Chris Howie sees difficulties in the inability to discover forward livestock prices.

AN inability of livestock producers to discover forward prices is hurting all sectors of the industry, especially sheep, according to RMA Network general manager Chris Howie in his latest wrap.

I am going to put my hand up and say I have no idea about where current livestock pricing is heading.

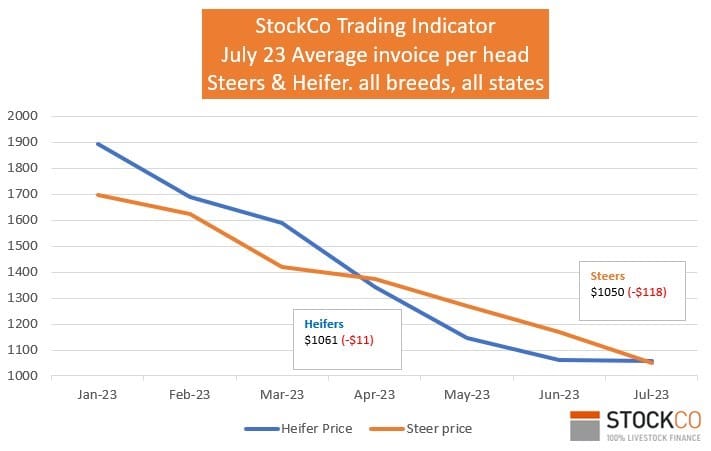

This month I have spoken to so many buyers and agents from every state and no one has the same thought. I know I have banged on about trends for three years, but they are only good if there is a baseline which seems to be very hard to find at present. My best guess is we are at the bottom for cattle because I am watching feedlots start to hunt for extra numbers and the cow job is just starting to twitch in the upward direction – so on this I haven’t been too far off in timing.

Sheep and lambs; however, are not so good. Numbers and quality have continued to go against trend with secondary types near impossible to move. The bit that confounds me is at these prices with the feed available opportunistic trades are slapping us in the face, yet there is very little enthusiasm. Ewes and lambs are now struggling at $170 per unit because no one knows the value of the lamb.

Live export is undervalued as a floor price – it would be good for analysts to run a comparison over the various times live export has been impeded and what the direct correlation to sheep and cattle prices have been. I know from my experience one directly impacts the other, every time. Any choke on live export immediately throws excess numbers back into the washing machine which moves the supply needle outside of its normal range.

Here are the dates ranges worth looking at. Sheep exports: 91 – 93, 2012 and now. Cattle exports: 94 – 96 (Egyptian slaughter), 2011 and the last 18 months. As well as the timing, exclusion of long term trading partners through the implementation of ESCAS created another supply hurdle. Yet they are now looking to re-engage and our loss ratio outcomes are far better than anywhere in the world including leisure cruise ships. Every one of these moments had an immediate impact on sale yard prices received by the farmer and the knock-on effect to all other agricultural supply segments.

Here are the dates ranges worth looking at. Sheep exports: 91 – 93, 2012 and now. Cattle exports: 94 – 96 (Egyptian slaughter), 2011 and the last 18 months. As well as the timing, exclusion of long term trading partners through the implementation of ESCAS created another supply hurdle. Yet they are now looking to re-engage and our loss ratio outcomes are far better than anywhere in the world including leisure cruise ships. Every one of these moments had an immediate impact on sale yard prices received by the farmer and the knock-on effect to all other agricultural supply segments.

Price discovery – our inability to put a finger on future price ranges is hurting everyone, especially the sheep industry at this time. When numbers were short, if it had a head and a heartbeat price was easily assessed because yesterday’s price was not enough. However, we are now on the opposite tack and the inability to find a base line price more than 10 days out has put a hand break on trading.

Sheep and lambs especially, are being discounted to the point of producers considering exiting the industry, just like 2008 – 2009. My advice is don’t throw the towel but ride the bump, because this job will straighten up.

Lamb traders are not prepared to buy and feed on because no one has any idea what price looks like in 60 days’ time. Even if processors put out a base line contract, it will help re start trading because everyone will have a line of sight on margin available irrespective of the price. In saying that, it is not all fair sailing for processors either, who are doing the right thing in April offered contracts at $6.80-$7/kg for August deliveries that are now putting them at odds on the other side when marketing product.

Cattle are also suffering from our lack of a future pricing mechanism. We tried futures in 2005 – 2008 and for those that understood the complexity we made it work but lack of liquidity and buy in from both ends of the cattle supply chain saw the ASX close it down. In short we need the livestock industry to pull some form of 90-180 day price/contract discovery tool together which will help every part of our industry. It can’t be that hard considering a seven year-old can build an app on their phone in 25 minutes these days.

Vendor beware; with an increase of supply, specification grids always tighten and the focus on faults and out of specifications increases from buyers. This is not a new thing as they have always been there, but it is important to take notice prior to consignment to a processor, feedlot or live exporter. Here is a list of current discounts that make a real difference to producer, agents and the bottom line. All species have their own selection of issues.

All specification sheets have a list of discounts at the bottom – read them

o Make sure the grid or spec number is noted in the special conditions of the contract.

Livestock that are lame, maimed, diseased or emaciated are not fit to load and will be condemned with a

potential fine. These are not covered by the old term “owner’s risk”.

Seed in lambs and mutton – discounts are now $2/ kilogram – do a test kill if you have any doubt.

Minimum number discounts – make sure you understand what this is and what the price impact is if you go under the number.

Cattle fat cover is aligned to different end user markets and different on most specifications.

