THE month-long rally in the spot wool auction market continued early in the week, fuelled by a weaker Australian dollar.

The auction market on Wednesday was more subdued, with the finer microns holding their gains and middle microns giving back a few cents.

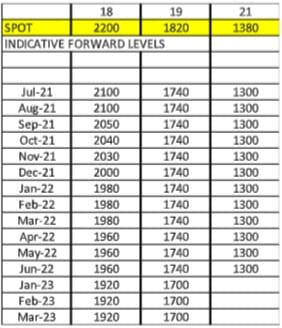

The forwards again traded in light volumes with buyers and sellers anticipating a modest pullback at a minimum. The 19 micron contract traded in September at 1760 cents and in January at 1780 cents. Both are around the 75th percentile of prices for the last decade.

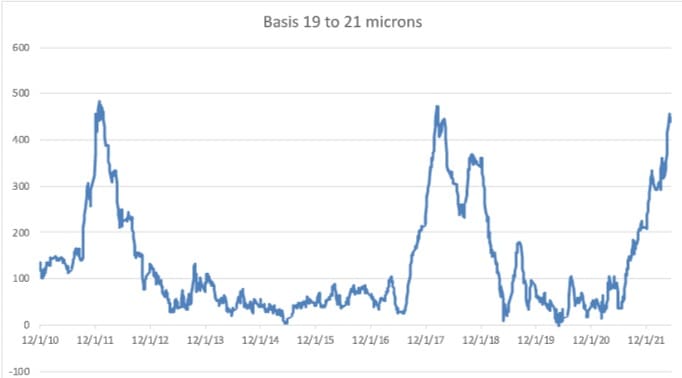

The focus has been on the fine wools, which is understandable when you look at the basis chart below. The difference between 19 and 21 micron has now exceeded 400 cents.

Interest has increased from the buy side this week for the 21 micron contract, with a base put in the market at 1300 cents from September through to June 2022. The 19 micron contract remains consistently bid, albeit under cash, from September to June at 1740 cents.

Growers have started to look at options again. An 18 micron November put contract traded at 85 cents for a 2100-cent strike. This showed an underlying willingness of the grower to spend a bit more on the premium to maintain a better strike. Option sellers are pricing in volatility under 20 percent, which seems very reasonable considering the last two seasons.

The market is expecting a bit of a pullback as we find ourselves in pre-COVID levels that were boosted by an Australian dollar at US60 cents

We expect the forward markets to look for support initially around a retraction of one third of the recent rally of around 200 cents, depending on the micron; or about 70 cents.

This week’s trades

September 19 micron 1760 cents 6 tonnes

December 17 micron 2400 cents 2 tonnes

January 19 micron 1780 cents 12.5 tonnes

November 18 micron put option, Strike 2100 cents, premium 85 cents 7 tonnes

Total 27.5 tonnes

HAVE YOUR SAY