Southern Aurora Markets partner Mike Avery.

FORWARD wool markets remained relatively dormant this week as conversations focused on the impact of the currency.

The weaker US dollar was expected to drive the market even lower in Australian dollar terms, but it held remarkably well with the AWEX Eastern market Indicator losing AU9 cents, but gaining US27 cents.

This is by no means unusual. History shows that the wool market will in general take it’s direction from macro-economic drivers and only be moderated by short-term movements. A recent example of this is the EMI’s recent peak in June 2022 (1474 cents) that occurred with the Australian dollar at US70 cents and the low this week of 1232 cents at US67 cents.

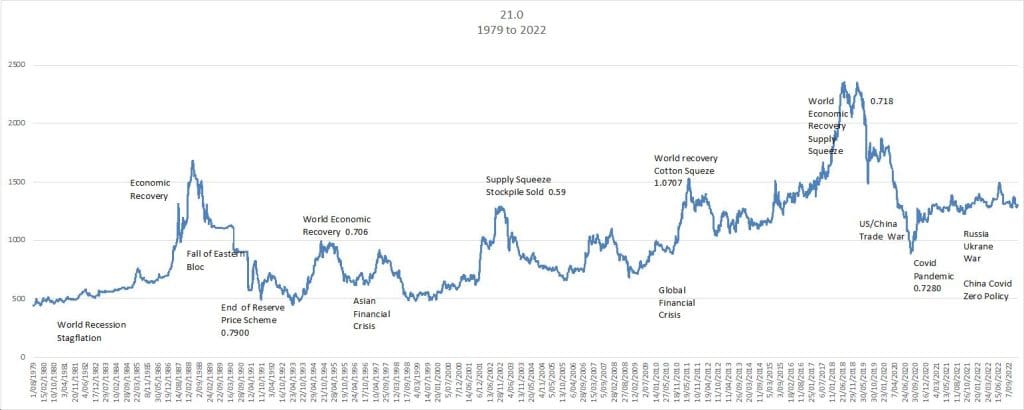

The chart below details this over 40 years. The highlight being wool market being able to withstand a USD at 1.07 during a commodity squeeze.

The outtake from this is that any recovery in wool prices will need to be led by improved demand, which will need to come from global influences such as the easing of the Chinese COVID zero policy and lockdowns, through to relieving tensions in Europe.

Considering the uncertainty that abounds, the forward markets remain relatively dormant. Modest trading in December at a 20-cent discount to cash was the early highlight with bidding interest stagnant early on the anticipated impact of the weak USD. Sellers focus is more than likely on the immediate impacts of the widespread flooding across much of Eastern Australia.

Hopefully, next week will see a lift in demand as we move ever closer to the Christmas recess and offshore processors need to fill some early New Year stocks.

This week’s trades

December 19 micron 1505 cents 2.5 tonnes

December 21 micron 1265 cents 2.5 tonnes

Total 5 tonnes

Source – Southern Aurora Markets.

HAVE YOUR SAY