Southern Aurora Markets partner Mike Avery.

“Confidence is a fragile thing” – Joe Montana

IT was another week that tested the resolve of Australia’s wool market.

Most viewed last Wednesday’s pause in the short-term rally as just that, a brief steadying after the double digit rise of Tuesday; more a result of the USD weakening than a change in sentiment.

Unfortunately, the result was a pull-back of about two-thirds of the hard-fought gains of early April. The optimism, confidence and orders that surrounded the IWTO Conference somewhat dissipated.

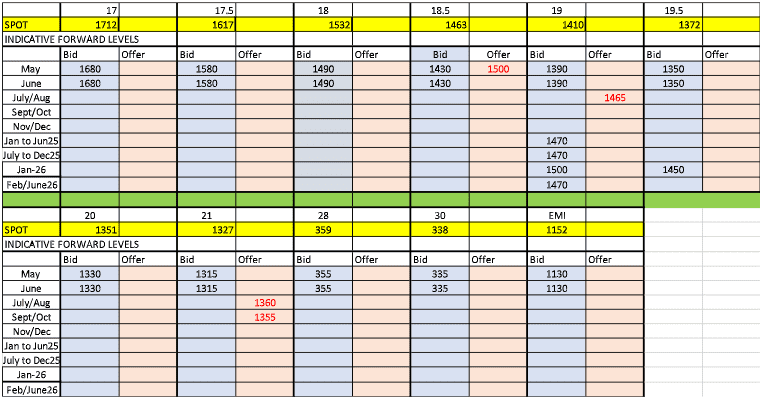

The forward market tended to follow a similar pattern. The aggressive bidding of last week that saw the majority of Good Till Cancelled orders in the market mellowed and appeared a little conservative to start the week. Pitched around 10 to 15 cents under the close, they drew little or no interest from the sellers. In hindsight, they were a bellwether and not that conservative.

Bidding is now sitting around 20 cents below closing for most Merino indicators and the EMI. Crossbreds remain bid at cash mirroring their firm tendency at auction albeit at historically modest levels.

Regretfully, this pattern is likely to continue in the short to medium-term. The market prone to react to surges in demand, changes in currency and overarching oscillations in global sentiment and consumer confidence.

This landscape will deliver some hedging opportunities, but volumes are likely to remain thin.

Source – Southern Aurora Markets.

HAVE YOUR SAY