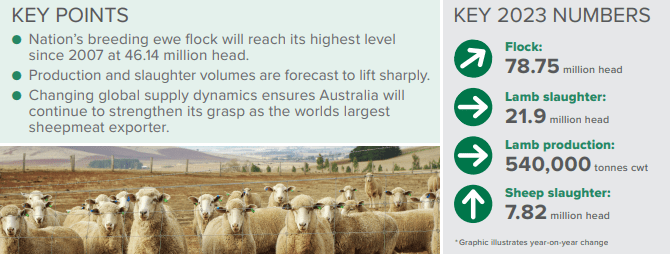

LAMB and mutton prices are forecast to lift in the next six months despite Australia’s general sheep and breeding ewe flocks reaching their highest levels since 2007.

MLA’s latest Sheep Projections Update also projects that Australia will strengthen its grip as the world’s largest sheep meat exporter with the flock at 78.75 million and breeding ewes reaching 46.14 million.

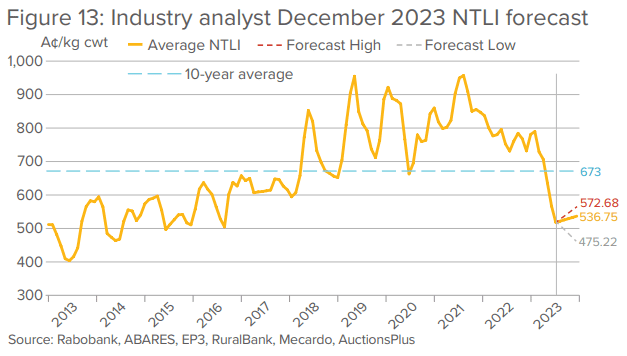

In a further expansion of price forecasts by six industry analysts, MLA has included a three-month price forecasts to 30 September and out to December 2023 for the National Trade Lamb Indicator and National Heavy Lamb Indicator in the projections.

Based on current prices, analysts are forecasting an improvement in prices for both indicators between now and the end of September.

For the National Trade Lamb Indicator, analysts are forecasting the price to lift by 4.5 percent or 24 cents to reach 553c/ kg carcase weight by 30 September – based on the current price of 529 cents.

For the National Trade Lamb Indicator, analysts are forecasting the price to lift by 4.5 percent or 24 cents to reach 553c/ kg carcase weight by 30 September – based on the current price of 529 cents.

For the National Heavy Lamb Indicator, analysts are forecasting a price of 569 cents by 30 September. This would be an improvement of 7.4pc or 39c/kg cwt on its current price at 530 cents.

The analysts — Rabobank, ABARES, EP3, RuralBank, Mecardo and AuctionsPlus — are also forecasting the NTLI to rise by 4.4pc or 22.5 cents to 537c/kg cwt by 31 December and for the NHLI to improve 2.2pc or 12c/kg cwt to 553c/kg cwt.

Drought recovery has been strong

MLA said the flock growth follows three consecutive years of above-average rainfall in Australia’s sheep regions that has driven an exceptional recovery post-drought.

MLA’s senior market information analyst, Ripley Atkinson, said the outcomes of this strong improvement in sheep numbers will deliver strong volumes of finished weight stock to market.

“With improved genetics and on-farm management driving historically elevated carcase weights, we will see record lamb production and export volumes, as well as high mutton production.

“This will ensure that Australia can continue to meet its domestic and ever-increasing global demand for high quality sheep meat,” he said.

Carcase weights to remain high

MLA said carcase weights in 2023 will remain 7pc above the 10-year average. Lamb carcase weights are projected to ease to 24.7kg in 2023 and continue to decline to 24.2kg in 2025, while sheep carcase weights are expected to ease to 25.2kg in 2023, 3pc higher than the 10-year average.

With carcase weights forecast to remain stable over the next three years, this will support high lamb and mutton production forecasts out to 2025. A move towards meat breeds and improvements in management and genetics are also behind the long-term trend of higher carcase weights, MLA said.

Lamb production is expected to reach 540,000 tonnes in 2023, still beating 2022’s record production of 534,500 tonnes.

Production will continue to increase in 2024 to 548,000 tonnes and then ease in 2025 to 537,000 tonnes after successive years of high mutton slaughter reducing lamb supply.

Mr Atkinson said that the supply of lambs entering the market will continue to flow through the system with another good lamb drop expected this season.

“This will allow for continued high slaughter numbers, flowing through to increased production in 2023 and 2024,” he said.

Mutton production has been revised upwards on MLA’s February projections to 197,000 tonnes in 2023. This follows strong weekly kill numbers in the first half of 2023 as processors prioritise mutton slaughter over lamb slaughter.

New Zealand sheep meat exports expected to decline

MLA said increased production and slaughter volumes within Australia, coupled with changing dynamics in key rival markets, will cement Australia’s place as the number one world exporter of sheep meat.

Lamb and mutton from Australia and New Zealand represented over 70pc of internationally traded sheep meat in 2022. However, according to Mr Atkinson, while the Australian outlook is positive, exports from New Zealand are likely to decline in the medium-to long term.

“This is due to a number of factors, but key among them are the changes in land use patterns within New Zealand, which are having a detrimental impact on the New Zealand flock size and have subsequently affected production.

“Lower sheep production results in declining exports from New Zealand,” he said.

“This means Australia has a prime opportunity to further increase our grasp as the world’s largest sheep meat exporter.

“Strong volumes are expected to continue and interest in Australian lamb across domestic and international markets remain extremely solid,” Mr Atkinson said.

“Ultimately the latest industry projections promote a positive outlook for the sheep meat industry over the next few years.”

View a full copy of MLA’s July 2023 Sheep Industry Projections here.

HAVE YOUR SAY