AN over-supply of Australian lamb on world or domestic markets is not on the horizon, according to Meat & Livestock Australia.

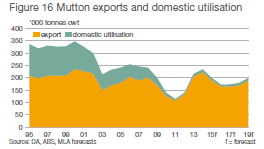

As he released the latest projections for Australia’s sheep industry for 2016-2020, MLA’s manager of market information Ben Thomas highlighted the declining lamb production of major competitor New Zealand, and the expected steady domestic consumption and growing export demand for Australian product.

“When you take a look at New Zealand and where their lamb forecasts are – 60-year low lamb crop, production expected to be down 6 percent next year and I would be very surprised in the next five years if there is any forecast for New Zealand’s lamb production to increase significantly.

“So taking that it into account, with not only the expected fairly steady Australian domestic demand and growing demand internationally, I don’t think we are going to get an over-supply at all.

“We are a niche product as it is and it will take a very, very long time before we are ever out of that if ever – no, not at all, ever.”

Demand for Australian lamb to hold steady

Demand for Australian lamb is expected to hold steady next year, with production expected to fall in 2016 and not increase until 2017, according to MLA’s 2016-2020 sheep industry projections.

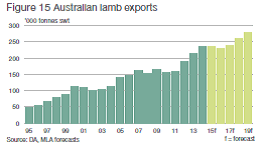

Australian lamb exports in 2016 are forecast to reach 230,000 tonnes shipped weight, down slightly (2 percent) from the estimated 2015 level.

This is the result of lower production levels, not waning overseas demand for Australian lamb, MLA said.

The post-drought decline in national lamb slaughter in 2016 is only expected to be small — down 3.4pc year-on-year to 21.5 million head. The fall in lamb production is forecast to be even more modest — down 2.2pc year-on-year, to 482,000 tonnes cwt — due to further increases in average lamb carcase weights.

However, MLA said by 2019, lamb exports are forecast to be 280,000 tonnes, up 19pc from 2015 levels, the result of increased Australian production and growing global demand. Improvements in lamb marking rates and small gains in average carcase weights are expected to drive lamb production from 2017 onwards – reaching 552,000 tonnes cwt in 2019.

However, MLA said by 2019, lamb exports are forecast to be 280,000 tonnes, up 19pc from 2015 levels, the result of increased Australian production and growing global demand. Improvements in lamb marking rates and small gains in average carcase weights are expected to drive lamb production from 2017 onwards – reaching 552,000 tonnes cwt in 2019.

MLA said the demand for Australian lamb in 2016 will continue to be heavily influenced by international customers, with the Australian dollar tipped to hover below the US70 cent mark, which will assist trade and Australian lamb prices considerably.

Exports are forecast to be the third highest on record next year at 230,000 tonnes, accounting for 55pc of all lamb production.

Domestic market will remain largest lamb consumer

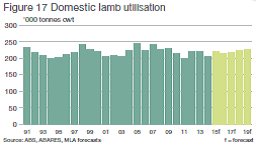

But the domestic market will remain the largest market on a volume and value basis, with 2016 utilisation forecast to be 214,000 tonnes cwt, down 2.7pc year-on-year. Assisted by population growth, this is projected to rise to 226,000 tonnes cwt in 2019, MLA said. Average per capita consumption is projected to remain steady at around 9kg for the duration of the projection period.

But the domestic market will remain the largest market on a volume and value basis, with 2016 utilisation forecast to be 214,000 tonnes cwt, down 2.7pc year-on-year. Assisted by population growth, this is projected to rise to 226,000 tonnes cwt in 2019, MLA said. Average per capita consumption is projected to remain steady at around 9kg for the duration of the projection period.

MLA expected lamb consumption to fall 3pc year-on-year in Australia this year to 214,000 tonnes cwt. Despite lamb’s strong niche position in the Australian market, the major challenges in 2016 are the expected decline in supply and continued strong demand from exports markets – forecast to take 44pc of total production – and consequent continued high lamb retail prices.

US lamb market expected to continue to grow

Mr Thomas said demand from the United States of America, Australia’s largest export market, is expected to keep growing, but there is likely to be a slight drop in demand from China due to its higher domestic production.

The smaller volume markets of Japan and Europe will be relatively steady but will remain highly valuable customers of Australian lamb, he said.

Australian dollar forecast to stay low

The Australian dollar is forecast by most banks to drift below US70 cents in 2016, and stay in that region for the duration of the year. This factor, combined with the significantly lower New Zealand lamb production and export forecasts will place Australian product in an extremely favourable position, and should ultimately assist Australian lamb prices at the farm gate, MLA said.

Higher marking rates, carcase weights and less competition

MLA said a combination of higher carcase weights, improved lamb marking rates and less competition from a shrinking New Zealand sheep flock make for an impressive outlook for Australian lamb producers over the coming years.

MLA said a combination of higher carcase weights, improved lamb marking rates and less competition from a shrinking New Zealand sheep flock make for an impressive outlook for Australian lamb producers over the coming years.

Mr Thomas said ongoing productivity improvements were contributing to the Australian sheep meat industry’s growing value.

“Over the past five years lamb marking rates and the ability to produce an early finishing lamb have steadily improved, and this continued in 2015 despite many producers facing unfavourable winter and spring conditions.

“Despite the dry season, average carcase weights increased 1.5 per cent, a trend partially attributed to the change in composition of the sheep and lamb flock,” Mr Thomas said.

“Even though fewer lambs will be processed next year, the heavier carcase weights will carry production through the next few years.

“Producers are driving this transition, moving from a Merino-based flock in the 1980s to higher yielding meat and composite breeds, and that should further boost carcase weights in the future,” he said.

Price volatility in the lamb market has eased slightly over the past three years, but Mr Thomas said the key to the industry’s strength would be reflected in productivity gains.

“Prices have been helped by the low Australian dollar and a weaker performance from our major competitor, New Zealand, where sheep numbers have reached a 60-year low as they the transition into dairying,” he said.

Mr Thomas said overall the industry appeared to be in a very favourable position. The national sheep flock is forecast to be relatively stable over the coming years, with genetic gains achieved on-farm driving increased lamb production in the future.

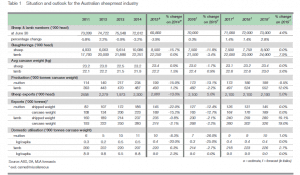

Mutton exports expected to drop

MLA said exports will continue to account for 95pc of mutton production from 2016 onwards, with Greater China, the Middle East and the US remaining the primary markets.

MLA said exports will continue to account for 95pc of mutton production from 2016 onwards, with Greater China, the Middle East and the US remaining the primary markets.

In 2016, exports will drop as a result of lower production – an estimated decline of 12pc year-on-year, to 127,000 tonnes, before eventually recovering to 145,000 tonnes by 2019. The demand factors assisting the Australian lamb market will also be influential for mutton over the coming years, MLA said.

Live exports dependent on Middle East access and policy

MLA expected live sheep exports to increase to 2.1 million head in 2016 and remain steady throughout the remainder of the decade. However, MLA said live sheep exports will continue to be dependent upon market access and government policy in the Middle East. In particular, Bahrain, as of October this year, has ceased its longstanding subsidised live sheep import program and will be a market to monitor over the next year. So far this year (January to September), 96pc of live sheep exports have been destined for the Middle East, assisted by additional exports out of Port Adelaide.

To download the full MLA report, click here.

Source: MLA

When ever MLA start making these bullish forecasts its a time for growers to have their crap detectors on red alert!