Bruising and dark cutters (MSA) – look after them when yarding and trucking. Use the preparation science.

Dingo and dog bites, wool pull, over-length wool, not curfewed, dags etc all create a loss to you.

Sheep and lamb skins with no commercial value – disposal fee is up to $3 per skin. Ask before consigning. It won’t change the outcome, but it will remove any surprise. Bare shorn Merinos and composites (ropy wool) are most affected.

Live export blood tests, IBR, property of origin and suitable to breed rejection.

NVD question 7, wording for antibiotic-free. Make sure it matches processor requirements.

On the flip side it is also important buyers, carriers and agents at a livestock auction read and understand the

Livestock auction terms and conditions which protect the rights of the vendor, the buyer and the agents. The ALPA terms and conditions apply in all yards across Australia with very few if any exceptions. Apart from all of the other words make sure you read Section 18 and Chapter 4. And for private sales always sign a contract – the T&C’ protect the vendor, buyer and the agent.

Kevin Thompson, Elders Wycheproof has decided to call it a day as he takes some well-earned long service leave. Starting as a young agent with Australian Estates on 23 August 1970, at 18. Three years later he was handed a second hand Falcon with P plates and asked if he could drive and told not to run over any of the clients – that was the training. I had the privilege of working with Kevin training new agents and in the darkest hours of Elders when a few who kept fighting really made a difference. I must say both of us didn’t always agree with the bosses but a good bottle of red helped us plan how to get them back on track. His wealth of knowledge, understanding of sheep trading and ability to take control of an auction and deliver the best possible outcome to the vendor was an art that

many will struggle to replicate as times change. Congratulations on your career Kevin and may you enjoy plenty of uptime with the farm and Group 1 winners.

Weather reporting seems to have become this ongoing drama when it use to be a voice in the morning and at night to help plan the day. Is the constant chatter about an El Nino positive or is it constantly dragging us back to a conservancy that in the long run is eroding the capture of opportunities? A drought always starts in the spring, but we seem to be acting as though it is here already. We can’t manage the rain but we should continue to grasp the opportunities presenting – even if we are buying a few less. Again mapping your feed and understanding target markets will give you confidence on the trade.

Cattle

Mick Laidlaw from StockCo SA & WA made the trip to Alice Springs for the delayed show sale. He reported 2600 head were yarded and that was back on the original numbers, as some of the larger lines had been sold. The 220-300kg steers made $2.85 to $3.10/kg, with heavier steers $3 to top at $3.31/kg. Heifers struggled along to be around $2.20/kg. Considering freight and the current market, he commented the sale was a bit better than expected. Buyers operated in the yards and strong activity from A+ saw cattle going to Katherine, Princess Royal, Dalby and some local activity. Steve Gaff Red Centre Rural added Central Queensland and Paraway Pastoral purchased also and Peter Daniel GDL Dalby was active on a range of cattle. Steve said the job was 10 – 15cents better than expected with vendors happy and again, when adding freight, Alice Springs has delivered an outstanding result on the yarding offered.

An old sparring partner of mine Scott Bremner has just started with McCulloch Agencies in Tamworth. He noted the feedlots are still being blocked up on delivering to slaughter with the meat trading environment still tough. “Every time the Australian traders get some traction our direct competitors cheapen their offering sucking the wind away.”

Angus feeders in NSW are trading at $3.70-$3.80/kg, but with 3-4 week waiting list.

Michael Unthank from Brian Unthank Rural Albury let me know Barnawartha cattle was better this week. Cows lifted 20-30 cents/kg, topping at $2.92/kg and the trade job was 5–10 cents better. Season is good with rain forecast.

Sheep

Mixed reports coming in from around the place. Isaac Hill, Wagga Regional Livestock quoted Wagga as better on finished lambs, with a $20-$30/head lift on export and heavy trade and middle range trade lambs improved by $10-$15. However, up the road at Bathurst, David Simpson, Elders and Dubbos Andrew Peadon, Barlow and Peadon Schute Bell both said the lack of demand on secondary stock has really seen the job become very hard. Quite a number of lambs are trading at $5-$30 with not a lot of interest from other areas. Cowra’s Craig Oliver from James P Keady let us know light lambs at $30-$70, trades $75-$118 and heavies $120-$166 ($4.40-$4.60/lg), all quoted as firm on a c/kg basis.

Mutton everywhere is flopping along between $2-$3/kg, with Merinos a bit more if a 1”skin or better. A bit of a highlight was at the Dublin Sheep market in South Australia. With only four pens of mutton to sell, Nick Billings, Spence & Dix Co, Clare was thrown on as the auctioneer without warning. A credit to the buying gallery on the day they made sure bidding was vigorous so Nick had a go and the sale lifted $20. Although Nick needs to learn that $80 comes after $78 not drops back to $70 to reheat the same pen. In 1988, Mike Bowley, Elders manager at Strathalbyn did the same thing to me. There’s not enough time to get frightened I suppose.

Ty Miller Nutrien Wickepin, WA gave me a report on current prices. Mutton has dropped from $3.20/kg to $2.50-$2.70/kg and lambs are now trading at $4.80/kg, with a bit of pressure although secondaries are similar to the east. The season in southern wheat belt is good, but the deep south got a late start and is struggling slow growth and the northern wheat belt is only marginal. The 15 big frosts in the last 20 days have put a handbrake on pastures.

Across all states, those invested in sheep are still focused on genetics and productivity but limited competition and current prices are eroding the confidence of some. We need to remain positive because this will straighten out and much of our country is made for sheep not cropping and cattle.

HAVE YOUR SAY