SUPPLY challenges, primarily due to drought conditions, combined with robust overseas demand has seen lamb prices across all stock categories reach unprecedented levels in 2019.

At times it appears that whichever saleyard has the most recent sale sets a new national record for heavy slaughter lambs.

Given the record prices, combined with a tough season, it has been no surprise to see many growers move towards a feedlot, or containment feeding option for their operation.

The AuctionsPlus Market Insights team recently looked at the correlation between new season store lamb prices through the winter months, and how historical slaughter lamb prices perform in spring.

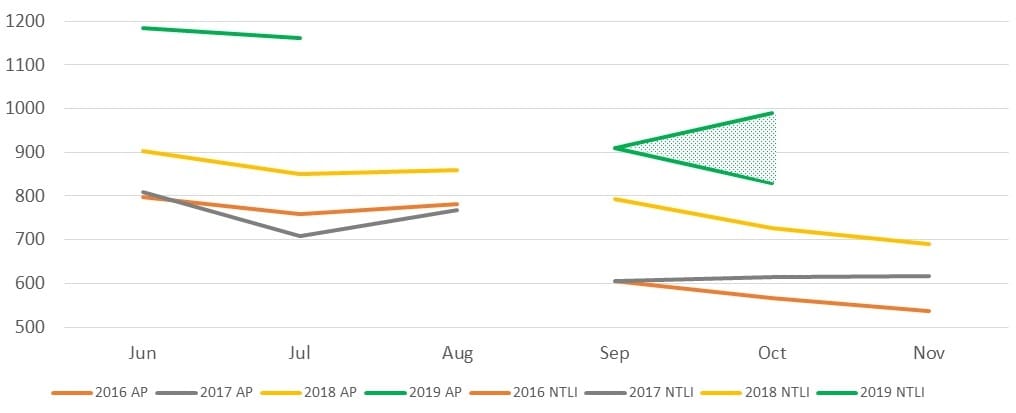

To answer this, we looked at new season crossbred store lambs sold between June-August and then compared those prices to the MLA National Trade Lamb Indicator.

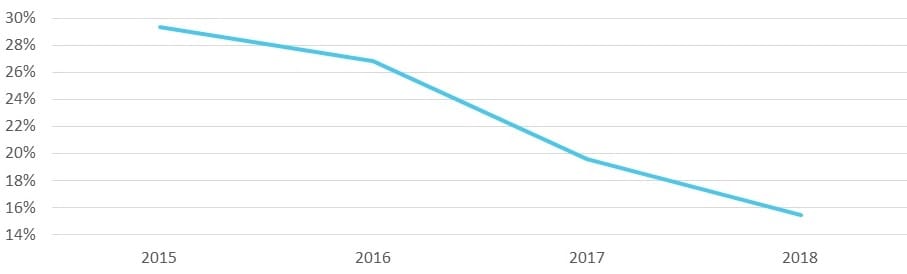

The initial trend emerging was the distinct drop over time in price differences, as slaughter prices are pushing to store stock highs, seen in this graph.

Average percentage difference between AuctionsPlus Store Lamb Price (June-Aug) and MLA National Trade Lamb Indicator (Sept-Nov)

Using the price difference above, of between 29pc and 15pc over the past four years – if the average new season store lambs from June and July on AuctionsPlus in 2019 (1185c and 1137c respectively) follow this same trend, growers have will potentially see the MLA NTLI average for the month ranging anywhere from 830c to an incredible 990c/kg cwt (see Graph 2).

If the trend seen over the past four years continues, the difference may be even less than 15pc. This possibility is supported by early new-season sucker contracts at $10/kg.

AuctionsPlus Store Lamb (June-Aug) and the MLA National Trade Lamb Indicator (Sept-Nov), c/kg dw

As an example, the table below highlights the price difference a 28kg liveweight terminal sire/Merino wether lamb sold in July compared if it was held through to sell in October as a 45kg trade lamb. This does not consider any inputs with the obvious exclusion of rising grain prices.

The record prices are seeing growers and agents diversifying their businesses.

David Welsh from Landmark Benalla, Victoria, has seen the rise offer some “pretty exciting” opportunities in the industry.

“There are people who are integrating finishing lambs into their cropping operations and putting lambs in paddocks with feeders and crops,” he said.

“There are great online communities emerging, on social media and industry websites, as people are learning from the drought, and learning more about animal nutrition and finishing high quality lambs during tough conditions,” he said.

Source: AuctionsPlus

HAVE YOUR SAY