiftly to challenges should position the sector well during the post-pandemic recovery.

“With a few notable exceptions, Australian agriculture has not been severely impacted by COVID-19 and has shown that it can adapt in most cases.

“Exporters of high-value seafood, wine and meat products did face significant impacts, but have also demonstrated adaptation by expanding online sales and marketing directly to households,” Mr Gooday said.

“We recognise that there is an enormous amount of uncertainty regarding the economic impact of COVID and the duration of effects.

“This translates to more uncertainty in agricultural markets, but as we have seen, demand for Australian exports of food staples remains relatively steady, and our industry has shown it can adapt as conditions change.”

Read the ABARES Agriculture Commodities June quarter report here.

HAVE YOUR SAY