THE roller coaster ride continued in Australia’s spot wool market again this week, rallying off a dramatic pull-back last week.

Since the start of the season, we have seen the Eastern Market Indicator fall 411 cents (24 percent), then rally 266 cents (19pc), only to fall back 98 cents last week.

Opinion is divided on the strength and longevity of this current rally, which has seen the EMI rise 32 cents.

The supply and demand balance are in question, with reports of building early stage stock in China countered by the ever-eroding supply particularly in NSW and Queensland. Demand seems to be stagnated and oscillating on the whims and rhetoric of the China-USA trade negotiations.

This continued uncertainty has seen volumes in the forwards dry up and be concentrated in the short term, pre-Christmas window.

Buyers seem to be keener to try to reduce risk with trades this week at and above cash. The 19 micron index traded at 1765 cents and 21 micron at 1750 cents for November maturity. Growers remain reluctant to offer without a substantial premium. This is understandable as many growers that covered during the sustained rise over the recent seasons had gotten weary of negative hedge results, even with the knowledge that the strategy was sound.

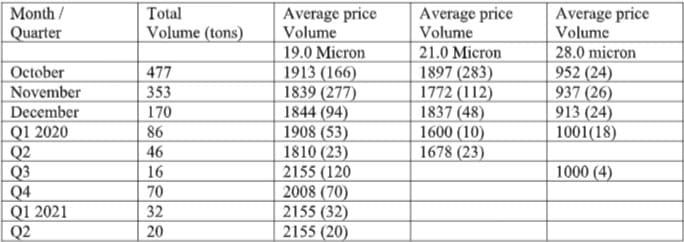

This is borne out in the analysis of the open positions of the forward market in the table below. The average covered price for 19 micron is October 1913 cents/November 1839 cents and December 1844 cents. For 21 micron, the levels are 1897cents, 1772 cents and 1837 cents respectively. Around 8000 bales are hedged for this period, which is about 2pc of the expected auction receivals for the final quarter of 2019.

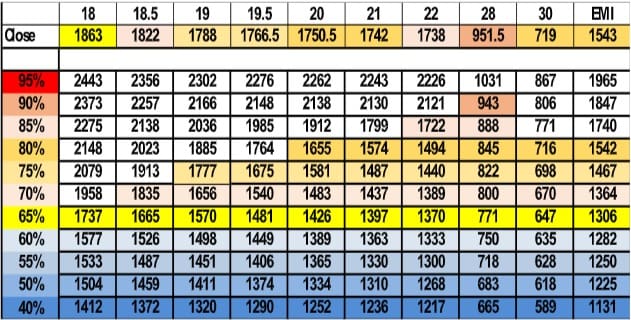

Volumes fall away for the New Year, with sellers yet to come to terms with the reset of pricing back to a more longer term level. The table below has EMI currently sitting on the eightieth percentile for the last ten years of pricing, 19 micron on the 75th and 21 micron also exceeding the 80th.

We expect interest to be maintained from the buy side in the short-term. Some confidence seems to be restored in global markets to end the week, with current indications that trade tensions will be at worse neutral and potentially improving. Sellers will need to readjust levels to attract buyers to share the risk into the New Year.

Southern Aurora Markets percentile chart Jan 2010 to October 10 2019

Trade summary

November 19 micron 1765 cents 5 tonnes

November 21 micron 1750 cents 10 tonnes

Total 15 tonnes

HAVE YOUR SAY