THE recent trend of selling inaction continued again this week, with the only forward wool trades executed ended up being at levels 30 cents over the closing spot cash prices.

The 19 micron contract traded at 1780 cents for February and closed the week at 1743 cents, and the 21 micron contract traded in March at 1730 cents and closed at 1708 cents.

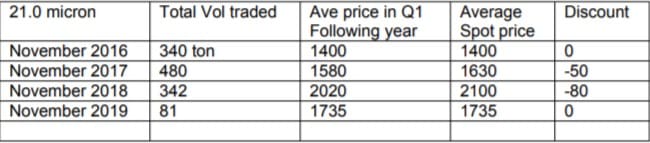

During November, the market traded only 81 tons. This is less than a quarter of the volume executed in November 2016, 2017 and 2018.

What is more interesting is when we examine the price trends and the curve during those periods, the reason for the current inaction is even more baffling.

There is no relationship to price or the position on the forward curve. Current global economic trends are less positive than they were previously. Wool’s price position compared to other apparel fibres does not lead to confidence, nor the even changing mood of the China/USA trade friction.

The underlying reasons for the lack of participation needs to be looked at more carefully, but likely lie with the drought-induced fatigue in the market, and with current volatility and supply concerns weighing on all.

On a more positive note, we expect the current trend of the curve to remain flat with exporters bidding relatively close to cash into the first quarter of 2020.

Indicative trading levels for next week

19 micron 21 micron

December 1740 cents 1700 cents

January/March 1730 cents 1700 cents

April/June 1700 cents 1660 cents

Trade summary

March 21 micron 1730 cents 5 tonnes

February 19 micron 1780 cents 5 tonnes

Total 10 tonnes

HAVE YOUR SAY