Southern Aurora Markets partner Mike Avery.

“There is nothing like the start of a season, before all the one-run losses, pitching breakdowns and missed opportunities. Before reality sets in.” – Michael Connelly

AUSTRALIA’S forward wool market profile remains mixed after the challenges of last season rolled into the new this week.

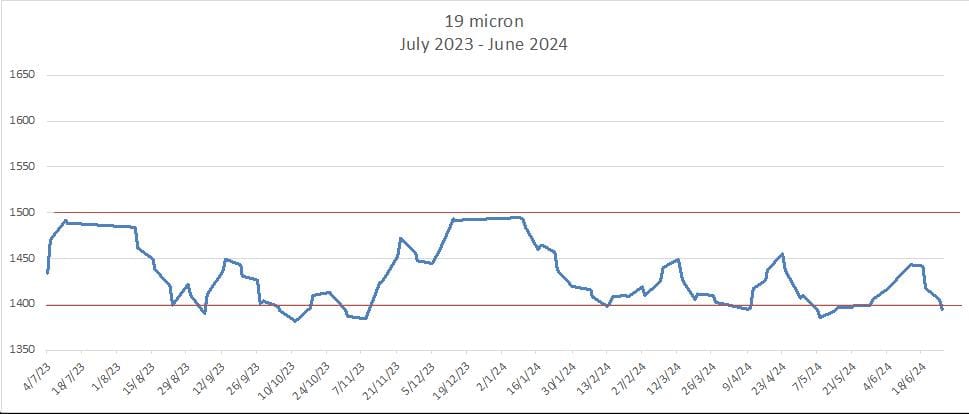

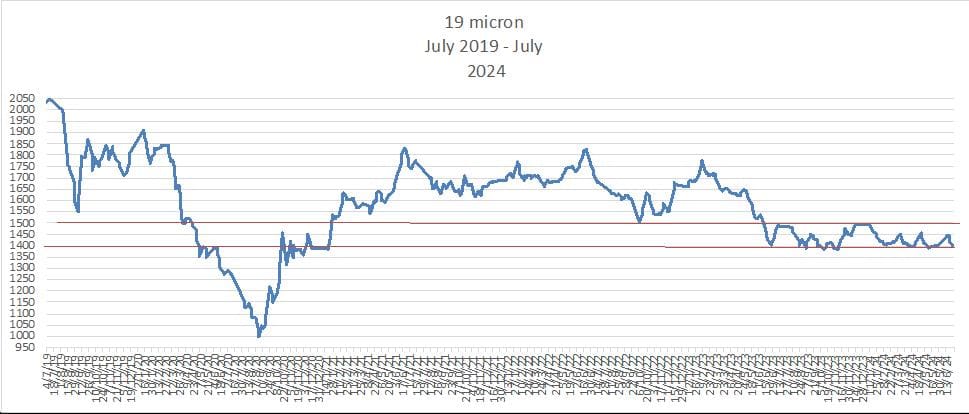

The first week of the sport auction market delivered falls of one or two percent for all wool types. Levels for most qualities have breached the bottom of their ranges of the last few years.

With all focused on the ‘just in time’ character of the current demand, the mid-year recess can’t come soon enough for traders.

The weight of poor consumer demand, cost of living pressures, political instability, and logistic issues both domestic and offshore confront most commodities.

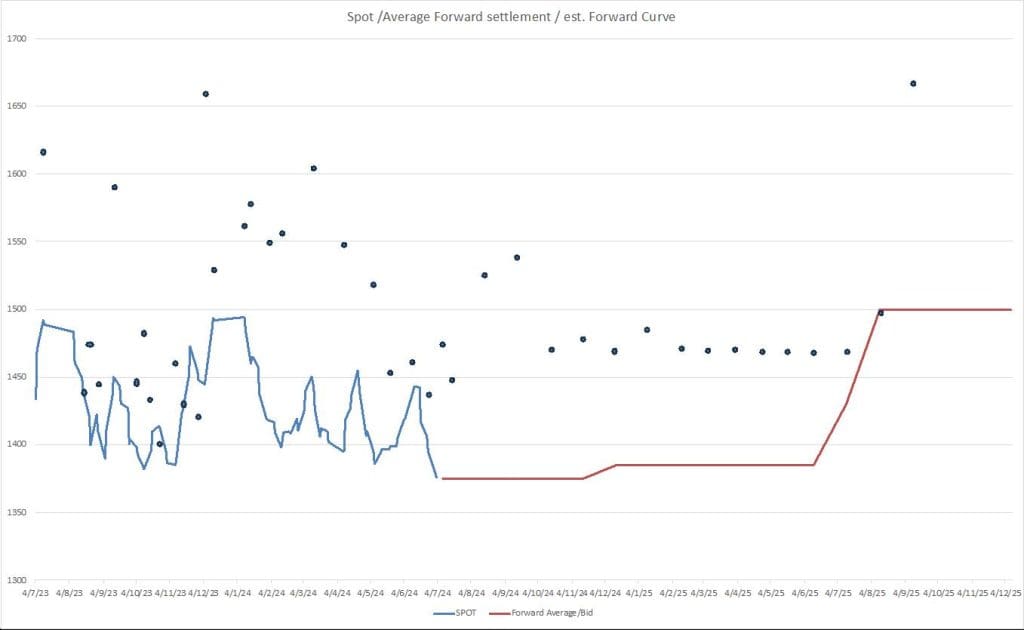

Forward pricing is patchy at best. Although there are very few bulges in the wool pipeline processors remain uncommitted preferring to wait with an eye to recess and northern Spring holidays.

The modest trade in the forward markets during the 2024/25 season can’t be legitimately placed at the foot of the buyers and exporters.

Two of the myths surrounding the forward market is that it is more often in discount and that it continually favours the buyer. Exporters/traders made most of the markets throughout the year quite often at premiums to the spot. Although the outcome of the settlements should not impact the value of the hedge to either party the fact remains that over the last twelve months more than 80 percent of the maturities settled in favour of the sellers. This in a market that simulated a rollercoaster for the entire season. The average benefit to the seller around 70 cents per kilogram or $80 per bale.

The forward market profile as we move to the recess is mixed. Sellers into the Spring remain at the premiums prior to the retraction of the last few weeks. Buyers are beginning their interest slightly over last week’s spot.

The support into the latter months of 2025 and throughout all of 2026/27 season remains resilient. Premiums are currently 125c per a kilo or $150 a bale for the 19 micron index.

Next week will likely see a steadying of the spot as short supply and a slight uptick in demand battle against the ever increasing stronger Australian dollar.

Source – Southern Aurora Markets.

HAVE YOUR SAY