AUSTRALIAN average lamb and sheep prices are forecast to increase about 10 percent next financial year, according to the latest ABARES forecasts.

AUSTRALIAN average lamb and sheep prices are forecast to increase about 10 percent next financial year, according to the latest ABARES forecasts.

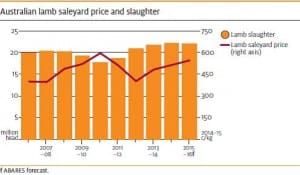

In the latest ABARES Agricultural Commodities June quarter report, analyst Peter Berry said the average saleyard lamb price is forecast to increase by 9pc to 565c/kg in 2015-16, reflecting a fall in lamb supply from a smaller flock with fewer breeding ewes.

This 2015-16 increase is expected on top of an average saleyard price of lamb of 519c/kg for 2014–15 as a whole, a year-on-year increase of 9pc.

ABARES estimates the sheep flock will fall to 70.1 million head by June 2015, following high lamb and sheep turn-off over the past two years, and then to rise slightly during 2015-16.

Mr Berry said aided by a lower Australian dollar, export demand for lamb in Australia’s major markets, particularly the United States and the Middle East, is expected to remain strong and continue to place upward pressure on prices.

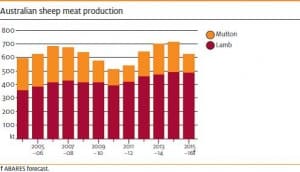

Australian lamb production in 2014-15 is estimated to increase by 3pc to about 487,000 tonnes, the largest tonnage on record. This reflects a 3pc increase in lambs slaughtered at about 22.5 million head.

Australian lamb production in 2014-15 is estimated to increase by 3pc to about 487,000 tonnes, the largest tonnage on record. This reflects a 3pc increase in lambs slaughtered at about 22.5 million head.

Mr Berry said lamb slaughter is forecast to fall to 22.2 million head in 2015–16, reflecting an expected fall in the number of lambs marked, with production forecast to decline by 1pc to 482,000 tonnes.

Lamb exports forecast to rise by 2pc in 2015-16

Australian lamb exports are estimated to increase by 4pc to 235,000 tonnes in 2014–15, driven by strong demand, but in 2015-16 shipments are forecast to decline by 2pc to 230,000 tonnes, reflecting reduced lamb production.

“A continuation of strong export demand and reduced supplies are expected to maintain upward pressure on export unit values, more than offsetting the decline in forecast export volumes on the value of exports.

“As a result, the total value of lamb exports is forecast to increase by 2pc to $1.68 billion,” Mr Berry said.

He said in the 10 months to April 2015, lamb exports to the United States rose by 16pc and lifted 14pc into the Middle East, compared to the same period last year. Over the period, lamb exports to other major destinations in Asia also increased, particularly to Japan, Malaysia and the Republic of Korea.

“In contrast, Australian lamb exports to China and Hong Kong fell as a result of increased domestic production in mainland China, strong competition from New Zealand and the relatively high import price of Australian lamb.

“Reflecting overall strong demand in Australia’s major export markets, the average lamb export unit value is estimated to increase by 8pc to $7 a kilogram in 2014-15,” he said.

“The total value of lamb exports in 2014-15 is estimated to increase by 12pc to $1.65 billion.”

Mutton price expected to rise 10pc in 2015-16

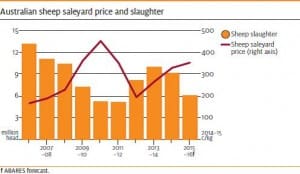

The Australian weighted average saleyard price for sheep is estimated to increase by around 27pc cent to 332c/kg in 2014–15, following a strong rise in the previous year.

The Australian weighted average saleyard price for sheep is estimated to increase by around 27pc cent to 332c/kg in 2014–15, following a strong rise in the previous year.

“In 2015-16 the saleyard price of sheep is forecast to increase by 10pc to 365c/kg, reflecting the combined effects of reduced sheep supplies and an expected continuation of strong demand for mutton in Asia and the Middle East,” he said.

Mr Berry said mutton production is estimated to fall by 7pc to about 212,000 tonnes in 2014–15, reflecting lower sheep numbers after high rates of turn-off over the past two years.

“In 2015-16 sheep slaughter is forecast to fall by 16pc to 7.7 million head and mutton production is forecast to fall by nearly 17pc to 177,000 tonnes.

“This reflects the forecast further decline in sheep numbers and reduced availability of ageing and unproductive sheep for slaughter after two years of relatively high turn-off,” he said.

“Also contributing to lower sheep slaughter in 2015–16 is the expected recommencement of flock rebuilding in the second half of the year, under an assumption of more favourable seasonal conditions.”

Mutton export value declining

Mr Berry said Australian mutton exports are estimated to decline by 6pc to 172,000 tonnes in 2014-15, following a 27pc rise in the previous year as a result of high rates of turn-off and strong export demand.

“In 2015-16 mutton exports are forecast to fall a further 15pc to 146,000 tonnes as a result of reduced slaughter, particularly when producers commence flock rebuilding in the second half of the year.

“Despite the decline in export volumes, export demand for mutton from markets in the Middle

East and Asia (with the exception of China) is expected to continue to grow in the coming year, supporting export returns,” he said.

“The total value of mutton exports is forecast to fall by 13pc to $690 million in 2015–16.”

Seasonal conditions a benefit, but also a risk

Mr Berry said favourable seasonal conditions across major sheep grazing regions in southern NSW, eastern Victoria, northern South Australia and the northern pastoral zone of WA supported higher fleece and carcase weights in the first half of 2015. But persistent dry conditions and below average pasture in parts of northern NSW, western Victoria and south-eastern SA, as well as in the sheep

Mr Berry said favourable seasonal conditions across major sheep grazing regions in southern NSW, eastern Victoria, northern South Australia and the northern pastoral zone of WA supported higher fleece and carcase weights in the first half of 2015. But persistent dry conditions and below average pasture in parts of northern NSW, western Victoria and south-eastern SA, as well as in the sheep

grazing regions in Queensland, have contributed to a relatively high sheep and lamb turn-off and further declines in the national flock.

Mr Berry said offsetting the downward pressure on prices of high sheep and lamb turn-off has been strong and growing export demand for Australian sheep meat, particularly from the United States and major importing countries in the Middle East and Asia.

Live exports forecast to rise 2pc in 2015-16

Australia’s live sheep exports are estimated to increase by 2pc to about 2.07 million head in 2014-15, reflecting relatively high turn-off and strong export demand, particularly from countries in the Middle East.

Live exports to Bahrain — one of Australia’s main export destinations for live sheep — have continued to grow following the resumption of trade in April 2014.

“Live exports to Bahrain are estimated to be up by 234 per cent to around 335,000 head in 2014-15.

“However, this volume is still less than half the record 776, 000 head of live sheep exported to Bahrain in 2008–09.”

Mr Berry said live exports to Bahrain are forecast to increase 2pc in 2015-16 to 2.11 million head, meaning it will be Australia’s main source of growth in export demand for live sheep.

“Despite strong export demand for live sheep, low growth in sheep numbers and strong competition from the sheep meat processing sector (for the meat export trade and the domestic market) will limit the rate of growth in live sheep exports in the short term.”

Click here for the complete ABARES Agricultural Commodities June quarter report.

Source: ABARES.

HAVE YOUR SAY