SHEEP and wool producers hoping for a more levy payer-friendly system from recent reform announcements this month might be disappointed.

SHEEP and wool producers hoping for a more levy payer-friendly system from recent reform announcements this month might be disappointed.

Calls for sheep and wool levy payers to have a greater choice in where their compulsory levies are allocated are getting louder, especially in the wool industry, where some growers would like a voluntary system or the right to allocate where their funds are spent.

In June this year, peak grower body WoolProducers Australia wanted the Federal Government to subsidise the halting of wool and sheep transaction levy collections for 12 months from August to help producers recover from the COVID-19 pandemic.

However, Sheep Central has been told that these levy issues will not be addressed by a $7.2 million investment to streamline agricultural levies legislation, announced this month by the Federal Government.

Levy payers across the country, as well as almost 8000 levy collection agents, will benefit from streamlined laws and reduced red tape, the government said.

The Australian Government said it is modernising agricultural levy laws to make them fit-for-purpose and business friendly, and to reform our agricultural levies legislation so that we can better respond to global economic disruptions such as COVID-19.

Minister for Agriculture, Drought and Emergency Management David Littleproud said streamlining and modernising the agricultural levies legislation is part of a suite of reforms aimed at reducing the regulatory burden for businesses across Australia as part of government’s deregulation agenda.

An Agriculture department spokesperson said the agricultural levies legislation project will not amend levy rates or settings, nor will the project create a discretionary mechanism to waive levy or charge liabilities, or for producers to ‘opt-out’ of paying levies and charges.

“Any agricultural industries interested in amending or introducing a new levy should refer to the Levy guidelines: How to establish or amend agricultural levies for details on the process.

“Current and future levies legislation would support the wool industry to adopt separate, fixed levies if it wanted to” the spokesperson said.

“Consistent with longstanding government policy, levies legislation will continue to enable agricultural industries to drive all aspects of their levy,

“Work to streamline the legislation will not change this,” the spokesperson said.

“This project is distinct from but complementary to the review of WoolPoll currently being delivered by the department.

“The WoolPoll review has examined the regulated process through which wool levy payers vote on their preferred levy rate.”

The department expects to complete its review of WoolPoll in 2020. Further information about the WoolPoll review, including the Terms of Reference, is available on the department’s website at: https://haveyoursay.agriculture.gov.au/woolpoll-review

The spokesperson said the streamlining of agricultural levies legislation will consider all laws relating to imposition, collection and disbursement of agricultural levies, including sheep and wool levies. The existing sheep, lamb and wool levies under the Primary Industries (Excise) Levies Act 1999, Primary Industries (Customs) Charges Act 1999, National Residue Survey (Excise) Levy Act 1998 and National Residue Survey (Customs) Levy Act 1998 will be incorporated in the new legislation.

“The new legislation will not amend existing levies or introduce new levies, but will transfer existing levy settings to a consistent location in the new legislative framework,” the spokesperson said.

The $7.2 million investment in the project will be allocated to the Department of Agriculture, Water and the Environment’s work to deliver the new legislative framework, including preparing the new legislation and consultation with stakeholders. This would include developing educational materials to support stakeholders to understand and comply with the new legislation and updates to the department’s online levy system and forms for levy payers and levy collection agents.

The spokesperson said benefits of the project for industry, including the sheep and wool industry, would include:

o easier to understand legislation, with operational details included in subordinate legislation, enabling industry to more readily address challenges or seize opportunities to benefit the sector

o more effective levy collection, supported by easier to use online levy return forms and a more tiered approach for enforcement of compliance.

The spokesperson said project consultation with industry is central to this project and started in 2019 with face-to-face meetings between the department and levy recipient bodies.

“The department has also undertaken an online survey, which was open until 31 May 2020. Due to the pandemic, planned consultation with industry representatives and levy collection agents for 2020 has been postponed.

“The department will resume consultation in early 2021.”

Mr Littleproud said current agricultural levies legislation is complex, inconsistent and ambiguous.

“It is a barrier for industries to innovate or respond to emerging risks and priorities such as drought, bushfires, climate change and the pandemic.

“The Australian Government is supporting the sector’s ambition to grow the value of Australia’s agricultural sector to $100 billion by 2030 through delivering streamlined laws that better support industry investment into research and development, marketing and biosecurity,” he said.

“The primary industry sector strongly supports the levy system, which provides approximately $800 million each year to fund research and development, biosecurity, residue testing and marketing,” Mr Littleproud said.

The government said more than 90 percent of agricultural industries have chosen to impose levies on themselves to fund industry priorities and research outcomes, but the current levies legislative framework no longer offers the clarity, flexibility or responsiveness industry needs to be an effective driver of the Australian economy.

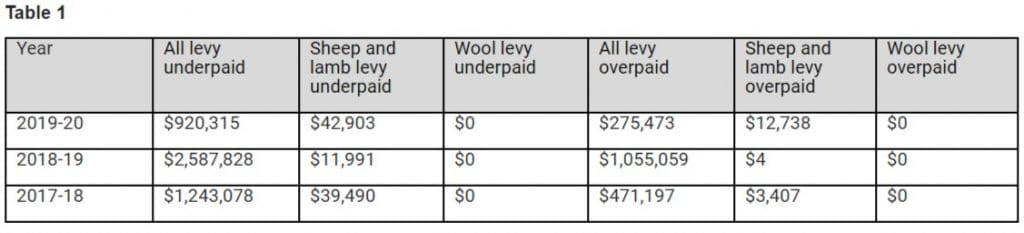

The existing legislation is made up of 20 primary Acts and more than 24 instruments that have evolved piecemeal over time. Each year, there are overpayments and underpayments of levies across a range of commodities due to confusing and complex levy rules.

Under the streamlined legislation, agricultural industries will have a clearer line of sight to levy settings and will be able to respond more readily to address challenges or seize opportunities to benefit the sector, for example, through innovation-driven increases to productivity, market access or biosecurity responses, the government said.

Table 1 shows overpayments and underpayments for 2017–18, 2018–19 and 2019–20 financial years. Source – National Compliance Program.

HAVE YOUR SAY