Southern Aurora Markets partner Mike Avery.

IT was another testing week for the wool auction spot market, despite pre-sale expectations, and forward trading volumes were disappointing.

Whilst expectations were high at the start of the week with solid demand signals, Tuesday’s opening left most disheartened.

Logistical and cashflow problems remain the exporters’ major concerns. The balance of the week played out with mixed results.

Wools finer than 19 microns continued to struggle, while 19 micron and broader Merino qualities looked to find a base and finished a little dearer on Thursday.

This activity translated into slightly more interest on the forward market, but volumes were again disappointing. Trading was once again limited to the nearby months. Prices improved on last week with May executed 10 to 20 cents above the closing cash.

Next week will likely test buyers resolve again, with almost 50,000 bales rostered. Finance lines will remain tight as costs increase and congestion along the delivery pipeline leaves cycle times frustratingly longer than normal.

Uncertainty and caution still dominant the macro view, but support levels on the medium wools look to be holding. Another week of solid prices in the spot will hopefully bring opportunity again for both medium and longer-term hedgers with activity picking up in the Spring and into 2024.

This week’s trades.

April 21 micron 1370 cents 3 tonnes

May 19 micron 1600/1630 cents 10 tonnes

May 19.5 micron 1600 cents 5 tonnes

May 21 micron 1450 cents 5 tonnes

Total 23 tonnes

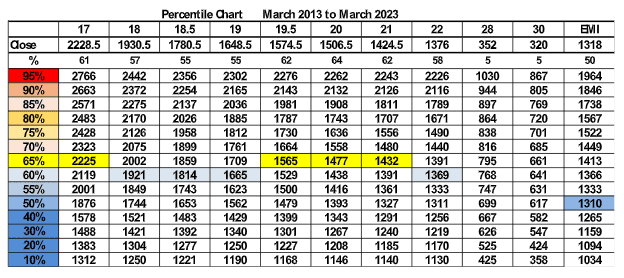

A couple of tables to mull over. First is the updated percentile chart that shows prices are still sitting above the average, except for the crossbreds; that are off the chart and not in a good way.

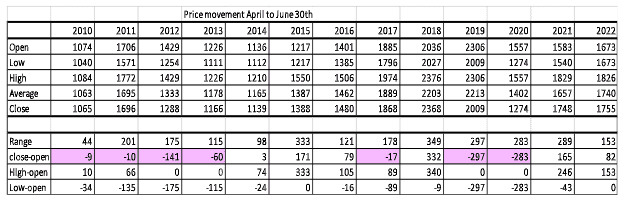

Price movements April to June for the last decade

Some comments over the last few weeks alluded to prices always increasing in the Autumn to Winter. Although May can be an active demand period, the table below busts that myth with prices just as likely to fall than rise during the last 13 years. Hopefully this year will even the score.

Source – Southern Aurora Markets.

HAVE YOUR SAY