A LACK of offshore confidence again hampered the spot auction and forward wool markets this week.

A weaker Australian dollar and the prospect of lower supply had anticipation of a better tone to the market on the agenda.

Forward prices were bid flat to cash out to March 2021, but failed to attract much interest prior to spot auctions opening on Tuesday with only 19 micron trading at 1050 cents.

Exporters stepped back from the pre-Christmas forwards as the auction barely held in the superfines and other fleece types fell 10 to 40 cents across the week.

Bidding into the New Year held firm with the 19 micron contract trading at 1060 cents for January and remaining bid there through to March. The broader 21 micron index didn’t fare as well, trading at 975 cents then falling back to close bid at 955.

Where to from here? Short to medium term it is difficult to see how demand will be able to keep pace with supply. Further deterioration in prices in the spot and short-term forwards seems likely. Any rally will hopefully provide hedging opportunities. Modest bidding demand in the first quarter of 2021 will likely be absorbed prior to the next auction series commencing 1 September.

The forward market is now looking like it is heading into carry with January trading and being bid 30 to 40 cents over September October.

The further fall this week has yet to stimulate demand into the Spring. Bidding in the forwards looks set around 40 to 50 cents under spot, whereas the New Year maintains some interest around the closing cash figures. Late Thursday, September 19 micron traded at 1010 cents (cash 1073 cents) and 21 micron traded 925 cents (cash 964 cents).

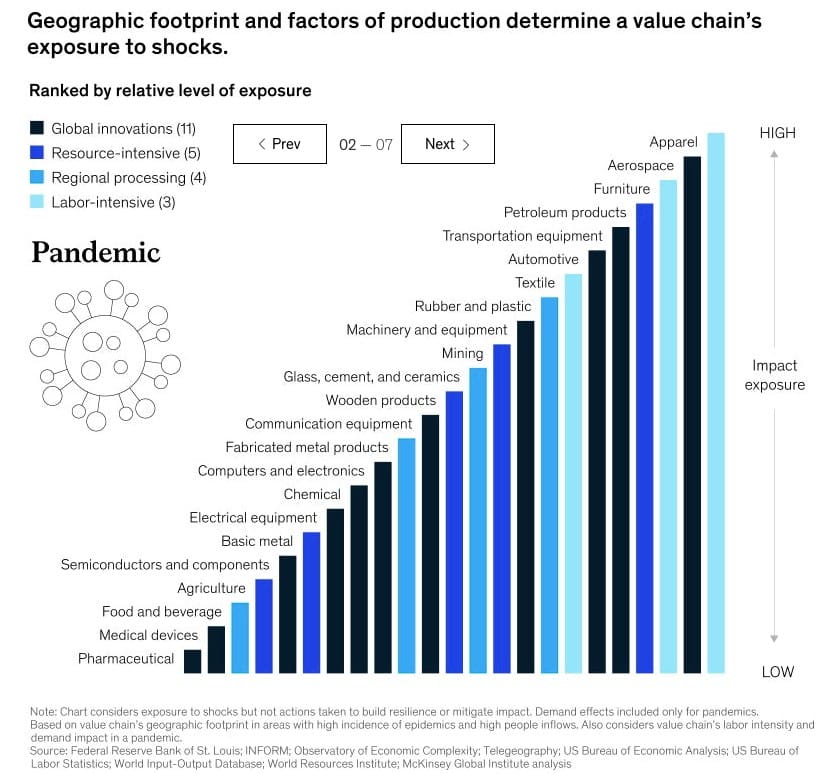

The chart below is taken from the current McKinsey impact report on the pandemic. Whilst we are all coping with the fallout in prices that began twelve months before COVID-19, we can’t afford to underestimate the compounding effect that the pandemic has caused.

How much we can attribute to the virus and when and where we will bottom at is difficult to gauge. McKinsey rates the shock of a pandemic to be hardest in the value chain of the apparel sector and higher than the obvious and visible impacts to the aerospace and petroleum industries.

Trade summary

September 19 micron 1010/1050 cents 9 tonnes

September 21 micron 925 cents 4 tonnes

January 2021 19 micron 1060 cents 5 tonnes

January 2021 21 micron 975 cents 5 tonnes

Total 23 tonnes

Indicative trading levels next week

19 micron 21 micron

Sept/Oct 1015 cents 935 cents

Nov/Dec 1005 cents 925 cents

Jan/Feb 1060 cents 955 cents

Mar/Apr 1060 cents 955 cents

May/June 1050 cents 945 cents

Source: McKinsey and Co.

HAVE YOUR SAY