Southern Aurora Markets partner Mike Avery.

IT was a lacklustre finish to the year for the wool spot auction and forward markets.

Great promise early, but lack of substance, pretty much sums up the year in a macro health and economic sense.

The forwards traded again in light qualities at flat to a slight premium. This trend has remained all year.

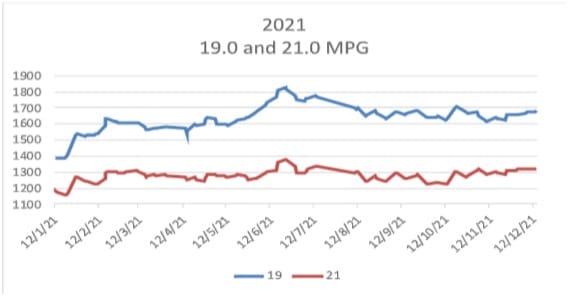

The graph below highlights that sellers, in general, have been able to secure a premium compared to spot when hedging.

This followed the general trend of the market over the year.

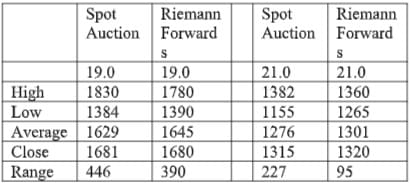

The table below sets out the absolute movement over the 12 months. In what graphically looks a fairly stable year, the ranges are reasonably wide. The forwards traded in a tighter range and averaged 1 percent higher on the 19 micron contract and 2pc higher on the 21 contract.

We expect next week to follow a similar pattern. Buyers are still keen to be paid flat throughout 2022 and into the first half of 2023 to hedge their positions. Stock carrying is not something anyone wants to take on board in the current tight fiscal environment.

The 19 micron contract traded April and June at 1680 cents and is currently bid out to June 2023 at 1670 cents. The 21 micron contract did not trade, but is bid 5 cents over cash at 1320 cents from July 2022 through to June 2023.

This week’s trades

February 28 micron 430 cents 5 tonnes

April 19 micron 1680 cents 5 tonnes

June 19 micron 1680 cents 10 tonnes

Total 10 tonnes

Source: Southern Aurora Markets.

HAVE YOUR SAY