"The herd instinct among forecasters makes sheep look like independent thinkers."

Southern Aurora Markets partner Mike Avery.

THE wool auction market returned from recess on Tuesday steady, but closed, with all Merino qualities losing between 10 and 20 cents.

The fall was somewhat muted by a strong US dollar. The AWEX Eastern Market Indicator fell only three cents in AUD terms, but 16 cents US.

The forward market was again only lightly traded, with buyers non-committal other than attaining cover in the nearby window. The 21 MPG contract traded August at 1350 cents and September at 1340 cents against closing cash of 1381 cents.

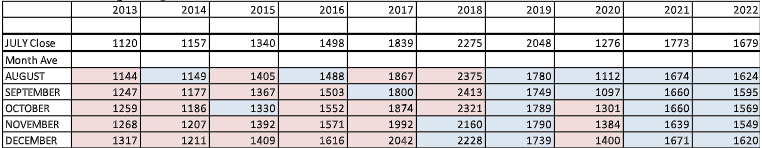

Most forecasters are predicting that the general global economic conditions will continue to be the driver of the market, with relief unlikely until sometime in 2024. This would mean that wool market will follow the pattern of the last two season’s prices (in the example below for 19 microns) and not return to their opening levels until well into the New Year.

GDP figures from China remain challenging, with any stimulus talk for their textile sector not on the horizon. The strong USD may provide some short-term impetus, but this should be viewed as an opportunity to place some short- and medium-term hedge positions.

With 45,000 bales rostered for next week, it is hoped that the strong dollar will stimulate enough demand to keep the market steady.

This week’s trades

August 2023 21 micron 1350 cents 5 tonnes

September 2023 21 micron 1340 cents 10 tonnes

Total 15 tonnes

Source – Southern Aurora Markets.

HAVE YOUR SAY