Southern Aurora Markets partner Mike Avery.

“The best way to predict the future is to create it” – Peter Drucker

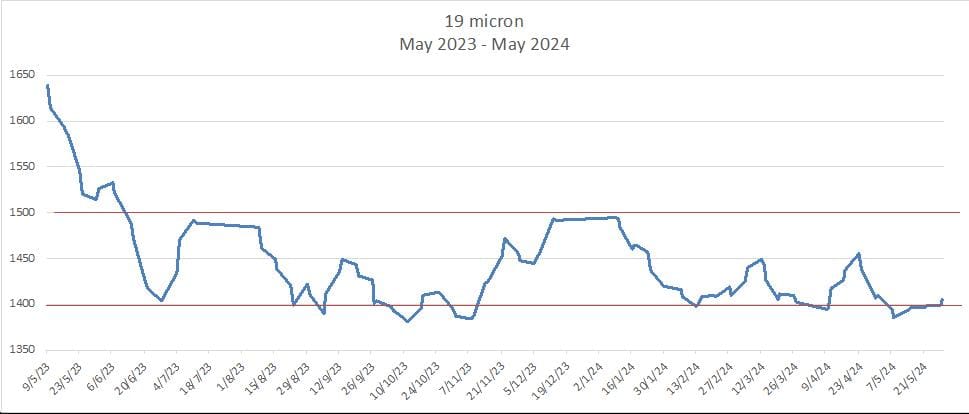

THE spot auction wool market continued the up and down pattern as it tries to bounce off support levels for most of the micron groups.

Most microns spent the new year below their 12-month average.

Broader microns were inclined to fare better with a spike post-Easter pushing prices to the top of their range before falling back through May.

The forward markets are showing several distinct patterns. Prices for all microns mirror the spot cash for June and July indicating that buyers see little change in the situation that bounds the market (tight supply/muted demand).

Spring and summer 2024 is a little less clear, with limited volume on the bid and offer. The early indication sees buyers willing to pay a 2 percent premium, but sellers looking for 4pc over spot.

The outlook for longer dated forwards looks more positive. This is demonstrated by the 19 micron contract bid at 1500 cents from spring 2025, through 2026 out to mid-2027. This equates to a 7pc premium to the current spot price of 1405. Even if that price point might not be deemed optimum it does underscore the value to the pipeline of forward markets.

Just as important, the first indications of grower hedge levels emerged this week with spring 2025 offered at 1700 cents for 19 micron. Hopefully, this will start more conversations around fair value, cost of production and risk management.

Next week auctions are restricted to the eastern seaboard with 27,500 bales on offer in Sydney and Melbourne. With a bit of luck this should see the spot market continue its firming trend.

Source – Southern Aurora Markets.

HAVE YOUR SAY