THE value of Australian agriculture in 2025-26 is expected to be the third highest on record at $91 billion, the opening stages of this year’s Australian Bureau of Agriculture and Resource Economics conference in Canberra yesterday.

Including fisheries and forestry, ABARES expects the ag sector to reach $98 billion, according to executive director Dr Jared Greenville.

“While this is slightly down on an exceptional 2024-25, particularly strong results are forecast for livestock and livestock products – expected to reach a new record value of $40 billion,” Dr Greenville said.

“Demand for red meat is reflected in both strong export volumes and rising export prices, which has led to the total value of meat exports expected to hit $22 billion this financial year.

“Agricultural exports are also looking healthy next year, with the value forecast to remain relatively steady at $72 billion – or $77 billion if we include fisheries and forestry.

On the cropping front this year, national winter crop production is estimated to have increased to 59.8 million tonnes in 2024–25, 27pc above the ten-year average and the third largest on record.

Summer crop production is predicted to fall slightly in 2024–25 but will remain 28pc above the ten-year average at 4.7mt.

“Conditions for winter crops were favourable across most of New South Wales and Queensland with timely rainfall in Western Australia. However, both Victoria and South Australia faced poor seasonal conditions resulting in lower crop yields,” Mr Granville said.

Based on the back of these livestock and cropping trends, average farm financial performance is estimated to increase for broadacre farms, ABARES suggested.

“On average, national broadacre farm cash income is forecast to rise by $89,000 in 2024–25 from $124,000 to $213,000, mostly driven by higher livestock prices and greater crop production.

“Next financial year average farm incomes are expected to increase further, to $262,000 per farm as input costs ease and higher prices support both crop and livestock receipts.

“That said, dry conditions in parts of South Australia and Victoria led to below-average farm financial performance in 2024–25 in those regions, but they are turning a corner. Improving climate conditions in these states are expected to lift production and profitability next financial year.”

Lamb and mutton prices to increase in 2025-26

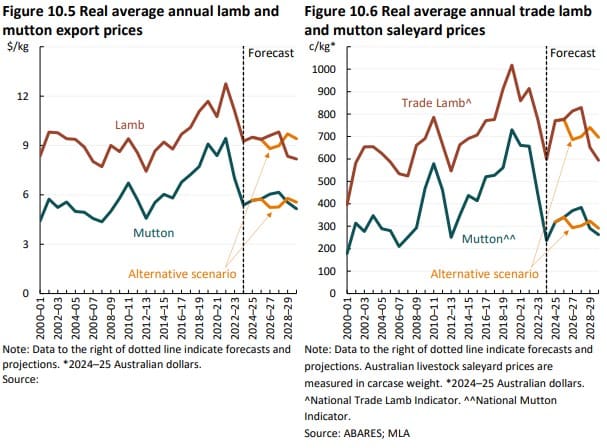

ABARES said lamb saleyard prices are expected to average 770 cents per kilogram (carcase weight), up by 32pc from 584 cents per kilogram in 2023–24. Mutton saleyard prices are expected to average 319 cents per kilogram (carcase weight), up by 38% from 231 cents per kilogram in 2023–24. Despite this rise, average lamb and mutton saleyard prices are expected to be 4pc and 38pc below their 10-year averages to 2023–24 in real terms, respectively.

The nominal average lamb saleyard price is forecast to rise by 4pc to 802 cents per kilogram in 2025–26 as saleyard demand – particularly from processors – remains elevated and supply falls. Strong saleyard demand from processors is expected to continue in 2025–26 as world

sheep meat demand drives elevated sheep meat export prices. Expected wetter seasonal conditions in sheep producing regions relative to 2024–25 are also expected to increase pasture availability, leading to higher lamb retention on farms for breeding, lowering supply to saleyards.

ABARES said the average average mutton saleyard price is also forecast to rise by 10pc to 351 cents per kilogram in 2025–26, reflecting strong processor and global demand. Lamb and mutton export prices are forecast to remain elevated in 2025–26 with strong global demand and lower global supply particularly from Australia. Real mutton and lamb saleyard prices are projected to rise and then fall over the outlook period in the baseline scenario as expected lower product

ABARES estimates the value of sheep meat and live sheep production to rise by 3 percent to $5.0 billion in 2025–26.

Lamb and mutton saleyard prices are expected to rise in 2025-26 reflecting increased saleyard demand, but the value of sheep meat exports is forecast to fall by 5pc to $4.5 billion.

.ABARES expects the real value of sheep meat production and exports to be higher over the medium term.

ABARES said nominal sheep meat and live sheep production values are forecast to rise to $4.9 billion in 2024-25, up by 12pc from an estimated $4.4 billion in 2023–24. The forecast rise in production values reflects rising saleyard prices offsetting a fall in production. Nominal sheep meat and live sheep production values are forecast to rise in 2025-26, up by 3pc to $50 billion as higher saleyard prices more than offset a decrease in production, ABARES said.

Over the medium term, real sheep meat and live sheep production values are projected to rise initially before falling, ranging between $3.4-$4.8 billion and ending at $3.4 billion in 2029-30

Lower sheep meat production is expected to outweigh higher saleyard prices as assumed wetter seasonal conditions cause flock restocking.

ABARES’ Agricultural Commodities Report March 2025 can be read here.

HAVE YOUR SAY