THERE was little action in the wool forward market this week, with the final week of auction sales before the recess doing little to clear the air.

THERE was little action in the wool forward market this week, with the final week of auction sales before the recess doing little to clear the air.

With auction prices ending mixed to unchanged, the bulls can point to a market holding firm against a clogged supply chain and our major customer in a self-induced COVID shutdown.

The bears can call the “trend is your friend” with the post-Christmas slide broadly intact. The Australian dollar jolting around this week wouldn’t have helped.

Selling interest still dominated the front of the forward market board, while buyers are looking to offset risk in late Spring, early Summer. The couple of trades that went through were around the auction price for six months’ peace of mind.

While it is easy to disengage when prices are chopping around in a tight range, it will not always be the case. For the last couple of years, the price difference between the Easter recess and Winter recess has been around 300 cents down in 2020 and 200 cents up in 2021, again something for both sides. The reality is that prices for 19 micron and below are pretty good. Why not take some of the guesswork out of your budget for next year?

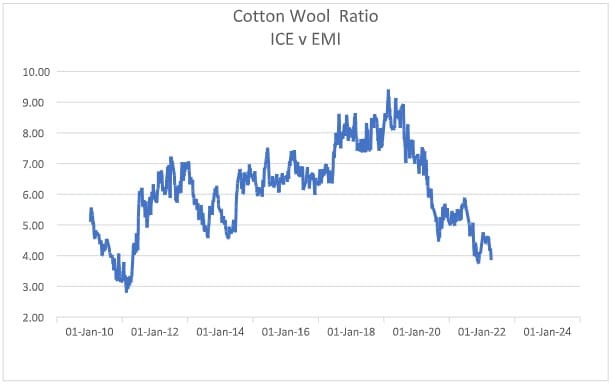

Interestingly the cotton market is pushing higher on Texas crop concerns and dwindling stocks in the United States. This has pushed the EMI/ICE futures price ratio below 4.0 (see chart below). This, in broad terms, means that wool is looking cheap in the fibre market. Of course, this depends on where you sit on the micron curve.

Have a safe and healthy Easter.

This week’s trades

November 2022 19 micron 1670 cents 5 tonnes

November 2022 19 micron 1675 cents 2.5 tonnes

Total 7.5 tonnes

HAVE YOUR SAY