EARLY forward wool trading pre-empted the rally in auction prices this week, but the continued strength of the spot market took all participants by surprise and tended to dampen any further forward activity.

Forward sellers are still looking for a forward premium to spot auction prices. Exporters are unable to find interest at these higher with off-shore processors continue to struggle to move stock.

Buyers lifted forward levels by 50 cents at weeks end reflecting the risk, uncertainty and volatility that hampers the product flows at present.

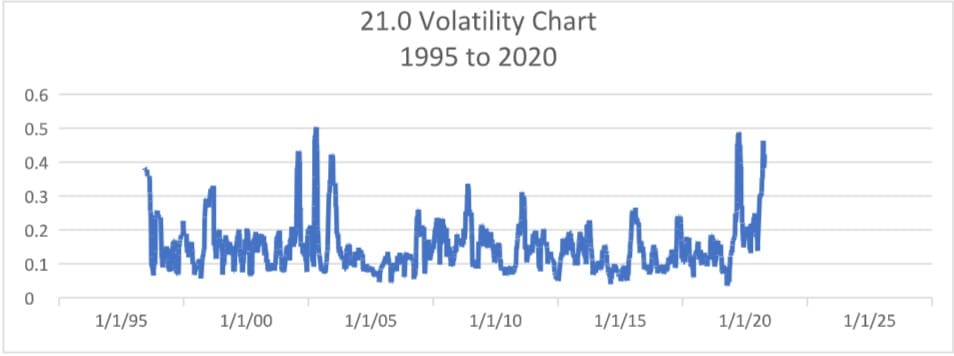

The graph below indicates that volatility has hit highs not seen since the early 2000s. In the 76 trading days this year the 21.0 micron index has moved more than 30 cents of 31 occasions (40% on the time). The value of certainty should not be under valued at this time.

Ahead of the next sales we anticipate bid offer spreads to remain quite wide to begin with as both sellers and buyers come to terms with this week’s 100 cent rise.

Likely trading levels next week

19 micron 21 micron

Oct 1300 cents 1120 cents

Nov/Dec 1280 cents 1110 cents

Jan/Feb 1250 cents 1080 cents

Mar/Apr 1200 cents 1050 cents

May/June 1200 cents 1030 cents

This week’s trades

October 19 micron 1255 cents 5 tonnes

November 21 micron 1055 cents 2 tonnes

January 21 19 micron 1250 cents 5 tonnes

October 21 19 micron 1235 cents 5 tonnes

TOTAL 17 tonnes

HAVE YOUR SAY